Indicadores técnicos para MetaTrader 5 - 32

Una herramienta para el backtesting de estrategias y el análisis del rendimiento en el gráfico.

Una utilidad para desarrollar, depurar y probar ideas de negociación personalizadas y funciones de indicadores.

Un indicador diseñado para probar rápidamente conceptos de negociación y visualizar la eficacia de diferentes parámetros de entrada.

Un sandbox todo en uno para probar desde simples cruces hasta complejos sistemas de negociación multicondición.

.

El MACD es probablemente uno de los indicadores técnicos más populares que existen. Cuando el mercado está en tendencia, en realidad hace un trabajo bastante bueno, pero cuando el mercado comienza a consolidarse y se mueve hacia los lados, el MACD no funciona tan bien. SX Impulse MACD para MT4 está disponible aquí . Impulse MACD es una versión modificada de MACD que funciona muy bien para el comercio de Forex, acciones y criptomonedas. Tiene su propia característica única que filtra perfectament

El indicador de Estimación Cuantitativa Cualitativa (QQE) se deriva del famoso Índice de Fuerza Relativa (RSI) de Wilder. En esencia, el QQE es un RSI muy suavizado.

Modificación de esta versión: ( convertido de tradingview script por Mihkell00, original de Glaz, salida 100% idéntica)

Así que hay Dos QQEs. Uno que se muestra en el gráfico como columnas, y el otro "oculto" en el fondo que también tiene una banda de bollinger 50 MA actuando como una línea cero.

Cuando ambos coinciden - se obtien

Analizador de Ondas de Elliot Pro calcula las Ondas de Elliot para ayudar a identificar la dirección de la tendencia y los niveles de entrada. Principalmente para Swing Trading Estrategias. Por lo general, uno abriría una posición en la dirección de la tendencia de la onda 3 o una corrección de la onda C . Este indicador traza los niveles objetivo para la onda actual y la siguiente. Las reglas más importantes para el análisis de la onda de Elliot son verificadas por el indicador. La versión Pro

El viejo UT BOT convertido del script TradingView por 'QuantNomad ', inicialmente por 'Yo_adriiiiaan '. y 'HPotter ' - así que usted puede apostar que esta es una herramienta poderosa. Si usted sabe, usted sabe. Esta es la parte superior de la línea, mientras que mantenerlo muy simple.

Función principal: identificación de tendencia con puntos de cambio de tendencia , creados por EMA(fuente) y ATR -La fuente es el PRECIO DE CIERRE con la opción de utilizar el gráfico HEIKEN ASHI en su lugar, pa

Indicador de ruptura de soporte y resistencia Este indicador personalizado para MT5 identifica automáticamente los niveles de precios clave en los que el mercado ha invertido históricamente (zonas de soporte y resistencia) y alerta a los operadores cuando estos niveles se rompen con convicción. Qué hace: El indicador escanea la acción del precio para detectar máximos y mínimos de oscilación significativos y, a continuación, traza líneas dinámicas de soporte y resistencia que se extienden hacia a

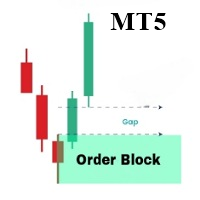

OrderBlock Analyzer es un indicador personalizado para MetaTrader 5 (MT5) diseñado para detectar y resaltar bloques de órdenes (Order Blocks) en los gráficos de precios. Este indicador ayuda a los traders a identificar estructuras clave del mercado, señalando posibles áreas de reversión o continuación. Basado en el comportamiento del mercado, OrderBlock Analyzer dibuja automáticamente los bloques de órdenes y distingue los bloques alcistas y bajistas mediante colores. Características principales

Mejore su trading de breakouts con el Trendlines with Breaks by LuxAlgo MT5, un indicador innovador basado en pivots que dibuja automáticamente líneas de tendencia dinámicas y resalta breakouts en tiempo real, inspirado en la popular suite LuxAlgo en TradingView donde ha acumulado más de 100,000 usos y reseñas positivas por su precisión en detectar niveles de soporte/resistencia. Celebrado en comunidades de trading como Reddit y YouTube por su opción no repintante y pendientes personalizables, e

El KT All-In-One Divergence está diseñado para identificar divergencias regulares y ocultas entre el precio y 11 osciladores ampliamente reconocidos. Esta potente herramienta es indispensable para detectar con rapidez y precisión los retrocesos del mercado. Es una herramienta imprescindible en el arsenal de cualquier operador, ya que proporciona patrones de divergencia claros y precisos. Su precisión y velocidad en la identificación de los retrocesos del mercado son notables, lo que permite a lo

Un indicador para dibujar un gráfico del estado actual e histórico de la cuenta, como Balance, Equidad, Margen, Margen Libre, Nivel de Margen, Reducción, Ganancia de la Cuenta, Depósito y Retiros.

