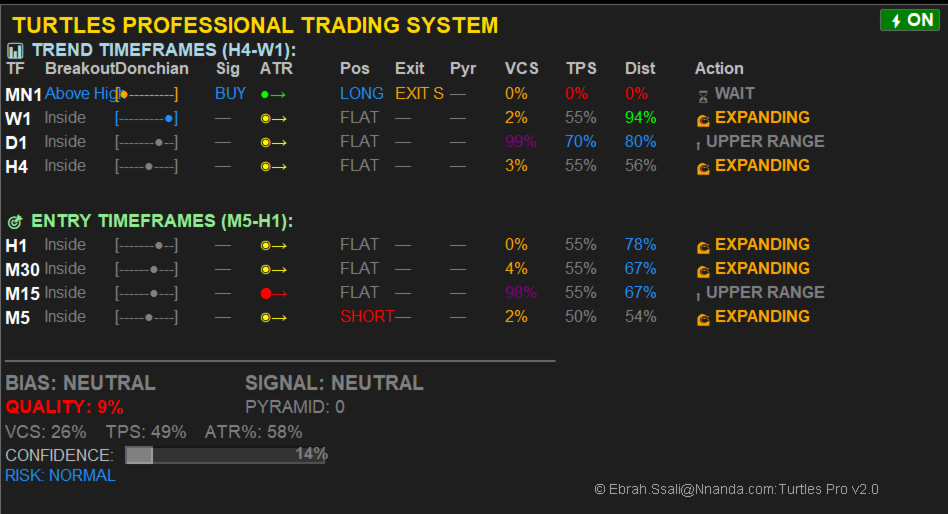

🐢 Turtles Professional v2.0

The Legendary Turtle Strategy, Reimagined for the Modern Trader

Turtles Pro transforms the iconic 1980s Turtle Trading System into a high-performance, multi-timeframe decision engine. It eliminates guesswork by providing institutional-grade analysis on trend structure, entry quality, and volatility all on a single chart.

Turtles Professional uses a Smart Weighted Bias Engine to prioritize higher time frames, ensuring your trades align with the dominant market force.

| FEATURE | HOW IT WORKS |

Weighted Bias

| Hierarchical analysis from MN1 (5.0 weight) to M5 (0.8 weight). |

Action Column

| Instant instructions: SQUEEZE, BREAKOUT, TREND, or ⏳ WAIT. |

Confidence Meter

| A 0–100% score based on trend persistence and volatility contraction. |

Risk Visuals

| ATR symbols (⬤ Red = Wide, ● Green = Tight) define the current volatility regime. |

Signal Hierarchy and Logic

The system evaluates multiple confluences to generate high-probability entries.

1. SQUEEZE (80–100%): High volatility contraction + strong trend. Prepare for explosive moves.

2. BREAKOUT WATCH (70–90%): Price testing Donchian edges; ready for entry.

3. TREND (60–80%): Established momentum; hold or add on pullbacks.

4. RANGE (20–60%): Price idling in the channel; wait for clarity.

Confidence = (|Weighted Bias| x 50) + (20 if VCS > 70) + (20 if TPS > 70)

A 12-column visual engine providing real-time intelligence across 8 timeframes:

• Donchian Position: Visual [●] bar showing exact location within the 0–100% channel.

• Volatility (VCS) and Trend (TPS): Scores that quantify "Squeeze" and "Persistence."

• Pyramid Tracking: Monitors unit additions based on classic Turtle rules (0.5× ATR).

• Summary Area: Global BIAS, SIGNAL, and RISK (Low to High) assessment.

