Meta Cipher B: The All-in-One Oscillator Suite for MT5

Estimated reading time: 5–10 minutes

TL;DR: Meta Cipher B brings professional-grade momentum analysis to MetaTrader 5, combining five powerful algorithms into one comprehensive oscillator.

If you've used or seen Market Cipher on TradingView and wished for something like it on MT5, your wait's over.

The Problem Every MT5 Trader Faces

Let's be honest: we've all been there. You open your MT5 chart with good intentions, ready to conquer the markets. You load up your RSI. Add some stochastic. Maybe throw in a MACD for good measure.

Before you know it, your screen looks like a Christmas tree had an accident with a rainbow factory.

"When your strategy looks more like abstract art than analysis."

The issue isn't that these indicators don't work, they do.

The problem is information overload. When you're trying to synthesize signals from five different windows, by the time you've made a decision, the opportunity has sailed past you faster than a scalper on 100x leverage.

What if I told you there's a better way? A way to get all that momentum analysis, money flow insight, and reversal detection in one clean, integrated oscillator panel?

Enter Meta Cipher B.

What is Meta Cipher B?

Meta Cipher B is a custom indicator for MetaTrader 5 that condenses five sophisticated algorithms into a single, visually intuitive oscillator.

Think of it as the Swiss Army knife of momentum indicators. Instead of a tiny scissors and a toothpick, you get:

- Money Flow Analysis (the green/red areas that tell you where the smart money is going)

- Dual Momentum Waves (the blue waves that spot divergences before they're obvious)

- VWAP Oscillator (the yellow wave that cuts through noise)

- RSI + Stochastic RSI (working together to identify extremes)

- Green and Red Dot Signals (your "okay, NOW is the time" moments)

Meta Cipher B - The 5 Core Elements

All of these operate together in a beautifully synchronized range from -100 to 100, designed to give you confluence at a glance.

When multiple signals align? That's when the magic happens.

Breaking Down the Components (Without Breaking Your Brain)

Let's dive into what makes Meta Cipher B tick. Don't worry, I'll keep the math to a minimum and the actionable insights to a maximum.