Entradas del Indicador : Dibujar Gráfico de Saldo Dibujar Gráfico de Equidad Dibujar Gráfico de Margen Dibujar gráfico de margen libre Dibujar gráfico de nivel de margen Draw Drawdown Gráfico Dibujar gráfico de beneficios de la cuenta Ocultar Datos en Gráfico y Buffers Conectar Gaps por Líneas Signo

KT Custom High Low muestra los máximos/mínimos más recientes obteniendo los puntos de datos de múltiples marcos temporales y proyectándolos en un único gráfico. Si se encuentran dos o más máximos/mínimos al mismo precio, se fusionan en un único nivel para despejar los gráficos.

Características

Está construido con un algoritmo de ordenación que desordena los gráficos fusionando los valores duplicados en un único valor. Obtenga máximos y mínimos de múltiples marcos temporales en un solo gráfico s

Golden Star MT5 es un indicador de tendencias profesional para la plataforma MT5 desarrollado por un grupo de comerciantes profesionales. El algoritmo de su trabajo se basa en el método del autor original, el cual permite encontrar puntos potenciales de reversión de tendencia con alta probabilidad y recibir señales para ingresar al mercado al inicio de la formación de una tendencia. Este indicador es adecuado para trabajar con oro, criptomonedas y pares de divisas en Forex. El sistema de alerta

Introducción al indicador de volatilidad de doble armónico El uso del análisis de Fibonacci para el trading financiero puede remontarse casi a 85 años desde el nacimiento de la Teoría de las Ondas de Elliott por R. N. Elliott. Hasta ahora, los operadores utilizan el análisis de Fibonacci para identificar los patrones en las series de precios. Sin embargo, no pudimos encontrar ningún intento de utilizar el análisis de Fibonacci para la Volatilidad. El indicador de volatilidad armónica fue el prim

Real-Time Synthetic FX Rate es un indicador diseñado para calcular una estimación sintética y robusta del tipo de cambio para cualquier par de divisas disponible en su bróker (incluyendo pares mayores, menores y exóticos). Su objetivo es ofrecer una referencia dinámica que refleje la formación del precio minuto a minuto , brindando una guía orientativa antes de la publicación de tasas oficiales o validaciones institucionales.

Cómo Funciona: Modelo Híbrido Robusto El indicador genera su valor si

FREE

Indicador Force VADX Force VADX es un avanzado indicador multifactorial que fusiona la fuerza de la tendencia ajustada al volumen, el índice de fuerza normalizado y las señales direccionales adaptativas. Diseñado para los operadores modernos, señala zonas de compra y venta de alta confianza, ofreciendo una sólida base técnica tanto para la negociación discrecional como para la automatizada.

Utilice este indicador junto con otras herramientas de confirmación y confluencia. Este indicador no pre

FREE

Muestra los niveles Murrey Math en el gráfico y también proporciona una alerta cuando el precio toca un nivel en particular. T. Henning Murrey, en 1995, presentó un sistema de trading llamado Murrey Math Trading System, que se basa en las observaciones realizadas por W.D Gann.

Aplicaciones

Para los amantes de Murrey Math, este es un indicador imprescindible en su arsenal. No es necesario que esté presente en la pantalla todo el tiempo. Cada vez que el precio toque un nivel, enviará una alerta.

Versión gratuita del indicador TickScalper. El indicador Tick Scalp es un asistente de operaciones para un operador de scalping. Funciona en una ventana independiente. Rastrea la actividad momentánea del mercado, muestra el gráfico del movimiento de los ticks y la fuerza de los alcistas o bajistas. A veces puede anticipar el comienzo de un movimiento fuerte antes que cualquier otro indicador. Ayuda al operador a tomar la decisión de abrir la orden deseada. Diseñado para funcionar en cualquier i

FREE

El precio medio ponderado por volumen (VWAP) es una referencia de negociación utilizada habitualmente por los grandes operadores que indica el precio medio al que se ha negociado un símbolo a lo largo del día. Se basa tanto en el volumen como en el precio. Este indicador contiene el VWAP Diario y el VWAP de MIDAS, lo que significa que usted puede anclar el inicio de los cálculos de MIDAS y, por lo tanto, podrá utilizar esta metodología para estudiar los movimientos de precio versus volumen despu