VCS (Volatility Contraction Score): Detects squeeze setups

TPS (Trend Persistence Score): Measures trend quality

ATR Percentile: Institutional volatility context

Professional Risk Management

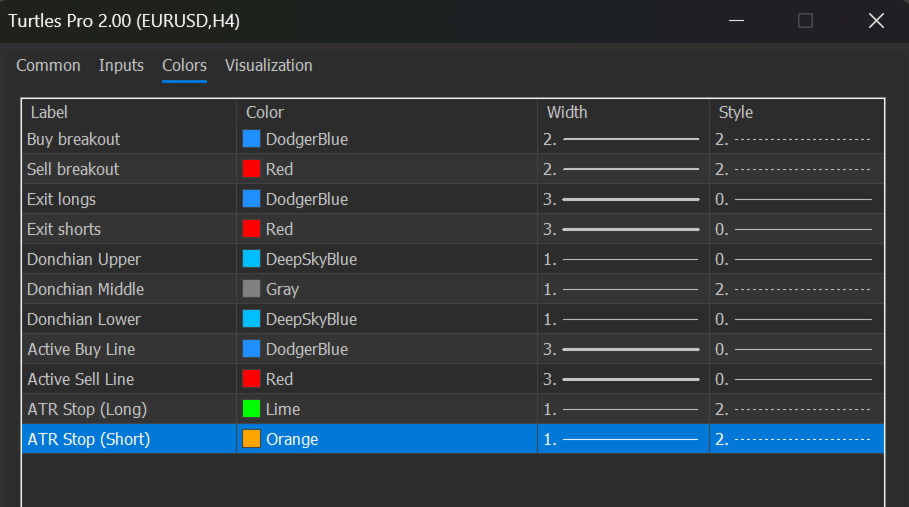

Stop-loss and take-profit guidance adapt to the market environment:

• Wide Volatility: Uses 2.5–3.0× ATR stops.

• Tight Volatility: Uses 1.5× ATR stops.

• Exit Strategy: Automated signals based on the 10-period Donchian exit.

EA-Ready and CPU Optimized

• Automation: 11 dedicated indicator buffers (Arrows, Stops, Channels) for seamless CopyBuffer() integration in Expert Advisors.

• Efficiency: Features a Smart Toggle (⚡ON / 💤OFF). Turn the panel off to save CPU while keeping the chart clear.

Why Choose Turtles Professional?

• Legacy Proven: The Dennis and Eckhardt concept evolved for 2026 markets.

• Zero Guesswork: One chart, eight timeframes, clear colour and emoji-coded actions.

• Precision Timing: Real-time breakout detection vs. lagging standard indicators.

A complete Turtle trading system that doesn't just show data - it makes decisions, manages positions, and can be rigorously tested. This isn't built by indicator developers but by systems architects into a quant-grade decision engine. That is what separates retail indicators from institutional trading tools. Our development implements the Turtle trading system, combines visual intuition with quantitative rigor, while providing CPU-saving features for practical use.

Utility:

Zero Mental Math - Visual patterns replace number crunching

Context at Glance - state, trend, and action

Faster Decisions - Color-coded cues trigger instinctive responses

Pattern Recognition - Visual bars show channel position instantly

Actionable Intelligence - The trader can now scan the panel in seconds and know:

Where price is in each channel

Whether volatility is expanding or contracting

What action to take (actionable signal column)

Trend quality (TPS)

Squeeze conditions (VCS)

This transforms the panel from a data display into a decision support system.

Stop hopping timeframes. Start trading with institutional insights and clarity. Due to character limitation and proprietory architecture confidentiality, we have not disclosed the entire 'How to' but reach out privately once you purchase with questions about aspects you wish to learn more about. For instance, the DIST (Distance) column is one of the most intuitive yet powerful features of Turtles Professional. It tells you exactly where price sits within the Donchian channel as a percentage, giving you instant context for breakout potential.

The DIST column transforms the Donchian channel from a static line into a dynamic probability meter. It answers the question: "How close are we to a breakout?" with instant, colour-coded clarity. In Turtles Professional, you don't need to calculate where price sits in the channel, it's served to you on a silver platter, updated in real-time, across all timeframes. Position within the channel isn't just data, it's the foundation of every Turtle trade.

While all columns provide value, these five form the core decision-making engine:

- ACTION tells you WHAT TO DO

- VCS tells you WHEN it will happen

- DIST tells you WHERE you are

- TPS tells you IF it will continue

- BIAS tells you WHICH SIDE to trade

Master these five (ask for 'Read Me' after purchase), and you'll never be confused by the markets again.

© 2026 Ebrah.Ssali@Nnanda.com