ExpertRider EA – Backtest Highlights & Call for Advanced Testers

Product Page: https://www.mql5.com/en/market/product/147936

Documentation: https://mfanya.com/docs/ExpertRider-EA-Documentation.pdf

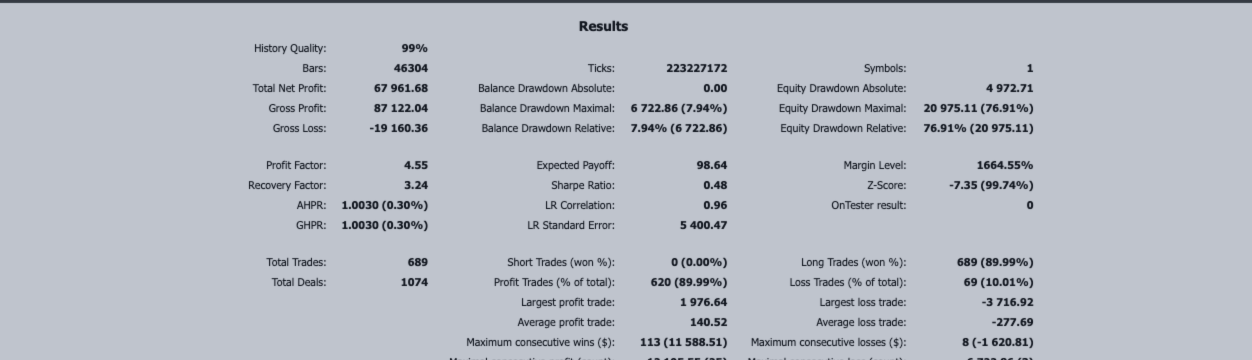

Backtest Summary (XAUUSD, H1, 2018–2025)

Using a conservative configuration, ExpertRider produced strong, stable performance over 7+ years:

-

Net Profit: 67,961 USD

-

Profit Factor: 4.55

-

Recovery Factor: 3.24

-

Win Rate: 89.99%

-

Maximum Drawdown: 7.94% (balance)

-

Expected Payoff: 98.64

-

Sharpe Ratio: 0.48

-

LR Correlation: 0.96

-

Total Trades: 689

-

Average Consecutive Wins: 14

-

Model Quality: 99%

The equity curve remained stable with no extreme spikes or erratic phases, even during major volatility events within the 2018–2025 window.

Key Technical Settings Used

Some of the notable parameters from this test:

-

BASE_DCA_PERCENT: 0.5

-

SAFE_MARGIN_PERCENT: 100

-

STOP_LOSS_PERCENT: 0.5

-

STOP_LOSS_SHARP_LEVEL: 4

-

DCA_MULTIPLIER: 1

-

MAX_DCA_MULTIPLIER: 5

-

TF Setup: M15 / H4 / D1

-

WICK_TRADE_LEVEL: 14

-

TRADE_MODE: Long-only

-

ENFORCE_DCA_MIN_STEP: true

-

CLOSE_LONG_RANGE / CLOSE_SHORT_RANGE: 8

-

TP_MAX_LEVEL: 8

-

USE_HYBRID_TP: false

-

ADX_THRESHOLD: 25

This configuration was designed to minimize aggressive behaviour while maintaining responsiveness in multi-regime environments (ranging, trending, and high-volatility gold conditions).

What ExpertRider Focuses On

-

Multi-timeframe alignment: strategic bias → structural confirmation → execution timing

-

Structure-aware DCA: controlled spacing with min-step enforcement

-

Volatility-adaptive logic: TP, SL, spacing scale with ATR conditions

-

Exit Control: structure TP, volatility TP, partial exits, and a sharp-level SL mode

-

Clean trade distribution: no clustering, no runaway DCA cycles

-

Tight drawdown behaviour: DD stays contained even during heavy gold whipsaws

Invitation for Advanced Testers

I’m opening ExpertRider to experienced algo traders who can:

-

run deeper multi-broker tests

-

analyze behaviour under specific volatility regimes

-

identify edge cases or parameter interactions

-

propose optimizations or structural improvements

-

compare results across symbols (XAU, BTC, indices, FX majors)

Your feedback will directly help refine and stabilize the next update.

You can download and test it here:

➡️ https://www.mql5.com/en/market/product/147936

Please feel free to share:

-

test results

-

logs

-

screenshots

-

observations

-

optimization findings

Thank you to everyone willing to test and contribute.