FREE

True TrendLines MT5 - Detección inteligente de tendencias y alertas Visión general True TrendLines MT5 es una herramienta de análisis técnico de nivel profesional que identifica y traza automáticamente líneas de tendencia de alta probabilidad en sus gráficos de MetaTrader 5. Utilizando un sofisticado algoritmo de detección de puntos de giro, ayuda a los operadores a visualizar con precisión la estructura clave del mercado y los posibles puntos de inversión. Características principales. Detec

FREE

Cuadro de mandos de la versión MT5: Escáner gratuito para monitorizar todos los pares y plazos. ¡Por favor, póngase en contacto conmigo después de la compra, voy a enviar a usted! Indicador versión MT4: https: //www.mql5.com/en/market/product/59127 Consejo: Este es un indicador para la visualización de señales en tiempo real. Cuando el indicador está cargado y funcionando en el gráfico, la señal pasada no se puede mostrar. La estructura del mercado cambia a medida que el precio se invierte Y f

Spike Detector Rider – Intelligent Trading in Volatile Markets Introduction

The Spike Detector Rider is an advanced system for MetaTrader 5 designed to detect explosive price movements in high-volatility assets such as synthetic indices and commodities.

It combines volatility filters, trend analysis, and automated risk management to provide intelligent trade confirmations. After purchase, please send me a private message via MQL5 to receive the installation manual and setup instructions. Asse

Indicador Tops & Bottoms GRATIS Tops abd Bottoms: Un indicador eficaz para sus operaciones

El indicador de máximos y mínimos le ayuda a encontrar formaciones de canales ascendentes y descendentes con indicaciones de máximos y mínimos ascendentes y/o descendentes. Además, muestra posibles oportunidades con un pequeño círculo amarillo cuando el indicador encuentra una formación de impulso.

Este indicador le proporciona más seguridad y velocidad en la toma de decisiones de entrada. Pruebe también

FREE

Indicador Heikin Ashi RSI para MT5 (HARSI) Visión general

El indicador Heikin Ashi RSI (HARSI) combina el suavizado de velas Heikin Ashi con el análisis del momento RSI, proporcionando una visión de doble capa de la acción del precio y la fuerza relativa. Ofrece una clara visualización de la dirección del mercado, condiciones de sobrecompra y sobreventa basadas en el RSI, y sistemas opcionales de backtesting y alertas para la validación de estrategias y la automatización de señales comerciales.

Indicador Adx altamente configurable.

Características: Funciones de alerta altamente personalizables (en niveles, cruces, cambios de dirección vía email, push, sonido, popup) Capacidad multi timeframe Personalización del color (en niveles, cruces, cambios de dirección) Opciones de interpolación lineal y modo de histograma Funciona en el probador de estrategias en modo multi timeframe (también en fin de semana sin ticks) Niveles ajustables Parámetros:

ADX Timeframe : Puede establecer los marcos

FREE

If you love this indicator, please leave a positive rating and comment, it will be a source of motivation to help me create more products <3 Cómo utilizar la línea de dirección de la pendiente Tendencia alcista: Cuando la línea SDL se inclina hacia arriba y pasa de rojo a verde, muestra que el precio está en tendencia alcista. Esto también se considera una señal de compra. Tendencia a la baja: Cuando la línea SDL se inclina hacia abajo y pasa de verde a rojo, muestra que el precio tiende a la b

FREE

Ver e interpretar una secuencia de Velas es fácil cuando se es humano... Altos más altos, bajos más altos, son el panorama de una tendencia de Compra, al menos en un corto período de tiempo... Viendo una vela actual más alta y una vela más baja, como un ser humano, puede detectar inmediatamente una "divergencia", una "alerta", un "rango inicial", pero al final y sobre la base de otros análisis un operador humano puede entender y comportarse en consecuencia a este tipo de datos de velas ... ¿Pero

FREE

The TrendChannelTracker Indicator is an innovative Forex trading tool. This indicator, which is based on the standard Stochastic Oscillator, provides traders with a unique and simplified method for observing market trends. In contrast to the traditional Stochastic Oscillator, which is shown at the bottom of the chart, the TrendChannelTracker Indicator is built into the price action itself. This removes the need for traders to continually switch their attention between the oscillator and the pri

