What happens if you take a simple volatility breakout strategy and feed the neural network with data from two moving averages and the price position relative to them as a filter?

- You can customize it to any symbol and timeframe.

- High signal accuracy.

- When using the optimization criteria built into the terminal, overtraining is high.

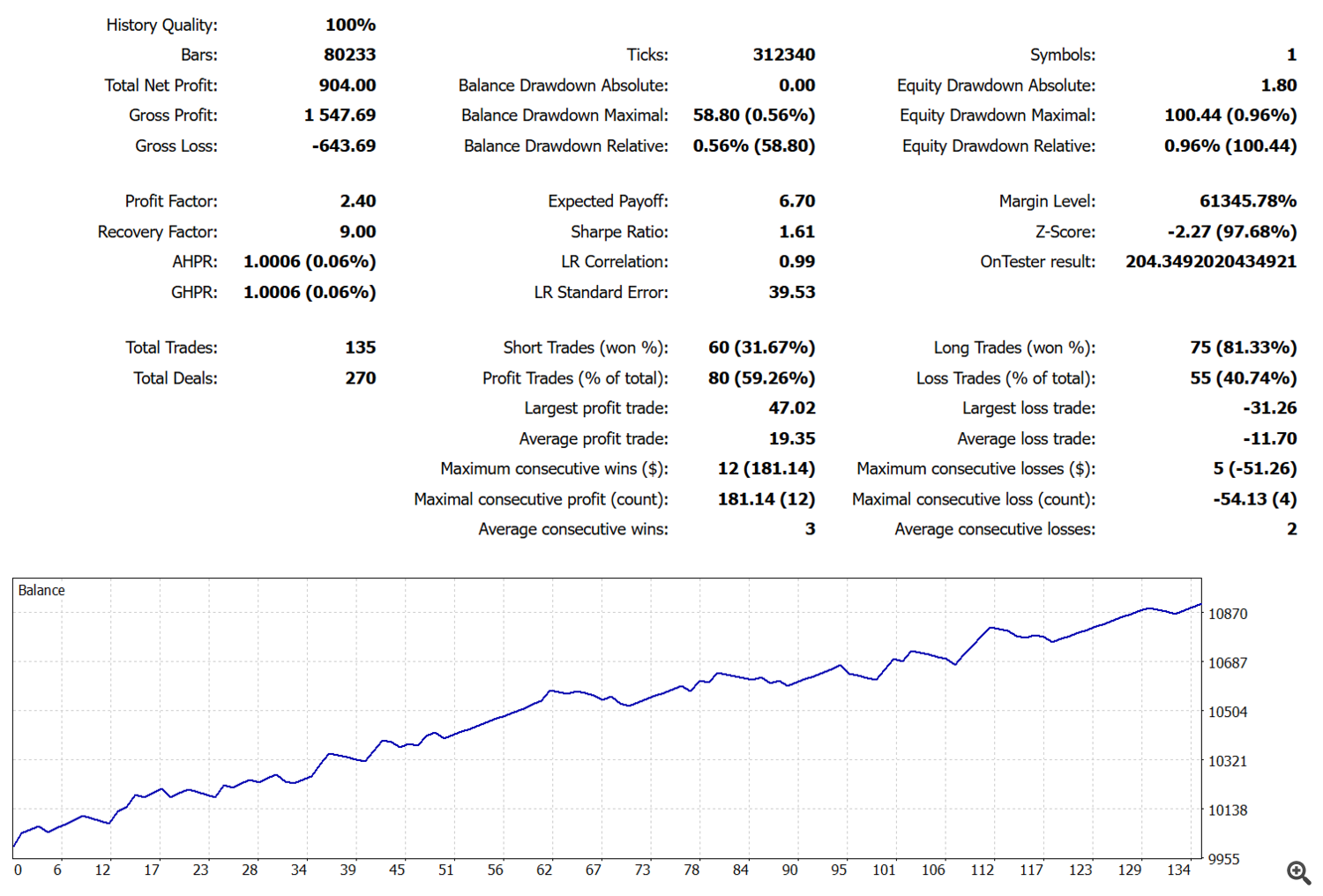

An automated advisor was written based on the above conditions. It was then trained on GBPUSD H1. Here are its results:

You can try to retrain the expert yourself or use the default parameters for GBPUSD H1: Download a free expert advisor

To use the Expert Advisor, you need to download the free "Moving Average Cross Signal" indicator from the MQL Market and keep it in the MQL Market. The indicator file should be located in the "Indicators/Market" folder.

The expert advisor is configured for the British Pound (GBPUSD) on the H1 (1 hour) timeframe. However, you can use the expert advisor on any symbol and timeframe by adjusting the parameters yourself.

