How I Manage Risk and Diversify Across Multiple Prop-Firm Accounts

One of the most common mistakes I see among prop-firm traders is concentrating too much risk in a single strategy or a single account. Even profitable systems can go through difficult periods, and when everything is stacked together, one bad phase can wipe out months of work.

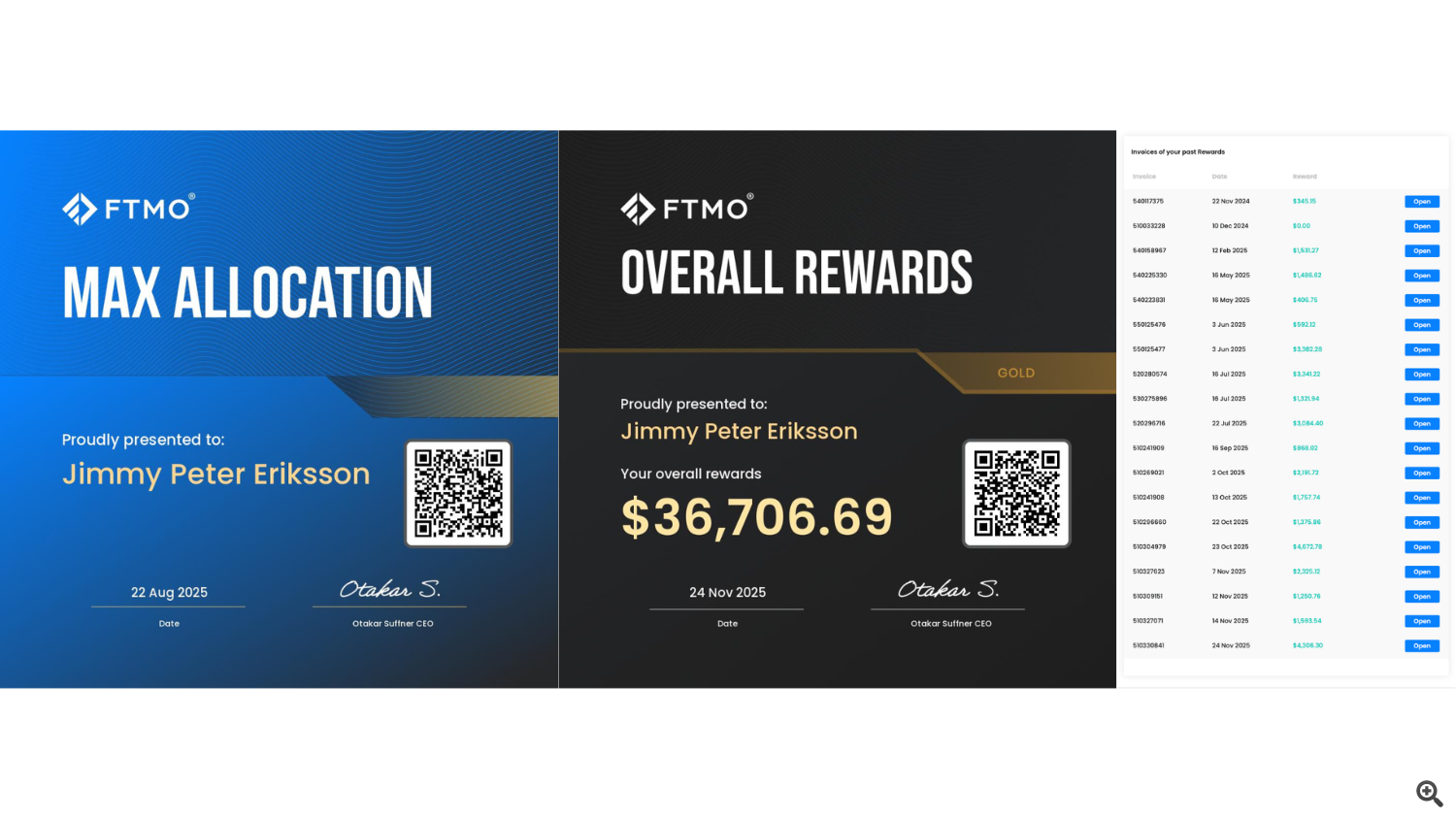

Over time, I’ve built a structure that focuses on risk separation, diversification, and longevity, rather than chasing short-term returns. This approach has allowed me to generate consistent payouts for over a year, with more than 20 payouts and over $36,000 USD withdrawn from FTMO-style accounts, while managing roughly $400,000 in funded capital.

This article explains exactly how I structure my accounts and why I do it this way.

Core Principle: Systems Fail Temporarily, Structures Should Not

I don’t rely on a single “perfect” strategy. Instead, I trade multiple uncorrelated Expert Advisors, each based on different market behaviors:

-

Different entry logic

-

Different time windows

-

Different trade frequencies

-

Different market conditions

Any individual system can underperform for weeks or months. The goal is not to avoid drawdowns entirely, but to make sure no single drawdown can hurt the entire operation.

My Setup: 8 Uncorrelated Expert Advisors

Let’s assume I am running 8 uncorrelated EAs and 4 × $100,000 prop-firm accounts.

Rather than cloning the same setup everywhere, I intentionally assign different roles to each account.

Account 1: Ultra-Safe, Long-Term Income Core

Purpose: Stability and longevity

Risk: Very low

Goal: ~1–2% per month

-

All 8 EAs are running together

-

Very low risk per system

-

Maximum diversification

-

Designed to survive almost any market condition

This account is not exciting — and that’s the point.

It acts as a base income account, meant to stay funded long-term and produce steady payouts. If everything else fails, this account is designed to keep going.

Account 2: Diversified but Higher Risk

Purpose: Controlled growth

Risk: ~2× the ultra-safe account

Goal: Higher monthly returns

-

All 8 EAs are still running together

-

Same diversification benefits

-

Slightly increased risk per trade

Here, I accept more volatility. I’m comfortable losing this account if it generates strong payouts first. Even one good cycle can produce several thousand dollars, which already offsets the risk.

This account balances diversification with performance.

Accounts 3 & 4: Split Systems, Split Risk

Purpose: Risk separation and redundancy

Instead of running all systems together, I split them:

-

Account 3: 4 EAs (low–medium risk)

-

Account 4: Remaining 4 EAs (medium–higher risk)

Why do this?

-

If a specific group of systems hits a bad period, it only affects one account

-

The other account may remain stable or profitable

-

Different system combinations behave differently, even in the same market

This dramatically reduces the chance of multiple accounts failing at the same time.

Why This Works Better Than a Single “High-Risk” Account

Many traders try to push one account hard to reach targets faster. That approach usually ends in:

-

Emotional pressure

-

Rule violations

-

Account loss during normal drawdowns

My structure accepts that:

-

Some accounts may be lost

-

Others are designed specifically not to be lost

-

Overall capital and payouts stay consistent

It’s a portfolio mindset, not a single-bet mindset.

The Big Advantage: Psychological and Statistical Stability

This structure gives two major benefits:

1. Psychological Stability

When one account is down, others are often up. This removes the urge to interfere with systems or increase risk emotionally.

2. Statistical Robustness

Uncorrelated systems + separate accounts = fewer extreme outcomes. You’re not betting everything on one market regime.

Final Thoughts

This approach is not about maximizing returns in a single month. It’s about:

-

Staying funded

-

Generating consistent payouts

-

Surviving bad market periods

-

Treating prop-firm trading like a business, not a gamble

If you trade multiple systems, I strongly recommend thinking not only about how they trade — but where and how they are allocated.