FREE

Los indicadores RSI (Relative Strength Index) de color de vela cambian los colores de las velas en el gráfico de precios para mostrar visualmente las condiciones del RSI como los niveles de sobrecompra/sobreventa o el impulso alcista/bajista, utilizando colores como el rojo para sobrecompra/bajista y el verde para sobreventa/alcista, ayudando a los operadores a detectar retrocesos o fuerza de un vistazo sin mirar el panel RSI separado. Estos indicadores personalizados a menudo colorean las vel

FREE

Esta es la última oferta de tr1cky.com. Se trata de un indicador de tiempo de sesión con horas de inicio y fin personalizables. El indicador traza una línea vertical de color al inicio y al final de las tres zonas horarias de negociación institucionales. Los colores de la sesión son los siguientes Tokio - Rojo Londres - Verde Nueva York - Azul Las horas están en Tiempo Universal Coordinado (UTC)

FREE

# Super Trend Indicator - Guía del usuario

**Versión:** 1.04 | **Plataforma:** MetaTrader 5 | **Lanzamiento:** Enero 2025

---

## RESUMEN

El **Indicador de Tendencia de Cuadrícula** combina filtros de Supertendencia con EMA Dual para identificar oportunidades de trading de alta probabilidad. A diferencia de los indicadores estándar que solo muestran señales alcistas/bajistas, este añade un tercer estado crucial: **NO TENDENCIA**.

### Características principales

**Sistema de triple esta

FREE

Este indicador calcula la tendencia a través de dos medias móviles diferentes y dibuja líneas de tendencia en zigzag. Puede cambiar la configuración de medias móviles rápidas y lentas para personalizarlo. Entradas:

Periodo de Tiempo MA Rápida : 64 Desplazamiento MA Rápido: 0 Método Fast MA: Suavizado Fast MA Aplicar a: Precio medio Periodo de tiempo MA lento: 32 Desplazamiento MA lento: 0 Método MA lento: Suavizado Slow MA Aplicar a: Precio medio ZigZag Color: Rojo Tipo de ZigZag: DashDot Ancho

FREE

MACD Lines - Indicador MACD con visualización de líneas Descripción Este es un indicador MACD (Moving Average Convergence Divergence) modificado que presenta una visualización más limpia y elegante en comparación con el MACD estándar de MT5. La principal diferencia es que elimina el histograma tradicional y mantiene sólo el MACD y las líneas de señal, lo que permite una mejor visualización de cruces y tendencias. Características principales Línea MACD en azul oscuro con grosor 2 Línea de señal e

FREE

About the indicator: DALA Forecast is a universal tool for predicting the dynamics of time series of any nature. For prediction, modified methods of nonlinear dynamics analysis are used, on the basis of which a predictive model is built using machine learning methods. To get the trial version of the indicator, you can contact me in private messages.

How to use the indicator: Apply the indicator to your chosen financial instrument or indicator with the settings you need. The prediction will be

FREE

Nuestro indicador ICT Swing Levels Support and Resistance es una herramienta poderosa para los operadores de MetaTrader 5. Ayuda a identificar los niveles clave en el mercado donde el precio puede cambiar de dirección al mostrar: Los máximos y mínimos de oscilación en el gráfico, Los máximos y mínimos del día, semana y mes anterior El nivel de apertura de la medianoche en Estados Unidos. (ICT afirma que en la medianoche de Nueva York, los robots se reinicializan y durante el día, el precio tiene

++++++++++++++++++++++++++++++++++ +++ Herramienta de tendencias ++++++++++++++++++++++++++++++++++ Hola Trader, Esta es una herramienta de tendencia que utilizo ... basado en cuatro medias móviles. Precio por debajo o por encima de la EMA200 es indicación de la tendencia a largo plazo. También cuenta la dirección de la pendiente. Usted puede personalizar en la configuración si lo desea. La herramienta está alineada con mi Sistema de Pronóstico y las Zonas de Rebote. - Sistema de Previsión --> h

FREE

Sesiones bursátiles es un indicador que identifica las principales sesiones bursátiles como:

Londres (09:00 - 18:00 UTC+2) Nueva York (15:00 - 00:00 UTC+2) Sydney (23:00 - 8:00 UTC+2) Tokio (02:00 - 11:00 UTC+2)

Muestra las horas de inicio y fin de cada sesión, junto con sus máximos y mínimos, proporcionando a los operadores una visión más clara de la volatilidad de los precios a lo largo del día. El indicador ofrece un alto grado de personalización, lo que le permite ajustar las horas de las se

