Join our fan page

- Views:

- 15116

- Rating:

- Published:

- Updated:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

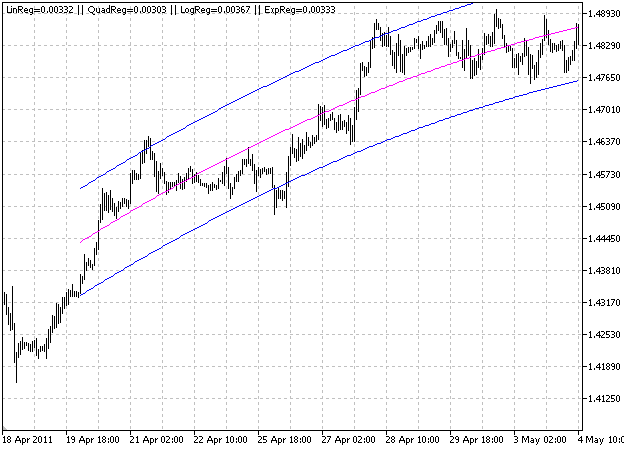

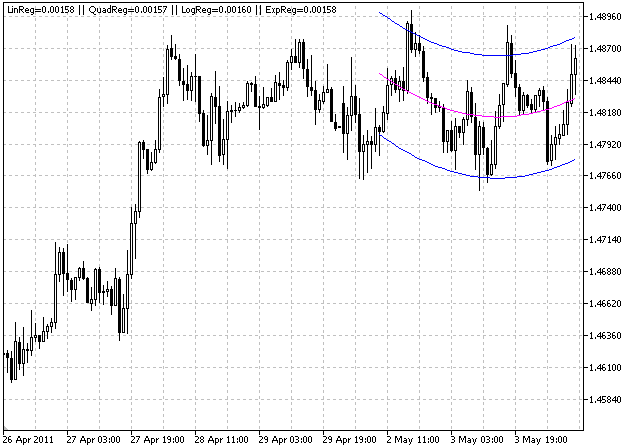

This indicator compares four types of regression (linear, quadratic, logarithmic and exponential) and chooses the one that best fits the data analyzed.

This analysis is done every time there is a new tick.

//--- input parameters // dp_limiter It should be >2 . If not it will be autoset to default value input ushort dp_limiter =100; // Number of data points input uint endpos =0; // Last value position input double multStdDev =1.96; // Bands separation input inputs_switch comments =On; // Comments switch input inputs_switch record =Off; // Record info into a file text

In the left top corner of the chart four values are displayed.

These values represent the dispersion of data regarding to its regression, so the smallest value indicates the best option.

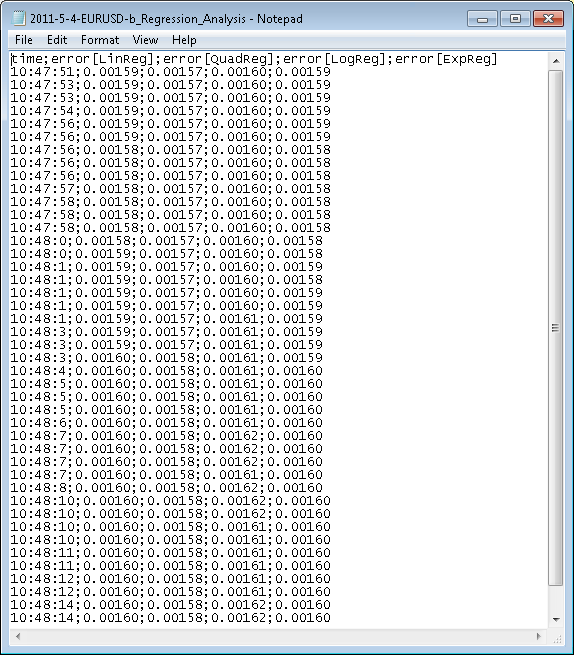

Additionally, the indicator allows recording these values into a text file for further analysis.

Kaufman Efficiency Ratio

Kaufman Efficiency Ratio

Kaufman Efficiency Ratio (also called "generalized fractal efficiency") according to Perry Kaufman books "Smarter Trading" and "New Trading Systems & Methods".

Kaufman Volatility

Kaufman Volatility

Kaufman Volatility indicator according to Perry Kaufman book "Smarter Trading: Improving Performance in Changing Markets".

sTimeToVariables

sTimeToVariables

The script converts the time, represented as datetime variable into the year, month, day, hour, minutes and seconds.

Exposure

Exposure

This script reads all opened position and calculates their exposure for each currency.