Impulses and Corrections 5

- Indicatori

- Svetoslav Boyadzhiev

- Versione: 3.0

- Attivazioni: 20

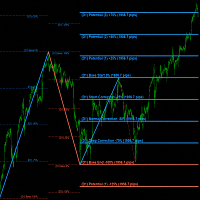

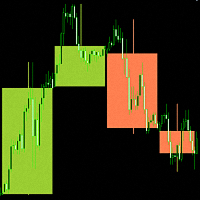

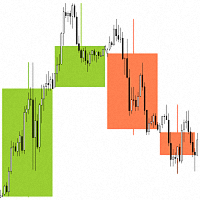

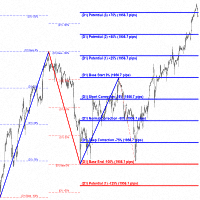

"Impulses and Corrections 5" is created to help traders navigate the market situation. The indicator shows multi-time frame upward and downward "Impulses" of price movements. These impulses are the basis for determining the "Base", which is composed of zones of "Corrections" of price movements, as well as "Potential" zones for possible scenarios of price movement.

Up and down impulses are determined based on a modified formula of Bill Williams' "Fractals" indicator. The last impulse is always "Unfinished" and is represented by a dashed line. For an impulse to be valid, an impulse in the opposite direction must occur.

The "Base" is determined based on a sufficiently large impulse, which is at least 62.5% (2.5/4) of the length of the impulse selected as the previous "Base". This size (62.5%) for determining the "Base" is the minimum required for building "Bases" for most financial instruments. It is permissible to increase the size of the impulse for defining a new "Base" to 75.0% (3/4). This clears the market "noise", but there is a risk of entering a cycle of price movements from "News" to "News". When the "Base" is built on an upward impulse, it is said that there is a "Bullish Base", and when it is built on a downward impulse, it is said that there is a "Bearish Base". Depending on whether there is a "Bullish" or "Bearish" base, the indicator builds corrections within the limits of the base. In the case of a "Bullish Base", the top of the impulse is defined as 0%, and the bottom of the impulse is defined as -100%. Accordingly, for the "Bearish Base", the bottom of the impulse is defined as 0%, and the top of the impulse is defined as -100%. We call the 0% level "Base Start" and the -100% level we call "Base End".

When the indicator determines an impulse for a new "Base", it divides this impulse into four equal parts. The parts between 0% and -100% are called "Corrections in the Base". Depending on whether the "Base" is "Bullish" or "Bearish", the corrections are of the significance of "Bullish" or "Bearish" corrections of price movements. The division of the "Base" into lines of -25%, -50% and -75% does not have the significance of "Resistance" and "Support" levels. This is not the intention of the indicator. Rather, these lines should be perceived as lines that define "Zones" of corrections of price movements. It is good to keep in mind that in order for a "Zone" to be fully filled, the price must have passed from one line to the other. These lines and zones are as follows and have their characteristics:

- The line of "Short Correction -25%" determines the zone between "Base Start 0%" to the correction level of -25%. When the correction of the price movement is fast and stays for a short time in this range, this means that there is a strong trend (tendency) and a new impulse of the price movement is expected in the direction of building the "Base". When the correction of the price movement stays for a long time in this range, this means that the trend is slowing down and the price will test the next correction zone of -50%.

- The line of "Normal Correction -50%" determines the zone between the "Short Correction -25%" to the correction level of -50%. This is a "systemic" correction that can most often be seen in market price movements. When the correction of the price movement is fast and stays for a short time in this range, this means that there is a strong trend (tendency) and a new impulse of the price movement is expected in the direction of building the "Base". When the correction of the price movement stays for a long time in this range, this means that the trend is slowing down and the price may test the next correction zone of -75% or return to the correction zone of -25%.

- The line of "Deep Correction -75%" determines the zone between the "Normal Correction -50%" to the correction level of -75%. This is an interesting correction zone of market price movements. Here there is still a high probability that the price will take the direction of building the "Base". When the correction of the price movement is fast and stays for a short time in this range, this means that there is a strong trend (tendency) and a new impulse of the price movement is expected in the direction of building the "Base". When the correction of the price movement stays for a long time in this range, this means that the trend is slowing down and the price may test the next correction zone of -100% ("Base End") or return to the correction zone of -50%.

- The line of "Base End -100%" determines the zone between the "Deep Correction -75%" to the correction level of -100%. This is also a very interesting correction zone. Other rules of behavior of market price movements apply here. There are three options for developing scenarios for the direction of price movement. The scenarios are as follows:

1. When the price movement correction is fast, stays in the given range for a short time and represents an impulse of 100% of the Base size, then we can expect the price to return to the "Base Start 0%" range with an impulse of 100% or more of the "Base" size. In this case, a new "Base" zone is formed. This scenario is observed on highly volatile instruments or when a long and strong trend reverses. Confirmation from another indicator is required, for example - "Trend Acceleration 5".