FREE

Detector FVG Multi-TF ( SIN FLICKER ). Indicador automático para detectar y mostrar niveles de precios clave basado en Smart Money Concepts (SMC) . El indicador identifica Fair Value Price Gaps (FVG) y Swing High/Low simultáneamente en el gráfico actual y desde múltiples marcos temporales superiores. Características y ventajas 1. Antiparpadeo avanzado A diferencia de los indicadores estándar que causan parpadeo durante las actualizaciones de ticks, aquí se implementa una lógica optimizada: El cá

FREE

GridLinesX es una utilidad ligera y eficiente para MetaTrader 5 diseñada para ayudar a los traders a visualizar los niveles de precios con precisión. Si usted es un Grid Trader, un Scalper, o simplemente necesita marcar niveles de precios psicológicos, GridLinesX automatiza el proceso al instante. Olvídese de dibujar manualmente líneas horizontales una a una. Simplemente defina su rango Alto/Bajo y el paso de la cuadrícula (en puntos), y la herramienta generará una superposición de cuadrícula li

FREE

El indicador Multi Pairs Forex es una herramienta de negociación avanzada que permite a los operadores seguir y analizar el rendimiento de varios pares de divisas en tiempo real en un único gráfico. Consolida los datos de varios pares de divisas, proporcionando una visión general de las condiciones del mercado a través de diferentes monedas y le ayuda a ahorrar tiempo. Útil para varios estilos de negociación, incluyendo scalping, day trading y swing trading. Tanto si está monitorizando pares pr

Ulimate MTF Soporte y Resistencia - 5 Star Best Seller Oferta de Año Nuevo - ahorre $20 (precio normal $79) Principiante o Profesional, nuestro Pivot Prof multi-marco de tiempo más vendido mejorará sus operaciones y le traerá grandes oportunidades de comercio con los niveles de soporte y resistencia que utilizan los profesionales. Pivot trading es un método simple y eficaz para entrar y salir del mercado en niveles clave y ha sido utilizado por profesionales durante décadas y funciona en todos l

Indicador Pivot Point Slim Vista general Un indicador de punto pivote de calidad profesional equipado con 6 tipos de pivotes. Con un diseño limpio y fácil de leer, muestra automáticamente importantes niveles de soporte y resistencia en su gráfico. Ajustes de visualización personalizables Ajustes de color individuales para cada nivel (P, S1-S5, R1-R5) Mostrar/ocultar cada nivel Activación/desactivación de la visualización de etiquetas Activación/desactivación de la visualización del precio Posici

FREE

Filtro de dirección de la tendencia podemos definirlo como un indicador profesional diseñado para identificar la dirección dominante del mercado , ayudando a los operadores a comprender mejor el contexto general en el que se mueve el precio. No es un indicador de señal de entrada, sino un filtro direccional creado para resaltar la estructura de tendencia subyacente y reducir el ruido del mercado. Cómo funciona El indicador analiza el comportamiento de los precios a través de una avanzada estruct

FREE

Si te gusta este producto, por favor dale una calificación de 5 estrellas como muestra de agradecimiento.

Este indicador calcula y dibuja los puntos pivote y los niveles de soporte/resistencia para los marcos temporales diario y semanal: Nivel pivote (central) Niveles de soporte S1, S2, S3 Niveles de resistencia R1, R2, R3 Permite mostrar pivotes diarios, semanales o de ambos tipos , ofreciendo a los operadores referencias visuales de posibles zonas de soporte/resistencia.

Modo pivote: Elija qu

FREE

ICT, SMC, Smart Money Concept, Soporte y Resistencia, Análisis de Tendencias, Acción del Precio, Estructura del Mercado, Bloques de Órdenes, Bloques Rompedores, Cambio de Momentum, Fuerte Desbalance, HH/LL/HL/LH, Brecha de Valor Justo, FVG, Zonas de Prima y Descuento, Retroceso de Fibonacci, OTE, Liquidez en el Lado Comprador, Liquidez en el Lado Vendedor, Vacíos de Liquidez, Sesiones de Mercado, NDOG, NWOG, Bala de Plata, Plantilla ICT.

En el mercado financiero, el análisis de mercado preciso

Indicador Balance of Power (BOP) con soporte multi-temporalidad, señales visuales personalizables y sistema de alertas configurable.