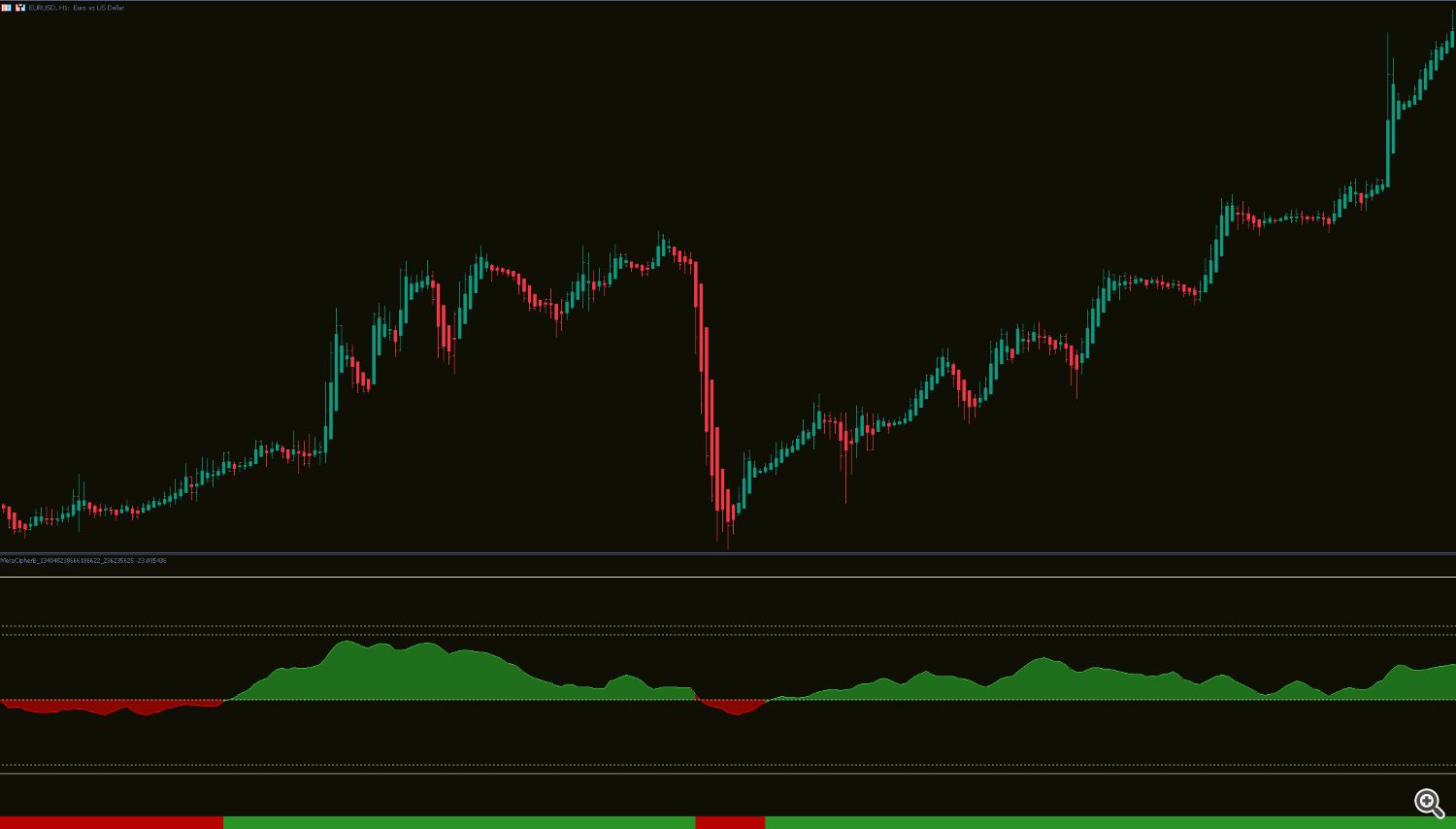

1. The Money Flow Wave: Your Market's Mood Ring

The Money Flow Index (MFI) is displayed as that gorgeous green and red filled area you see at the base of the oscillator. But here's what makes it special: unlike pure price-based indicators, MFI incorporates volume. It's literally tracking how much money is flowing in versus flowing out.

The Trading Philosophy:

- When the flow is thick and green: Think of it like a growing plant, price overall wants to go up. Your strategy? Buy the dips. When green, resistance tends to break easily.

- When the flow is red: Price wants to go down. Your strategy? Short the peaks. When red, support tends to fail.

- When the flow is thin (or choppy): Step away from the keyboard. Grab a coffee. This is not the time to trade.

Pro tip: Always start your morning routine by checking money flow on higher timeframes (Trading the 1min? Check the 15min. Trading the 1H? Check the 4H or Daily). This tells you the environment.

Are we in accumulation or distribution? Once you know the weather forecast, you can dress appropriately for your trades.

Meta Cipher B - Money Flow Overview

2. The Momentum Waves: Where Divergences Come to Party

Those beautiful blue waves (light blue and dark blue overlapping) are the heart of Meta Cipher B's predictive power.

They can be used to visualise market momentum, the push and pull between buyers and sellers, in a clear, cyclical form.

They oscillate between –100 and +100, highlighting key zones:

- Below -60: Long territory (oversold) - momentum is bottoming out, suggesting buyers may soon regain control.

- Above +60: Short territory (overbought) - momentum is peaking, signalling that sellers could step in.

