hello sir,

u have this indicator's mq4 version

This indicator is based of the following trading system :

PriceChannel Parabolic system

PriceChannel Parabolic system basic edition

- indicators and template to download for black background (first post of this thread)

- PriceChannel indicator is on CodeBase here, same for white background, how to install

- Clock indicator to be used with this trading system - Indicator displays three variants of time in the chart: local, server and GMT

- pricechannel_parabolic_system_v1 EA

- pricechannel_parabolic_system_v1_1 EA with updated indicator

- Fully updated EA with trading system is on this post and latest indicators to download

- tp/sl levels and timeframes

- how to trade with explanation

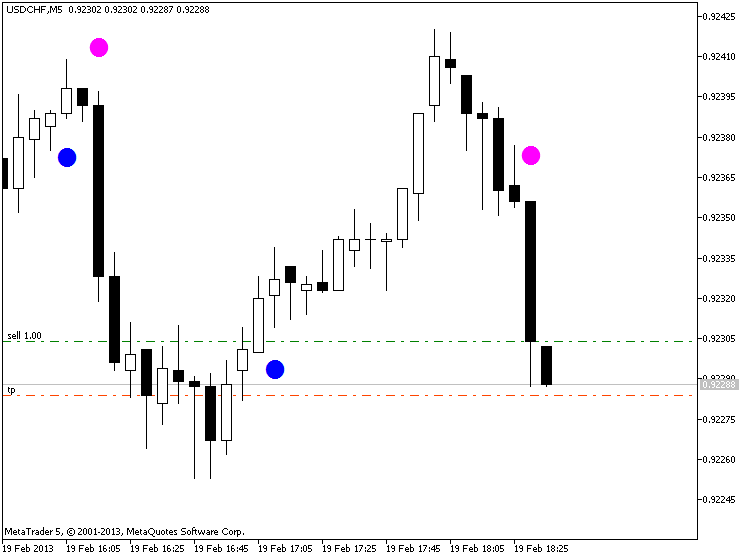

- graphical illustration about where to enter and where to exit with latest version of the system

- how to use AFL Winner indicator with more explanation,

- Updated manual system with templates and indicators - this post

- optimization results for this EA for EURUSD H4

- backtesting results for EURUSD H4 with the settings #1

- backtesting results for EURUSD H4 with the settings #2

- optimization results for EURUSD M15

- backtesting results for EURUSD M15 with the settings #1

- optimization results for GBPUSD M15

- backtesting results for GBPUSD M15 with the settings #1

- MT5 statement is here

- Updated statement is here

- More trading updates

- Updated MT5 statement

- More updates

- 811 dollars for 3 trading days and final statement for scalping

- statement (77 dollars in less than 1 hour)

- statement (517 dollars for one day)

- first statement

- updated statement (257 dollars in 2 days)

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.07 09:08

Who Can Trade a Scalping Strategy? (based on dailyfx article)

- Scalpers look to trade session momentum

- Scalpers do not have to be high frequency traders

- Anyone can scalp with an appropriate trading plan

The term scalping elicits different preconceived connotations to different traders. Despite what you may already think, scalping can be a viable short term trading methodology for anyone. So today we will look at what exactly is scalping, and who can be successful with a scalping based strategy.

What is a Scalper?

So you’re interested in scalping? A Forex scalper is considered anyone that takes one or more positions throughout a trading day. Normally these positions are based around short term market fluctuations as price gathers momentum during a particular trading session. Scalpers look to enter the market, and preferably exit positions prior to the market close.

Normally scalpers employ technical trading strategies utilizing short term support and resistance levels for entries. While normally fundamentals don’t factor into a scalpers trading plan, it is important to keep an eye on the economic calendar to see when news may increase the market’s volatility.

High Frequency Trading

There is a strong misconception that all scalpers are high frequency traders. So how many trades a day does it take to be considered a scalper? Even though high frequency traders ARE scalpers, in order for you to qualify as a scalper you only need to take 1 position a day! That is one of the benefits of scalping. You can trade as much or as little as you like within a giving trading period.

This also falls in line with one of the benefits of the Forex market. Due to the 24Hr trading structure of Forex, you can scalp the market at your convenience. Take advantage of the quiet Asia trading session, or the volatile New York – London overlap. Trade as much or as little as you like. As a scalper the choice is ultimately yours to make!

Risks

There are always risks associated with trading. Whether you are a short term, long term, or any kind of trader in between any time you open a position you should work on managing your risk. This is especially true for scalpers. If the market moves against you suddenly due to news or another factor, you need to have a plan of action for limiting your losses.

There are other misconceptions that scalpers are very aggressive traders prone to large losses. One way to help combat this is to make scalping a mechanical process. This means that all of your decisions regarding entries, exits, trade size, leverage and other factors should be written down and finalized before approaching the charts. Most scalpers look to risk 1% or even less of their account balance on any one position taken!

Who can Scalp?

So this brings us to the final question. Who can be a scalper? The answer is anyone with the dedication to develop a trading strategy and the time to implement that strategy on any given trading day.