¿Qué es BOP? Balance of Power (BOP) es un oscilador que mide la fuerza de los compradores versus los vendedores comparando el cambio en el precio con el rango de la barra. El indicador se calcula como (Close - Open) / (High - Low), luego suavizado con una Media Móvil Simple (SMA). Los valores de BOP varían entre -1 y +1. Los valores positivos indican que los comp

FREE

¿Está cansado de perderse las tendencias rentables del mercado? ¿Le gustaría tener una herramienta confiable que pudiera identificar las continuaciones de tendencias con precisión y exactitud?

¡No busque más! Nuestro indicador de continuación de tendencia está aquí para potenciar su estrategia comercial y ayudarlo a mantenerse a la vanguardia del juego.

El indicador de continuación de tendencia es una herramienta poderosa, creada específicamente para ayudar a los operadores a identificar y co

El Hydra Multi Trend Dashboard es una poderosa herramienta de escaneo de mercado diseñada para MetaTrader 4 y MetaTrader 5. Supervisa hasta 25 pares de divisas o activos simultáneamente en los 9 marcos temporales estándar (de M1 a mensual). Utilizando una fórmula de tendencia especial patentada, el panel filtra el ruido del mercado y proporciona señales claras y visuales alcistas o bajistas, permitiendo a los operadores identificar las alineaciones de tendencia de un vistazo sin cambiar de gráf

Indicador para negociación manual y análisis técnico de Forex.

Consiste en un indicador de tendencia con el nivel de apertura del día de negociación y un indicador de flecha para determinar los puntos de entrada.

El indicador no cambia de color; funciona cuando se cierra la vela.

Contiene varios tipos de alertas para flechas de señal.

Puede configurarse para funcionar en cualquier gráfico, instrumento comercial o período de tiempo.

La estrategia de trabajo se basa en la búsqueda de movimientos

Este indicador funciona como un oscilador de impulso, sin embargo, es más utilizado para navegar por las tendencias. A pesar de ser un oscilador, el MACD (Moving Average Convergence/Divergence) no funciona con condiciones de sobrecompra o sobreventa. Gráficamente se muestra como dos líneas y un histograma con la diferencia de ellas. Metatrader estándar tiene este indicador, sin embargo, con sólo las dos líneas y sin el histograma. De esta manera es mucho más fácil de leer y entender.

FREE

¿Por qué no funcionan los indicadores técnicos?

Muchos operadores pierden dinero por culpa de cruces de indicadores retrasados y rupturas falsas. Los indicadores son espejos retrovisores. No son más que bonitas ecuaciones matemáticas de datos PASADOS. ¿Conduciría usted hacia adelante mirando su espejo retrovisor? Absolutamente NO. El indicador del "Santo Grial" no existe. Decodificación de la Acción del Precio: ¿Cómo opera REALMENTE el dinero inteligente?

Al mercado no le importan sus indicador

Velas HTF es un indicador que traza el contorno de las velas de tiempo superior en la vela inferior. El indicador le da la opción de elegir si desea o no ver en vivo la vela HTF actual, sin retardo o repintado. Características No se dibujan objetos en el gráfico: El indicador no traza ninguna línea u objeto rectangular en el gráfico, simplemente dibuja las velas HTF. Esto mantiene su gráfico simple y limpio. Selección MTF: El indicador le permite elegir todos los diferentes plazos superiores par

The TrendOscillator Indicator is an upgraded version of the traditional Stochastic Oscillator. It comprises two lines: %K and %D. The %K line represents the current market position. In contrast, the %D line is a moving average of the %K line used to generate signals and identify potential entry or exit points. The good thing is the indicator works on all timeframes like the traditional Stochastic. However, to avoid any false signals, applying the indicator on longer timeframes is better

FREE

Este indicador de marco de tiempo múltiple y símbolo múltiple identifica formaciones superiores / inferiores dobles o triples o una ruptura del escote siguiente (superior / inferior confirmada). Ofrece filtros RSI, pin bar, envolvente, pinzas, estrella matutina / vespertina, así como opciones de filtro de divergencia que permiten filtrar solo las configuraciones más fuertes. El indicador también se puede utilizar en modo de gráfico único. Lea más sobre esta opción en el producto blog . Comb

El indicador Trade Visualizer da vida a tus datos de trading mostrando el historial completo de operaciones directamente en los gráficos de MT5. Ya sea que analices tu propio rendimiento o estudies señales de traders en MQL5, esta herramienta transforma los datos brutos en visuales claros e intuitivos. Cada operación se muestra con flechas de entrada y salida, líneas conectadas y detalles como precio, beneficio, volumen y pips. Nota: Si descargaste este indicador, envíanos un mensaje con tu corr

