Cumulative Volume Delta MAX MTF

- Indicatori

- Ebrah Ssali

- Versione: 4.2

- Attivazioni: 5

Cumulative Volume Delta MAX MTF Pro v3.0 - The Ultimate Volume-Based Trading Edge

One Indicator to Rule Them All: See What the Market REALLY Thinks

Stop guessing - Start knowing what institutional players are doing before price shows you. The CVD MAX MTF Pro indicator represents the pinnacle of volume analysis technology, transforming complex volume data into clear, actionable trading signals across multiple timeframes. This sophisticated tool doesn't just show you volume - it reveals the hidden forces driving price movements. Dual-Perspective Volume Analysis reveals STRATEGIC BIAS (Instant bull/bear volume regime awareness) and TACTICAL MOMENTUM insights (real-time volume acceleration/deceleration)- it's a complete trading decision support system that reveals the hidden battle between buyers and sellers across ALL user-enabled timeframes simultaneously.

Why This Changes Everything:

1. INSTANT CLARITY - Zero Analysis Paralysis

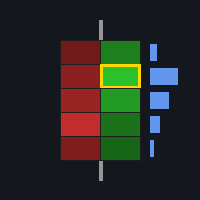

- Single Panel View: See 6 timeframes at once (3 trend + 3 entry) without chart-hopping

- Color-Coded Simplicity: Green/Red = Buyers/Sellers in control. No complex interpretations needed

- Real-Time Bias: Know instantly if you should be bullish, bearish, or waiting

2. SIMPLE SETUP - 3 Minutes to Mastery

Only 3 essential settings to worry about:

CDIPeriod = 14 // Volume smoothing (leave as default or adjust if you choose)

MAPeriod = 20 // Trend confirmation (leave as default or adjust if you choose)

Timeframes = D1, H4, H1, M30, M15, M5 // Your preferred multi-timeframe setup

No complex optimization needed - Works brilliantly out-of-the-box across all markets and timeframes.

The Professional's Edge: 5-Layer Confluence System

Layer 1: Volume Delta Core

- What: Real buying vs selling volume

- Why it matters: Institutional activity leaves footprints - we show you when, what direction and what relative magnitude

Layer 2: Momentum Throttle

MOMENTUM THROTTLE (VOL DIR):

▲▲ = Strong CVD acceleration (Add to position)

▲ = CVD acceleration (Enter/Continue)

-- = Neutral CVD movement (Wait/Caution)

▼ = CVD deceleration (Take profits)

▼▼ = Strong CVD deceleration (Exit/Reverse)

REGIME FLOW:

Acc = Accelerating IN CURRENT regime - Above zero: Bullish momentum increasing

- Below zero: Bearish momentum increasing

Dec = Decelerating IN CURRENT regime

- Above zero: Bullish momentum fading

- Below zero: Bearish momentum fading

Know not just DIRECTION but VELOCITY - Critical for timing entries/exits.

Layer 3: MAX Trend Signals (MAX= Moving Average Cross)

- TREND UP (Aqua): MA confirms bullish regime

- TREND DOWN (Magenta): MA confirms bearish regime

Filters out noise - Trade WITH the confirmed trend, not against it.

Layer 4: Exhaustion Detection (Your Risk Management Secret)

- Max/Min CVD Buy Arrow (White) = Selling EXHAUSTION point

- Max/Min CVD Sell Arrow (Yellow) = Buying EXHAUSTION point

⚠️ Game-Changer: These arrows show you EXACTLY where:

- Stop losses should go (below Max/Min CVD Buy, above Max/Min CVD Sell)

- Take profit zones are (near opposite exhaustion points)

- Institutions stopped their aggressive moves

You can set the colour of these arrows to ‘None’ and they don’t appear if you prefer.

Layer 5: Multi-Timeframe Confluence

Smart Weighting System:

- Higher timeframes (D1, H4) = 40-35% weight

- Entry timeframes (H1, M30) = 30-25% weight

- Not just counting - Intelligently weighing based on timeframe hierarchical importance

Signal Hierarchy - Know Your Confidence Level

Level 1: Weak Signal (Watch Only)

- Single timeframe CVD crosses zero

- Action: Mark level, wait for confirmation

Level 2: Moderate Signal (Consider Trading)

- CVD cross + Momentum acceleration

- Action: Small position, tight stops

Level 3: Strong Signal (Normal Trade)

- CVD cross + MA trend alignment + 2+ timeframe confluence

- Action: Full position, standard risk

Level 4: Power Signal (Maximum Conviction)

- MAX exhaustion arrow + MA confirmation + 70%+ confluence score + 4+ timeframe alignment

