Highly effective Triple Strike candle pattern + full-fledged Trading System

Candlestick patterns are a great way to determine trade entry points. And most importantly, they work.

The Triple Strike pattern is a rare but extremely effective Japanese candlestick combination. The pattern works on any timeframe.

It can be used as a signal to find an entry point on the weekly chart, or as a scalping entry on the M1 timeframe. I prefer hourly (H1) charts.

Pattern identification rules Triple Strike

We are looking for 3 consecutive strike bars in different directions.

- An Ascending Impact Bar is a bar whose closing price is higher than the high of the previous bar.

- Downward Impact Bar - a bar whose closing price is lower than the low of the previous bar.

An additional confirmation is the increasing size of the bars.

Logics

The logical explanation for this pattern is pain. Essentially, traders are being deceived twice. Before a truly strong move, the market likes to knock out the stop-losses of small players.

Trading system

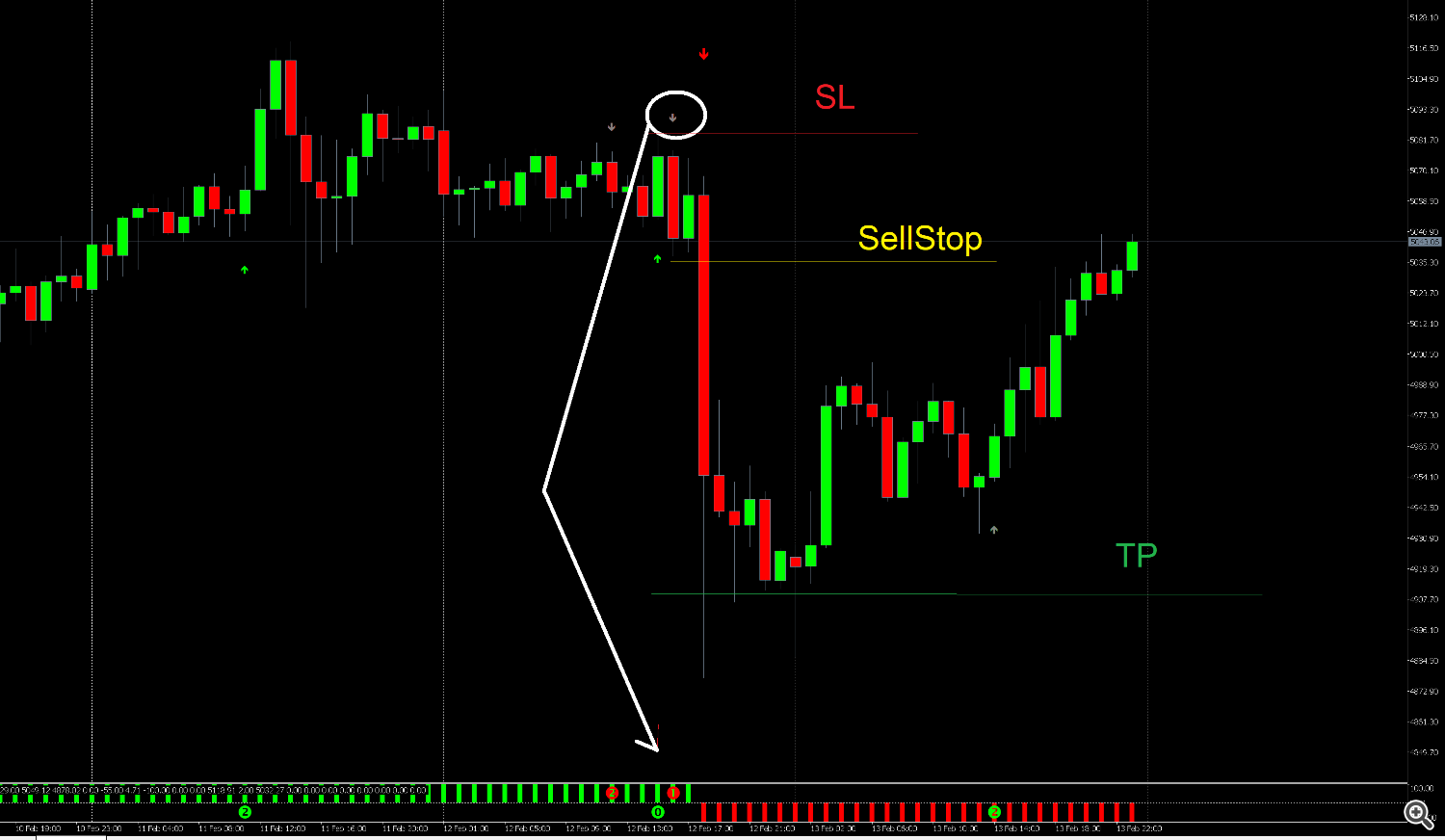

- To confirm an entry, use a breakout of the high or low of the last bar in the pattern. This isn't necessary, as the pattern itself is very strong.

- Set stop loss at the maximum (for sales) of the pattern.

- Take profit should be a multiple of stop loss, from 0.5 to 3, depending on preference.

In the screenshot below, I used the AceTrend indicator to identify the pattern. It automatically draws the Triple Strike pattern and marks it as #1.

The pattern is so strong that it often initiates a trend reversal!

Candlestick patterns really work!

If you still don't believe it, here's an example of my real automated trading using candlestick patterns:https://www.mql5.com/en/signals/2339244Summary: Why the Triple Strike Works and How to Use It in Your Trading

The Triple Strike pattern isn't just a random combination of candlesticks, but a reflection of market psychology, where a stronger player (or the market itself) "shakes out" the crowd before triggering a momentum wave. To summarize, there are five key reasons why this pattern deserves a place in your trading arsenal:

-

High reliability due to "double deception".

Unlike simple candlestick formations, the Triple Strike forces traders to make mistakes twice in a row. The first strike bar catches some, the second catches others. By the time the third bar forms, there's minimal liquidity (stop-losses) left in the market before the real move, making it a highly accurate harbinger of a reversal or a strong trend continuation. -

Versatility of timeframes.

You mentioned that you prefer H1, but the beauty of the pattern is its scalability. Finding a Triple Strike on M1 is just as effective as on Weekly. The main rule is: the higher the timeframe, the stronger the movement will be, but the less frequently the signal will occur. -

Easy identification.

You don't need a heavy arsenal of indicators. While using tools like AceTrend speeds up the search, the pattern is easily spotted with the naked eye: three bars, each successive bar closing beyond the previous one, creating a "three-steps-of-violence" effect before the breakout. -

Clear risk management.

The pattern provides crystal-clear levels for capital protection. Stop-loss orders are placed beyond the pattern's extreme, and take-profit orders, which are multiples of the risk (from 0.5 to 3), allow you to flexibly adjust the strategy to your trading style—whether conservative scalping or aggressive swing trading. -

Strength of trend reversal.

A "triple strike" often occurs at key support/resistance zones or at trend tops/bottoms. If you see this pattern on an hourly chart near a strong level, you can safely consider it an early sign of a global trend reversal.

Summary for a trader:

Don't chase the number of signals. The "Triple Strike" is a rare sight on the chart, but when it does appear, the market seems to be shouting its intentions at you. Add it to your checklist, always wait until the third bar closes, and remember: your goal isn't to time the move, but to enter it after the market has "knocked out" all weak players. The discipline of entering this pattern pays off with a high probability of a successful trade.