FREE

Divergence Hunter - Sistema profesional de detección de divergencias multioscilador Visión general Divergence Hunter es un indicador técnico de nivel profesional diseñado para detectar y visualizar automáticamente divergencias precio-oscilador en múltiples marcos temporales. Diseñado para operadores serios que comprenden el poder de las operaciones con divergencias, este indicador combina algoritmos de detección de precisión con una interfaz visual intuitiva. Características principales. Soporte

FREE

Cybertrade Doble Banda de Bollinger - MT5 El indicador de Bandas de Bollinger muestra los niveles de los diferentes máximos y mínimos que ha alcanzado el precio de un valor en una duración determinada y también su fuerza relativa, donde los máximos están cerca de la línea superior y los mínimos están cerca de la línea inferior. Nuestro diferencial es presentar este indicador de forma doble, con la disponibilidad de sus valores para simplificar la automatización.

Funciona en períodos más largos

FREE

MACD Pro - Indicador MACD para MetaTrader 5 Descripción

MACD Pro es un indicador de Convergencia y Divergencia de Medias Móviles (MACD) para MetaTrader 5. Sigue el método estándar de cálculo MACD y muestra la dirección de la tendencia y el impulso en una ventana separada del indicador. Sigue el método estándar de cálculo MACD y muestra la dirección de la tendencia y el impulso en una ventana separada del indicador. Elementos del indicador Línea MACD basada en la diferencia entre las medias móvi

FREE

Indicador Crypto_Forex "Histograma de tendencia suavizado" para MT5, sin repintado.

- El indicador de histograma de tendencia suavizado es mucho más eficiente que cualquier cruce de medias móviles estándar. - Está especialmente enfocado en la detección de grandes tendencias. - El indicador tiene 2 colores: rojo para tendencia bajista y verde para tendencia alcista (los colores se pueden cambiar en la configuración). - Con alertas para dispositivos móviles y PC. - Es una gran idea combinar este

Currency Strength Meter is the easiest way to identify strong and weak currencies. This indicator shows the relative strength of 8 major currencies + Gold: AUD, CAD, CHF, EUR, GBP, JPY, NZD, USD, XAU. Gold symbol can be changed to other symbols like XAG, XAU etc.

By default the strength value is normalised to the range from 0 to 100 for RSI algorithm: The value above 60 means strong currency; The value below 40 means weak currency;

This indicator needs the history data of all 28 major currency

Este indicador es un indicador muy simple que dibuja velas en un gráfico. Sin embargo, es posible dibujar no sólo en el gráfico principal, sino también en varios subgráficos. Además, es posible dibujar diferentes símbolos y marcos temporales desde el gráfico principal. características. 1. cualquier símbolo 2. cualquier marco temporal 3. dos tipos de velas (normal y heikin ashi) 4. muchos colores de velas(intersección con ma_1) 5. línea de pivote (ver1.2) En caso de vela positiva, FULL : cambia d

FREE

El comercio de tendencias es una estrategia en la que los traders intentan entrar en una posición en la dirección del movimiento principal del precio y mantenerla hasta que la tendencia cambie. Anti EMA puede ser una herramienta útil en este tipo de comercio, ya que se enfoca en datos de precios a largo plazo, ayudando a ver movimientos sostenibles y evitar señales falsas de fluctuaciones a corto plazo.

Una de las diferencias clave de Anti EMA con respecto a las medias móviles ordinarias, como

Oferta especial : TODAS LAS HERRAMIENTAS , solo $35 cada una. Las nuevas herramientas costarán $30 durante la primera semana o para las primeras 3 compras ! Canal de Trading Tools en MQL5 : únete a mi canal de MQL5 para recibir mis últimas novedades Este indicador visualiza niveles de liquidez y zonas de liquidez basados en conceptos de ICT, además de Liquidity Voids para resaltar desplazamientos de precio unidireccionales. Se centra en dónde tienden a agruparse las órd

Este indicador combina RSI(14) y ADX(14) para encontrar la señal de que el precio se mueve con fuerza. Cuando aparece la señal (representado por el punto amarillo), y el precio está bajando, vamos a considerar para abrir una orden de venta. De lo contrario, considere abrir una orden de COMPRA. En este caso, la fuerza del movimiento es fuerte (normalmente después de un periodo lateral), por lo que podemos establecer el TP en 3 veces el SL .