=================

Trading examples

Metaquotes demo

- MT5 statement is here

- Updated statement is here

- More trading updates

- Updated MT5 statement

- More updates

- 811 dollars for 3 trading days and final statement for scalping

GoMarkets broker, initial deposit is 1,000

- statement (77 dollars in less than 1 hour)

Alpari UK broker initial deposit is 1,000

- statement (517 dollars for one day)

RoboForex broker initial deposit is 1,000

- first statement

- updated statement (257 dollars in 2 days)

hi

i cannot add to chart

Code Base failed to compile file 'C:\Users\Me\AppData\Roaming\MetaQuotes\Terminal\2506E8E7E4116548D478CE2C3598FAB1\MQL5\Indicators\Downloads\ultrarsi.mq5'

hi

i cannot add to chart

Code Base failed to compile file 'C:\Users\Me\AppData\Roaming\MetaQuotes\Terminal\2506E8E7E4116548D478CE2C3598FAB1\MQL5\Indicators\Downloads\ultrarsi.mq5'

tnx

i compiled the file and got this errors

'ultrarsi.mq5' ultrarsi.mq5 1 1

'SmoothAlgorithms.mqh' SmoothAlgorithms.mqh 1 1

'Smooth_Method' - declaration without type SmoothAlgorithms.mqh 537 18

'Method' - comma expected SmoothAlgorithms.mqh 537 32

'Smooth_Method' - declaration without type ultrarsi.mq5 82 7

'Smooth_Method' - declaration without type ultrarsi.mq5 89 7

'W_Method' - undeclared identifier ultrarsi.mq5 135 43

'W_Method' - cannot convert enum ultrarsi.mq5 135 43

'SmoothMethod' - undeclared identifier ultrarsi.mq5 137 53

'SmoothMethod' - cannot convert enum ultrarsi.mq5 137 53

'W_Method' - undeclared identifier ultrarsi.mq5 141 52

'W_Method' - cannot convert enum ultrarsi.mq5 141 52

'SmoothMethod' - undeclared identifier ultrarsi.mq5 142 54

'SmoothMethod' - cannot convert enum ultrarsi.mq5 142 54

'W_Method' - undeclared identifier ultrarsi.mq5 232 74

'W_Method' - cannot convert enum ultrarsi.mq5 232 74

'SmoothMethod' - undeclared identifier ultrarsi.mq5 246 82

'SmoothMethod' - cannot convert enum ultrarsi.mq5 246 82

'SmoothMethod' - undeclared identifier ultrarsi.mq5 247 82

'SmoothMethod' - cannot convert enum ultrarsi.mq5 247 82

'Method' - undeclared identifier SmoothAlgorithms.mqh 540 11

'Method' - illegal switch expression type SmoothAlgorithms.mqh 540 11

'MODE_SMA_' - undeclared identifier SmoothAlgorithms.mqh 542 12

'MODE_SMA_' - constant expression is not integral SmoothAlgorithms.mqh 542 12

'MODE_EMA_' - undeclared identifier SmoothAlgorithms.mqh 543 12

'MODE_EMA_' - constant expression is not integral SmoothAlgorithms.mqh 543 12

'MODE_SMMA_' - undeclared identifier SmoothAlgorithms.mqh 544 12

'MODE_SMMA_' - constant expression is not integral SmoothAlgorithms.mqh 544 12

'MODE_LWMA_' - undeclared identifier SmoothAlgorithms.mqh 545 12

'MODE_LWMA_' - constant expression is not integral SmoothAlgorithms.mqh 545 12

'MODE_JJMA' - undeclared identifier SmoothAlgorithms.mqh 546 12

'MODE_JJMA' - constant expression is not integral SmoothAlgorithms.mqh 546 12

'MODE_JurX' - undeclared identifier SmoothAlgorithms.mqh 547 12

'MODE_JurX' - constant expression is not integral SmoothAlgorithms.mqh 547 12

'MODE_ParMA' - undeclared identifier SmoothAlgorithms.mqh 548 12

'MODE_ParMA' - constant expression is not integral SmoothAlgorithms.mqh 548 12

'MODE_T3' - undeclared identifier SmoothAlgorithms.mqh 549 12

'MODE_T3' - constant expression is not integral SmoothAlgorithms.mqh 549 12

'MODE_VIDYA' - undeclared identifier SmoothAlgorithms.mqh 550 12

'MODE_VIDYA' - constant expression is not integral SmoothAlgorithms.mqh 550 12

'MODE_AMA' - undeclared identifier SmoothAlgorithms.mqh 551 12

'MODE_AMA' - constant expression is not integral SmoothAlgorithms.mqh 551 12

'MODE_SMMA_' - case value already used SmoothAlgorithms.mqh 544 12

see previous usage SmoothAlgorithms.mqh 543 12

'MODE_LWMA_' - case value already used SmoothAlgorithms.mqh 545 12

see previous usage SmoothAlgorithms.mqh 544 12

'MODE_JJMA' - case value already used SmoothAlgorithms.mqh 546 12

see previous usage SmoothAlgorithms.mqh 545 12

'MODE_SMA_' - case value already used SmoothAlgorithms.mqh 542 12

see previous usage SmoothAlgorithms.mqh 546 12

'MODE_JurX' - case value already used SmoothAlgorithms.mqh 547 12

see previous usage SmoothAlgorithms.mqh 542 12

'MODE_AMA' - case value already used SmoothAlgorithms.mqh 551 12

see previous usage SmoothAlgorithms.mqh 547 12

'MODE_ParMA' - case value already used SmoothAlgorithms.mqh 548 12

see previous usage SmoothAlgorithms.mqh 551 12

'MODE_T3' - case value already used SmoothAlgorithms.mqh 549 12

see previous usage SmoothAlgorithms.mqh 548 12

'MODE_VIDYA' - case value already used SmoothAlgorithms.mqh 550 12

see previous usage SmoothAlgorithms.mqh 549 12

49 errors, 0 warnings 50 1

What was not enough to tell you how to run it on a chart?

Downloaded it, pushed it to folders and.... can't find it in the indicators.

Not everyone here is a programmer)

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

UltraRSI:

This indicator is based on RSI (Relative Strength Index) and its multiple signal lines analysis.

A trend direction in this indicator is determined by the cloud color, while its power is determined by the cloud width. You can use the overbought (UpLevel) and oversold (DnLevel) levels that are set in percent value from the indicator maximum amplitude.

Author: Nikolay Kositsin