RSI AutoTrader Pro Smart Multi Symbol ATR Engine

🧠 Introduction

RSI AutoTrader Pro is not another simple RSI bot — it’s a complete, intelligent trading system built for multi-symbol automation and dynamic risk control.

Attach it to any chart, and it automatically scans every symbol in your Market Watch, identifies RSI signals, manages trades with ATR-based stop levels, and optimizes each position size according to your selected risk percentage.

It’s more than an indicator-based bot. It’s a fully automated position manager — combining RSI logic, volatility-driven trade sizing, adaptive trailing, and visual HUD control into a single compact engine.

⚙️ How It Works

At its core, the EA uses RSI (Relative Strength Index) to detect overbought and oversold zones, combined with ATR (Average True Range) to measure volatility and adjust all risk parameters dynamically.

Core Logic:

-

RSI < 35 → Potential BUY zone (oversold).

-

RSI > 70 → Potential SELL zone (overbought).

-

RSI returns to neutral zone (45-55) → Active position is closed.

-

ATR defines all price distances (SL, TP, Trailing).

-

Dynamic lot sizing automatically adjusts volume based on your risk percentage and ATR distance.

-

Cooldown filter prevents overtrading by enforcing a pause between trades on the same symbol.

🧩 Step-by-Step Workflow

1️⃣ Market Scanning

EA automatically loads every active symbol from Market Watch (EURUSD, XAUUSD, BTCUSD, USDJPY, etc.).

Each symbol’s RSI(14) and ATR(14) are monitored in real-time on the selected timeframe (default: M5).

2️⃣ Signal Detection

-

When RSI < 35 → EA opens a BUY trade.

-

When RSI > 70 → EA opens a SELL trade.

-

ATR determines stop distances:

-

SL = ATR × 1.5

-

TP = ATR × 2.5

-

Trailing Stop = ATR × 1.0

-

3️⃣ Dynamic Risk Management

Your chosen risk percentage (e.g., 2%) defines the maximum loss per trade.

The EA calculates position size automatically based on:

-

Account balance

-

ATR-based stop distance

-

Symbol tick value

4️⃣ Position Handling

-

RSI Exit: if RSI crosses the neutral line (e.g., BUY trade and RSI > 55), the EA closes the trade early.

-

Trailing Stop: dynamically adjusted on every update according to ATR.

-

Cooldown: no new trades until the defined cooldown period expires.

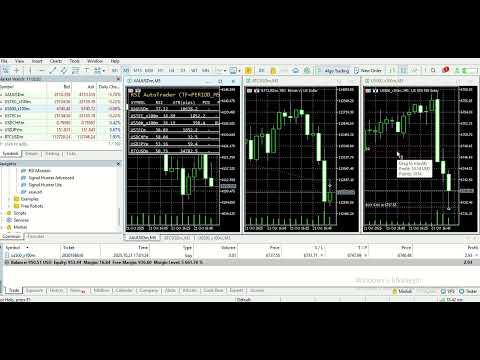

5️⃣ HUD Panel

A real-time information panel appears on the chart showing every monitored symbol:

RSI value, ATR (pips), trade type, open P/L, and signal status.

When a signal is triggered, that row turns green (BUY) or red (SELL) — you instantly know where the action is.

📊 Example Trade Scenarios

Scenario 1 – Gold (XAUUSD)

-

RSI drops to 29 → EA opens a BUY position.

-

ATR = 3.50 → SL = 5.25 USD, TP = 8.75 USD.

-

Dynamic risk = 2% → EA calculates 2.3 lots.

-

RSI later rises above 55 → trade closes with +80 pips profit.

Scenario 2 – USDCHF

-

RSI spikes to 75 → EA opens a SELL.

-

Low ATR = tight stop and small target.

-

RSI reverses below 45 → trade closes early with a small loss.

-

Cooldown prevents any immediate re-entry, avoiding double exposure.

Scenario 3 – Multi-Symbol Monitoring

-

EA runs only on one chart (e.g., EURUSD M5).

-

Simultaneously monitors 10+ pairs (EURUSD, GBPUSD, BTCUSD, XAUUSD…).

-

Opens and manages trades independently for each symbol.

-

HUD displays all positions and signals on one screen.

🚀 Key Advantages

| Feature | RSI AutoTrader Pro | Typical RSI Bots |

|---|---|---|

| Multi-symbol support | ✅ Monitors all Market Watch symbols | ❌ Single symbol only |

| Dynamic lot (risk %) | ✅ Yes | ❌ Fixed lot |

| ATR-based SL/TP | ✅ Adaptive | ❌ Static pips |

| RSI reversal exit | ✅ Yes | ❌ None |

| ATR trailing stop | ✅ Volatility-driven | ⚠️ Basic distance |

| Cooldown system | ✅ Smart anti-spam | ❌ No filter |

| Visual HUD panel | ✅ Colored, live updates | ❌ No display |

| Plug-and-Play automation | ✅ One-chart setup | ⚠️ Manual per symbol |

💎 Why Traders Love It

-

One EA, unlimited opportunities: monitors the entire market automatically.

-

Risk-smart engine: every trade respects your balance and volatility conditions.

-

Volatility-adaptive: ATR makes the system flexible in both calm and high-momentum markets.

-

RSI reversal exits: lock profits and cut losses faster.

-

Cooldown filter: eliminates noise and duplicate entries.

-

Beautiful HUD: stay visually connected with every open trade and signal in real time.

Ideal for traders who want to automate multi-symbol RSI trading without sacrificing intelligent risk control.

⚙️ Input Parameters

| Parameter | Description |

|---|---|

| UseMarketWatch | Automatically scans all Market Watch symbols |

| RSI_Period | RSI calculation period (default 14) |

| RSI_BuyLevel / RSI_SellLevel | Oversold/overbought thresholds |

| ATR_Period | ATR period for volatility calculation |

| SL_ATR_Multiplier | Stop-loss distance (× ATR) |

| TP_ATR_Multiplier | Take-profit distance (× ATR) |

| TS_ATR_Multiplier | Trailing Stop distance (× ATR) |

| Risk_Percent | % of account balance risked per trade |

| CooldownMinutes | Pause time before re-entering same symbol |

| ShowHUDPanel | Enable or disable on-screen panel |

🧠 Recommended Settings

-

Timeframe: M5 (best balance between speed and accuracy)

-

RSI Levels: 35 / 70

-

Minimum Balance: 500 USD or higher

-

Best Symbols: Major FX pairs, Gold (XAUUSD), Bitcoin (BTCUSD)

-

Run 24/7: VPS highly recommended

-

Suggested Risk: ≤ 2% per trade for consistent growth

💬 Final Thoughts

RSI AutoTrader Pro transforms the classic RSI concept into a professional-grade, volatility-aware trading framework.

No need for multiple charts or manual symbol switching — one chart, one setup, all markets covered.

Every trade is calculated, protected, and optimized by a smart risk engine built to adapt.

Whether you’re a beginner looking for a safe RSI system or an advanced trader automating a portfolio, this EA delivers reliability, clarity, and control.