2. When the price movement correction is fast, stays in the given range for a short time and represents an impulse of 100% of the Base size, then we can expect a return of the price to the "Normal Correction -50%" range and then a price movement in the direction of the -100% "Base End" and the following "Potential" levels of corrections. In this case, we have a trend reversal and the indicator forms a new "Base". This scenario is also difficult to trade and requires confirmation from another indicator such as "Trend Acceleration 5".

3. The third scenario is classic. When the correction of the price movement comes from other correction zones (-50%, -75%) or stays for a long time in this range, it means that the trend has reversed and the price can test the next "Potential" levels of corrections.

In the last few years, markets have changed their price movement patterns, moving from strong and large "Impulses" to weak and short price movements. For this reason, "Potential" levels have been created, which also have the role of corrections. Movements from short "Impulses" are also defined as a "Trend" (Tendency), but this "Trend" is fragmented. "Potential" levels should also be perceived as "Zones" of price movements.

- "Potential" lines after the "Base Start 0%" show how far the price of a financial instrument could go in the direction of the trend. "Potentials" in the direction of the trend are +25%, +50%, +75% and +100%.

- "Potential" lines after the "Base End -100%" show how far the price of a financial instrument could go in the opposite direction of the trend. "Potential" levels in the opposite direction of the trend are -125%, -150%, -175% and -200%.

Of course, there are always exceptions to the rules and patterns of price movements. For example, on some financial instruments, price movements can be seen in a range lasting from one to several weeks. With the help of the "Impulses and Corrections 5" indicator, this can be easily determined. In these places, most traders lose money. When the market is in such a situation, one option is not to trade this instrument. The other option is to trade the range. For this purpose, the indicator shows the distance between the individual lines in pips.

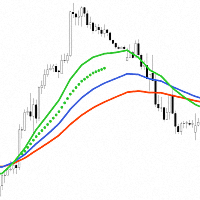

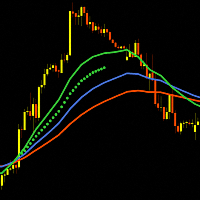

It is recommended to use confirming indicators. For example, in combination with the "Trend Acceleration 5" indicator, you can see how big the "Unfinished Impulse" would be or how long to hold an open position. In combination with the "MR Reversal Patterns 5" indicator, you can decide when to open or when to close a position, and the "MR Volume POC Levels 5" indicator can show how far the price would make a correction. The "MR Range Breakouts 5" indicator will show the different ranges, from different time frames, that will coincide with the "Corrections" or "Potentials" zones.

Show Multi Time Frame Impulses from: - Multi time frame on which to calculate the indicator. By default, the indicator works with data from time frame D1.

Bars History for Impulses calculation: - Number of bars (candles) on which the indicator works from multi time frame D1.

Section "Impulses Settings"

Up Impulse line color - Line color of Up impulse.

Down Impulse line color - Line color of Down impulse.

Impulses line style - Selecting the Impulses line style.

Impulses line width - Selecting the width of the Impulses line.

Unfinished Impulse line style - Select the Unfinished Impulse line style.

Unfinished Impulse line width - Selecting the width of the Unfinished Impulse line.

Section "Visual Corrections Styles Settings"

Style 1: Delete inactive Levels - Shows or deletes inactive "Correction/Potential levels". The shows of inactive "Correction/Potential levels" is for the purpose of researching the history of a financial instrument.

Style 2: Show active Levels short Info - Show an abbreviated form of information about "Correction/Potential levels". If not, it shows an expanded form of the "Correction/Potential levels" information.

Style 3: Show Pips Info - Shows or not Information text about the size of pips between the separate "Correction/Potential" lines.

Section "Correction Levels Settings"

Percentage to calculate new "Base": - Percentage to calculate new "Base". By default, the minimum percentage is set to 62.5% of the last "Base" size. It is permissible to go up to 75%

for the calculation of the new "Base".

Bullish Correction Levels color - Color of bullish "Base/Correction/Potential" levels lines. It is recommended that the color match the color of "Up Impulse".

Bearish Correction Levels color - Color of bearish "Base/Correction/Potential" levels lines. It is recommended that the color match the color of "Down Impulse".

Correction Levels width - Selecting the width of the "Base/Correction/Potential" levels lines.

Section "Correction Levels Text Settings"

Points in 1 Pip - Offers you a choice of the number of Points in 1 Pip.

Correction Levels Text position in Pips - You can choose text distance to "Base/Correction/Potential" lines.

Correction Levels Text font size - You can choose the font size of the text.

Bullish Correction Levels Text Color – The color of the text next to the Base/Correction/Potential bullish level lines.

Bearish Correction Levels Text Color - The color of the text next to the "Base/Correction/Potential" bearish levels lines.