FREE

El Phoenix FVG & S&R Toolkit es un motor visual de nivel profesional diseñado para detectar la liquidez institucional y los desequilibrios del mercado con precisión quirúrgica. Al automatizar la detección de las zonas de Fair Value Gaps (FVG) y de Soporte y Resistencia (S&R), esta herramienta elimina las conjeturas del análisis técnico y le ayuda a centrarse en las configuraciones de "Dinero Inteligente" de alta probabilidad. El indicador identifica las zonas en las que el precio se ha movido c

FREE

Time Dashboard MT5 es un indicador de MetaTrader 5 potente y fácil de usar diseñado para proporcionar información en tiempo real sobre la zona horaria y el reloj directamente en su gráfico de operaciones. Ideal para operadores de divisas y participantes en mercados globales, esta herramienta muestra la hora del servidor, la hora local y la diferencia horaria entre ambas, mejorando su capacidad para gestionar operaciones en diferentes zonas horarias. Características principales : Visualización de

FREE

Presentación del indicador de brecha del valor razonable : Una herramienta de negociación sencilla y eficaz El indicador Fair Value Gap está diseñado para ayudar a los operadores a identificar y utilizar fácilmente los Fair Value Gaps (FVG) en sus estrategias de negociación. Los FVG ponen de relieve los desequilibrios de precios que el mercado vuelve a visitar a menudo, ofreciendo posibles oportunidades de entrada o salida en las operaciones. Tanto si es un principiante como un operador experim

FREE

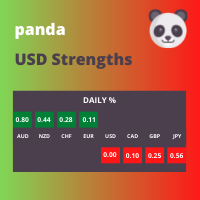

Este panel muestra el cambio porcentual del precio

Muestra el cambio porcentual del precio desde la última apertura: Marcos temporales diario, semanal y mensual. Los números son más fáciles de usar que los medidores de divisas histograma. Alinee las fortalezas/debilidades de los tres timeframes para tendencias fuertes. Compare las divisas más fuertes con las más débiles. El USD es la moneda de reserva mundial para comparar.

Modo de empleo 1. Comparar la divisa más fuerte con la más débil; o 2

FREE

Puntos de giro Niveles Descripción El indicador Pivot Points Levels es una herramienta avanzada y completa para el análisis técnico basada en niveles de soporte y resistencia calculados a partir de puntos pivote. Este indicador gratuito combina 6 métodos de cálculo diferentes con soporte para múltiples marcos temporales, ofreciendo una solución robusta para identificar áreas clave de reversión y continuación de precios. Características principales 6 métodos de cálculo : Tradicional, Fibonacci, W

FREE

Bienvenido a HiperCube VIX Código del -25% de descuento en Darwinex Zero: DWZ2328770MGM Este indicador le proporciona información real del mercado de volumen de sp500 / us500

Definición HiperCube VIX, conocido como el índice de volatilidad CBOE, es una medida ampliamente reconocida del miedo o estrés del mercado. Señala el nivel de incertidumbre y volatilidad en el mercado de valores, utilizando el índice S&P 500 como un indicador del mercado en general. El índice VIX se calcula en función de

FREE

HA Trend Flow es un indicador profesional de tendencia Heiken Ashi suavizado en dos fases para MetaTrader 5.

Está diseñado para visualizar claramente las tendencias del mercado , reducir el ruido e identificar de forma fiable las fases laterales del mercado - sin repintar. Ideal para operadores de tendencia, scalpers, swing traders y análisis multi timeframe . Principales ventajas Tendencias mucho más suaves en comparación con Heiken Ashi estándar. Suavizado en 2 etapas (OHLC + Heiken Ashi)

FREE

El Mercado MetaTrader es una plataforma única y sin análogos en la venta de robots e indicadores técnicos para traders.

Las instrucciones de usuario MQL5.community le darán información sobre otras posibilidades que están al alcance de los traders sólo en nuestro caso: como la copia de señales comerciales, el encargo de programas para freelance, cuentas y cálculos automáticos a través del sistema de pago, el alquiler de la potencia de cálculo de la MQL5 Cloud Network.

Está perdiendo oportunidades comerciales:

- Aplicaciones de trading gratuitas

- 8 000+ señales para copiar

- Noticias económicas para analizar los mercados financieros

Registro

Entrada

Si no tiene cuenta de usuario, regístrese

Para iniciar sesión y usar el sitio web MQL5.com es necesario permitir el uso de Сookies.

Por favor, active este ajuste en su navegador, de lo contrario, no podrá iniciar sesión.