Multi Time Frame VWAP

- Indicatori

- Ebrah Ssali

- Versione: 3.10

- Attivazioni: 5

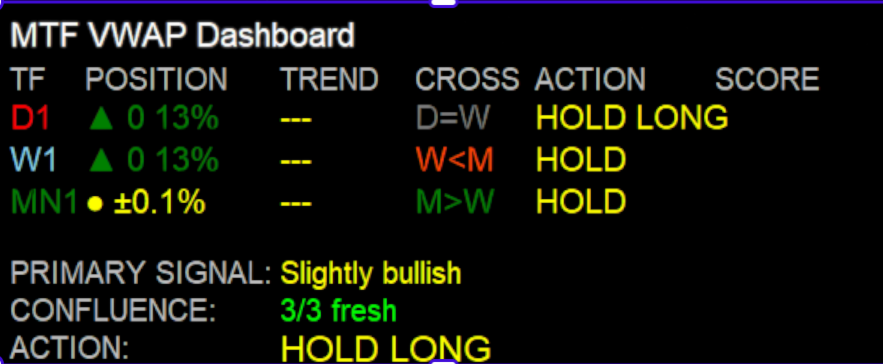

MTF VWAP Indicator - Quick Overview

This indicator shows you where institutional money is flowing across multiple timeframes using Volume Weighted Average Price (VWAP) to identify high-probability trading zones.

What It Actually Does:

1. Tracks Smart Money Levels:

- Shows Daily, Weekly, and Monthly VWAP lines where big players (banks, funds) are trading

- Tells you if price is above or below these key institutional levels

- Shows distance from VWAP as a percentage (tells you how extended price is)

2. Reveals Timeframe Confluence:

- Tells you when multiple timeframes agree (e.g., Daily AND Weekly both bullish)

- Shows when timeframes disagree (warning sign of choppy markets)

- Scores market bias from 0-100 based on overall alignment

3. Provides Clear Trading Actions:

- Gives specific ACTION signals (BUY, SELL, HOLD, WAIT) based on rules

- Shows throttled trend direction with arrows (▲▲ = strong uptrend, ▼ = downtrend)

- Highlights fresh crosses (✓) when Daily crosses above/below Weekly

4. Manages Risk Visually:

- Stop losses are obvious (below Daily VWAP for longs, above for shorts)

- Targets are clear (next VWAP level above/below)

- Risk:Reward is visible (distance between VWAP levels)

For Traders, It Means:

If you're confused about direction:

→ Look at the ACTION column and Score - tells you what to do

If you don't know where to enter:

→ Buy when price bounces off Daily VWAP with bullish action

→ Sell when price rejects at Daily VWAP with bearish action

If you don't know where to exit:

→ Take profit at next VWAP level (Weekly for Daily trades)

→ Stop loss below/above Daily VWAP

If you're unsure about risk:

→ Large position when 3/3 timeframes agree

→ Small position when only 2/3 agree

→ No position when timeframes disagree

Bottom Line:

This indicator turns complex multi-timeframe analysis into simple color-coded signals that tell you:

- WHAT to do (Buy/Sell/Hold)

- WHEN to do it (on crosses/bounces)

- WHERE to place stops/targets (at VWAP levels)

- HOW MUCH to risk (based on confluence)

Think of it as: Your personal institutional flow tracker that shows where the smart money is positioned across different time horizons.