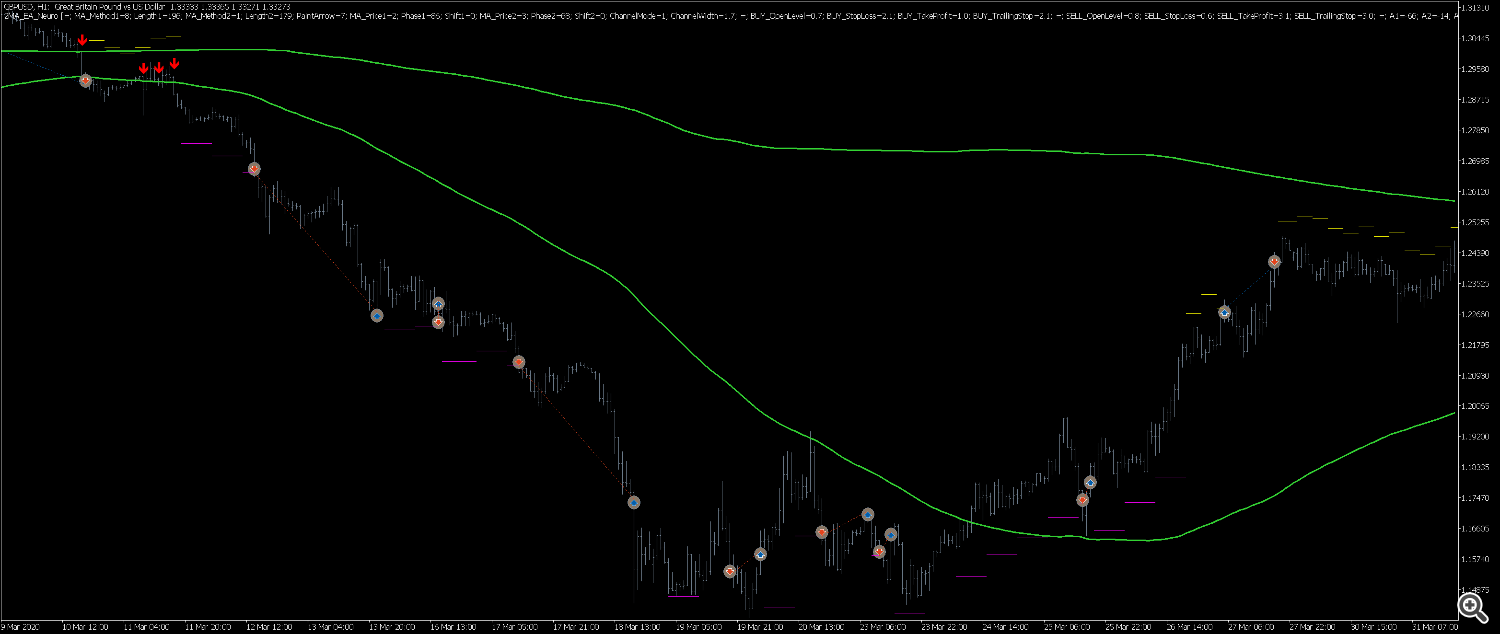

This is what the advisor's transactions look like

Conclusions:

-

Potential versatility of the strategy. Using a simple volatility breakout strategy in conjunction with data from two moving averages and the price position relative to them allows the trading system to be customized for various symbols and timeframes. This makes the approach quite flexible and potentially applicable to a variety of markets.

-

Possibility of high signal accuracy. Feeding moving averages and price data into a neural network can improve the quality of trading signals. Moving averages help smooth out noise and highlight trends, and combining them with volatility analysis can increase the likelihood of successful trades.

-

The problem of overfitting. High model overfitting when using the terminal's built-in optimization criteria can be a significant drawback. This means that while the model performs well on historical data, it may show less consistent results on new data, which poses risks in real trading.

-

Additional configuration and testing required. Despite the stated ability to work with any symbol and timeframe, successful use of the Expert Advisor requires careful parameter adjustment and testing on target markets. Results obtained on GBPUSD H1 do not guarantee the same effectiveness on other instruments.

-

Dependence on market conditions. Even a well-tuned model is not immune to losses in unfavorable market conditions (for example, low volatility, flat trading, or sudden trend changes). Therefore, it is important to combine algorithmic trading with sound risk management.

-

The importance of external components. The advisor requires an additional indicator ("Moving Average Cross Signal"), which is essential for its proper functioning. It is important to ensure that the indicators used are up-to-date and functioning correctly.

-

Risk in automated trading. Automated systems can execute trades without taking external factors and news into account, potentially leading to losses. It is recommended to combine algorithmic trading with fundamental analysis and market monitoring.

-

The need for individual risk assessment. Before using an advisor on real accounts, you should carefully evaluate its effectiveness, taking into account your own trading goals, risk level, and market characteristics.