Join our fan page

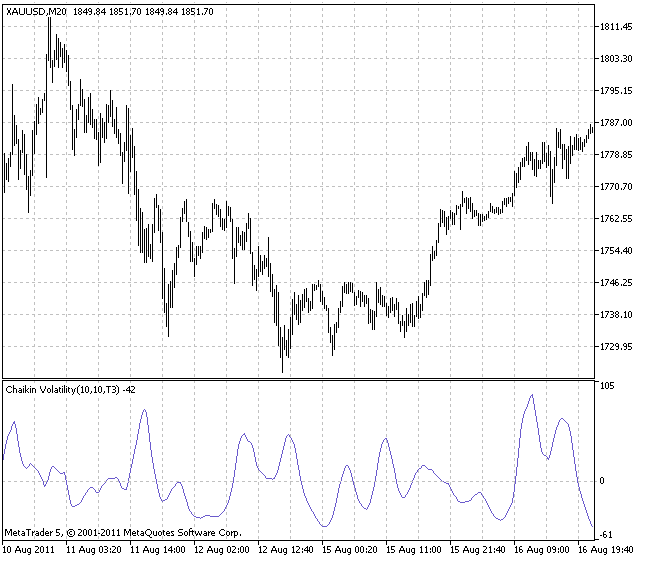

Chaikin Volatility Index With a Smoothing Algorithm Selection - indicator for MetaTrader 5

- Views:

- 9353

- Rating:

- Published:

- Updated:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

The main difference of this indicator from its standard equivalent is the possibility to change the smoothing algorithm by selecting an appropriate one out of ten algorithms present:

- SMA - simple moving average;

- EMA - exponential moving average;

- SMMA - smoothed moving average;

- LWMA - linear weighted moving average;

- JJMA - JMA adaptive average;

- JurX - ultralinear smoothing;

- ParMA - parabolic smoothing;

- T3 - Tillson's multiple exponential smoothing;

- VIDYA - smoothing with the use of Tushar Chande's algorithm;

- AMA - smoothing with the use of Perry Kaufman's algorithm.

It should be noted that Phase parameter has completely different meaning for different smoothing algorithms.

- For JMA it is an external Phase variable changing from -100 to +100.

- For T3 it is a smoothing ratio multiplied by 100 for better visualization;

- For VIDYA it is a CMO period, for AMA it is a slow EMA period;

- For AMA fast EMA period is a fixed value and is equal to 2 by default. The ratio of raising to the power is also equal to 2 for AMA.

The indicator uses SmoothAlgorithms.mqh library classes (must be copied to the terminal_data_folder\MQL5\Include). The use of the classes was thoroughly described in the article "Averaging Price Series for Intermediate Calculations Without Using Additional Buffers".

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/471

Multistochastic

Multistochastic

The indicator for multi-currency technical analysis based on the related financial assets resonances.

Keltner Channels Set

Keltner Channels Set

Set of Keltner Channels based on the universal smoothing.

ZigZag

ZigZag

The variant of the ZigZag indicator optimized by its operation rate.

Spearman's Rank Correlation

Spearman's Rank Correlation

Spearman's Rank Correlation is a non-parametrical method used for statistical analysis of the correlation.