James Simons: How This Mathematician Made $25 Billion Trading

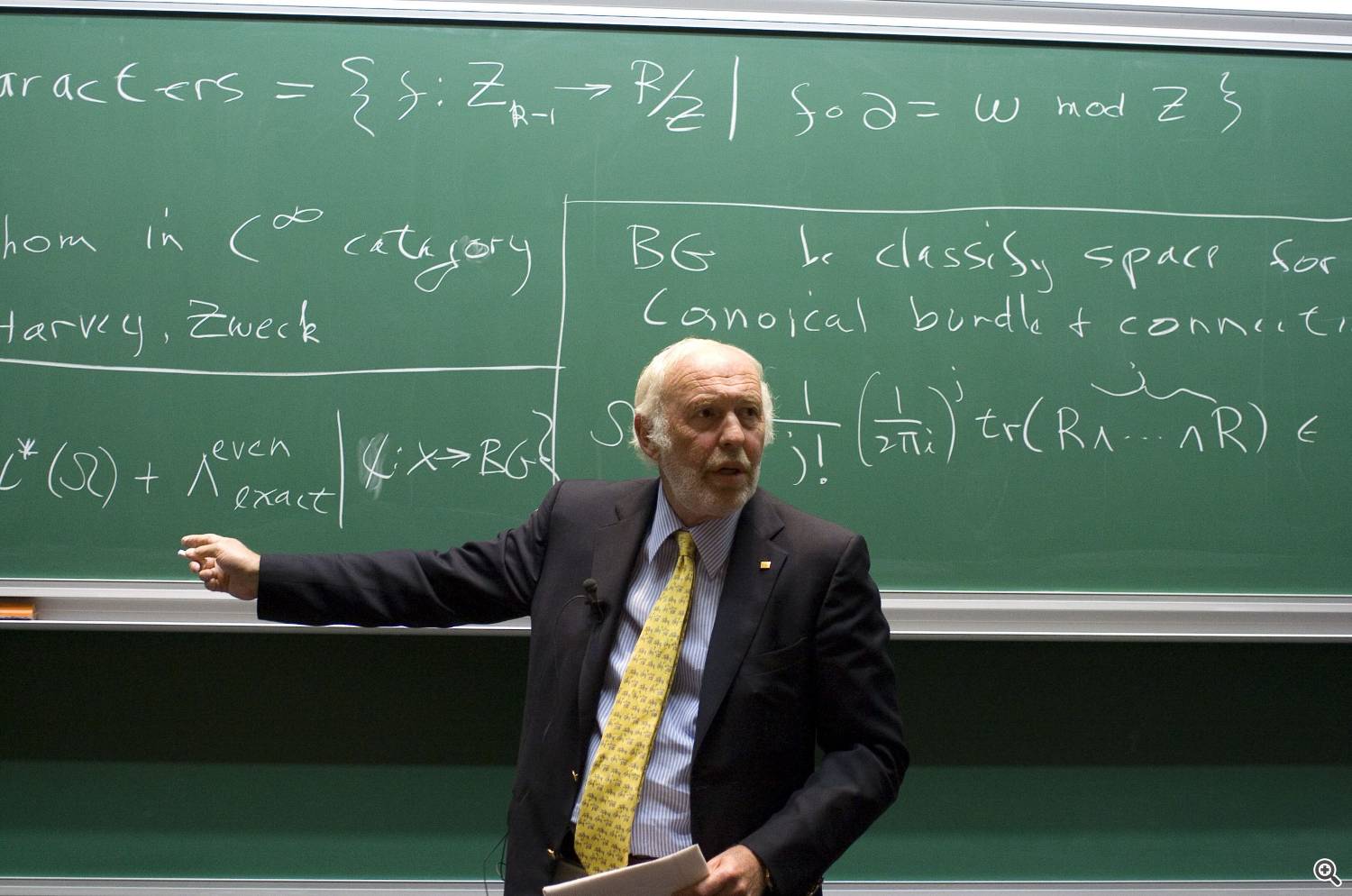

James Simons — mathematician, professor, and founder of one of the most successful hedge funds in history.

My solutions on MQL5 Market: Evgeny Belyaev’s products for traders

His fund, Renaissance Technologies — particularly its closed, algorithmic Medallion Fund — generated over $25 billion in net profits for investors over three decades. Yet Simons never relied on fundamental analysis, technical indicators, or market forecasts.

His path to financial revolution did not begin on a trading floor, but in a laboratory. In the 1960s, he worked for the NSA, breaking Soviet codes during the Cold War — an experience that taught him to see hidden structures where others saw only chaos. Later, in protest against the Vietnam War, he left intelligence work and returned to pure mathematics, becoming a professor of geometry at Stony Brook. There, he solved a pivotal problem in differential geometry — a discovery now enshrined in textbooks as the “Chen-Simons Theorem.”

Yet at age 44, with not a single day of trading experience, he concluded that markets were not economics — they were mathematics. In 1982, he founded Renaissance Technologies and assembled a team not of traders, but of physicists, statisticians, cryptographers, and even astronomers. Not a single finance expert. Their task was simple in words, unprecedented in practice: uncover hidden statistical patterns in historical price, volume, and time-series data — regardless of their economic interpretation.

Medallion never tried to predict the market. It sought arbitrage opportunities — tiny, fleeting imbalances between assets lasting only milliseconds. These signals were invisible to humans, yet detectable through advanced machine learning models, cross-validation, and big data processing. The fund traded across all asset classes — from currencies and futures to bonds and equities — across all timeframes, from seconds to days.

Medallion’s strategies were so secretive that even employees had no access to the full models. Each scientist worked on a single component of the system — like a lab where no one knows the complete experimental design. This was not secrecy for control; it was a principle of scientific rigor: to avoid overfitting, emotion, and bias, the process had to be broken into isolated, testable components.

The result? Medallion’s average annual return over 30 years exceeded 66% before fees. Even during global crises — 2000, 2008, 2020 — the fund remained consistently profitable. This was not the product of luck or market timing. It was the outcome of a systematic approach: rejection of intuition, rigorous hypothesis testing, continuous model optimization on new data, and the complete elimination of emotional decisions.

Simons never published his strategies, gave interviews about his methods, or trained traders. His success was not rooted in secrecy — but in a fundamental rethinking of financial markets: they do not move based on news or sentiment, but obey hidden, recurring statistical patterns — if you know how to measure them.

Today, James Simons remains one of the few who proved that maximum profit on financial markets is not achieved through trend analysis, but through identifying structural anomalies in data — using science, not intuition. His story is not a fairy tale about wealth, but a demonstration of how precision, discipline, and the scientific method can rewrite the rules of the game.

And after amassing billions, he did not retreat into obscurity. Through the Simons Foundation, he has donated over a billion dollars to support fundamental research in mathematics, physics, and science.

Do you think an algorithm based on statistical patterns can beat an experienced trader? Share your thoughts in the comments.

If you’re interested in how other legendary traders approached the markets — through intuition, discipline, or systems — you can read my analytical profiles on:

Larry Williams — how $10,000 became $1,100,000 through discipline;

Linda Raschke — Why Linda Raschke's Rules Still Work Decades Later;

George Soros — How George Soros traded: the trades that made him $1 billion in a day.

If you prefer ready-made technical solutions to manual analysis, I publish proven trading tools on my MQL5 channel, including working indicators and expert advisors for MetaTrader. These automated solutions are designed to identify high-probability setups based on reliable market models: https://www.mql5.com/en/channels/trendscalper