- Action: Add to position, wider stops for swing trades

Practical Trading Applications

A. Precision Entries

Before: Enter when price moves (chasing)

Now: Enter when VOLUME shows institutional commitment (leading)

Don’t chase trades, let them come to you

B. Risk Management Revolution

Stop Loss Placement:

Long Trade: Stop below nearest Max/Min CVD Buy arrow (selling exhaustion)

Short Trade: Stop above nearest Max/Min CVD Sell arrow (buying exhaustion)

Take Profit Targets:

1st Target: Previous Max/Min CVD Sell level (buying exhaustion)

2nd Target: Confluence strength meter suggests extension

C. Exit Timing Perfected

Never give back profits again:

- Momentum shifts from ▲ to ▼ = Take partial profits

- Momentum shifts to ▼▼ = Full exit

- Max/Min CVD Sell arrow appears while long = Immediate exit/hedge

The Confluence Meter - Your "Trade Confidence Score"

0-30% (Red): Weak confluence - Avoid or tiny positions

30-50% (Orange): Moderate confluence - Standard trades

50-70% (Yellow): Strong confluence - Above-average positions

70-100% (Green): Power confluence - Maximum position size

This isn't guessing - It's mathematical certainty based on volume alignment across timeframes.

Speed Advantage - See It First Fast ⚡

Retail traders see: Price moving

You see: Volume flow direction 1-3 candles BEFORE price moves

Example Scenario:

Candle 1: CVD crosses up, Momentum ▲, Max/Min CVD Buy appears

Candle 2: MA confirms trend up, Confluence hits 65%

Candle 3: Price starts moving up

You're in on Candle 1 - Others are chasing on Candle 3.

Designed for REAL Traders

No PhD Required

- Color-coded: Green = Go, Red = Stop

- Simple arrows: Up = Buy, Down = Sell

- Plain English: "STRONG BULLISH TREND" not "Oscillator divergence with RSI confirmation"

Works Anywhere

- Forex (All pairs)

- Stocks

- Indices

- Crypto

- Commodities

All Trading Styles

- Scalping: M1-M5 timeframes with instant signals

- Day Trading: M15-H1 with confluence confirmation

- Swing Trading: H4-D1 with MAX exhaustion points

- Position Trading: D1-W1 with trend alignment

Your Trading Insurance Policy

Avoids False Signals

- Single timeframe cross? Check confluence first

- Price breakout? Check volume confirmation

- News volatility? Check institutional footprint

Prevents Overtrading

- Red confluence = Stay out

- Weak momentum = Reduce size

- Mixed timeframes = Wait for alignment

What You Get TODAY:

The Indicator Includes:

1. Main CVD Histogram with real-time buy/sell balance

2. 6-Timeframe Panel with instant market bias

3. Momentum Throttle showing acceleration/deceleration

4. MAX Trend Signals for confirmed direction

5. Exhaustion Arrows for risk management

6. Confluence Meter with confidence scoring

7. Trade Suggestions in plain English

Bonus Features:

- Strategy Tester Optimized: Test strategies without lag

- EA-ready: The signals are stored in buffers for easier access by EAs ( EA Developed but not yet for sale, sorry)

- One-Click Enable/Disable: Turn ‘Off’ when not needed (designed to conserve CPU resources)

- Performance Optimized: Uses caching for smooth operation

The Bottom Line

Unlike lagging indicators repainting past data, this is a forward-looking institutional footprint detector that shows you:

1. WHO is in control (buyers vs sellers)

2. HOW STRONG their control is (momentum)

3. WHERE they're likely to stop (exhaustion points)

4. WHEN to act (multi-timeframe confluence)

5. HOW MUCH to risk (confluence score)

Perfect for Traders Who:

- Are tired of indicator overload

- Want clarity, not complexity

- Need better risk management

- Want to trade WITH institutions, not against them

- Value their time (no more hours of analysis paralysis)

Your Results Will Show:

- Higher win rates (trading WITH volume)

- Better risk/reward (precise stop placement)

- Less stress (clear signals, no guessing)

- More consistency (mathematical edge, not emotion)

Price is what you pay. Volume is what you get. With CVD MAX MTF Pro v3.0 - you get BOTH.

Ready to trade what the market IS DOING, not what it MIGHT DO?

Volume precedes price. Always has, always will. Now you can see it in real-time across all timeframes. Price can be manipulated but Volume can’t. In fact, some predatory market actors use Volume to manipulate Price.

(Combine this with our ‘Fisher Transform MTF’ in the same indicator window and observe very interesting intersection between that and this indicator’s dynamic colour Moving Average)

https://www.mql5.com/en/market/product/161569?source=Site+Profile+Seller

CVD MAX MTF v4.0 - Your Edge in Every Trade.