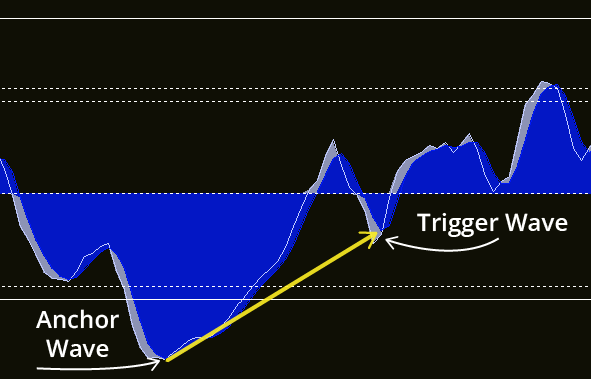

When you see a large, dominant wave form, that's your anchor wave, it sets the tone for the move.

The smaller waves that follow are your trigger waves, reacting to new bursts of momentum within that same trend.

The relationship between these waves often reveals divergences: moments when price moves one way, but momentum quietly hints at a reversal.

Meta Cipher B - The Momentum Waves

3. The VWAP Wave: The Momentum Rubber Band

That yellow oscillating line cutting through the middle? That's your Volume-Weighted Average Price (VWAP) indicator, but turbocharged for oscillator use.

The Rule is Simple:

- Yellow below zero and rising? Bullish momentum. Bears are running out of steam. Time to start planing your longs.

- Yellow above zero and falling? Bearish momentum. Bulls are stepping aside. Could be time to take profits or even look for shorts.

- Yellow crossing the zero line? That's your primary timing signal. Many traders use this cross as their trigger, especially when it aligns with money flow and momentum.

The Mean Reversion Play: If the yellow wave is far above or far below zero, it has to snap back eventually. The further the stretch, the stronger the rubber band effect. Use this to your advantage, don't chase extremes, wait for the reversion.

Meta Cipher B - VWAP Crosses (Watch how these crosses lead the trend reversal)

4. The RSI Duo for Spotting Overbought/Oversold

Meta Cipher B features two RSI-based lines working in harmony:

- Purple line: Your traditional, smoothed RSI (0-100 range). When above 80, it indicates that the market is overbought, when below 20, oversold.

- Green/Red line: Your Stochastic RSI (color-coded for instant recognition)

Here's the genius part: instead of staring at two lines crossing, the Stochastic RSI changes color based on position:

- Green when below the RSI line -> Bullish momentum building.

- Red when above the RSI line -> Bearish momentum taking over.

The Squeeze Indicator: Watch the space between the purple line and the green/red line. The smaller this gap, the steeper the trend. A tight squeeze with both rising? Buckle up for a strong move.

Meta Cipher B - The RSI Duo

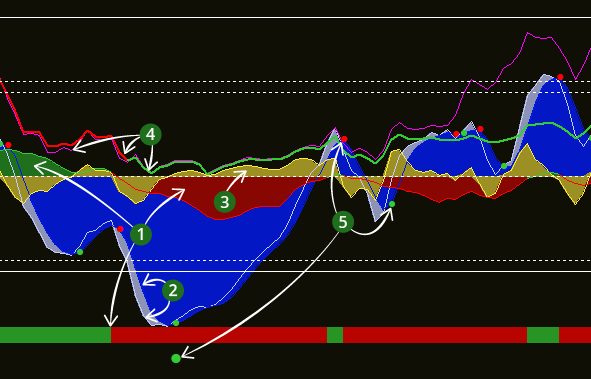

5. Green and Red Dots: In Case You Blinked

Those little dots on the oscillator aren't magic entry signals, they're attention markers. Think of them as alerts from your chart saying, "Hey, something's happening here."

- Green dot below the waves: Momentum (light blue) crosses above from a low point. It often marks a shift toward strength, not necessarily a buy.

- Red dot above the waves: Momentum (light blue) crosses below from a high point. It hints at weakening momentum, not an automatic short.

Context still rules the game:

A green dot with money flow heading up and VWAP crossing? That's a high-confluence setup worth attention.

A green dot with money flow heading down and oversold RSI? That's a maybe-kinda-sorta-we'll-see situation. Context is king.

The dots are weighted heavily in the momentum algorithm and can trigger alerts, so you'll never miss a potential setup. But please, for the love of profitable trading, don't chase every dot. Wait for confluence.

Meta Cipher B - The Dots!

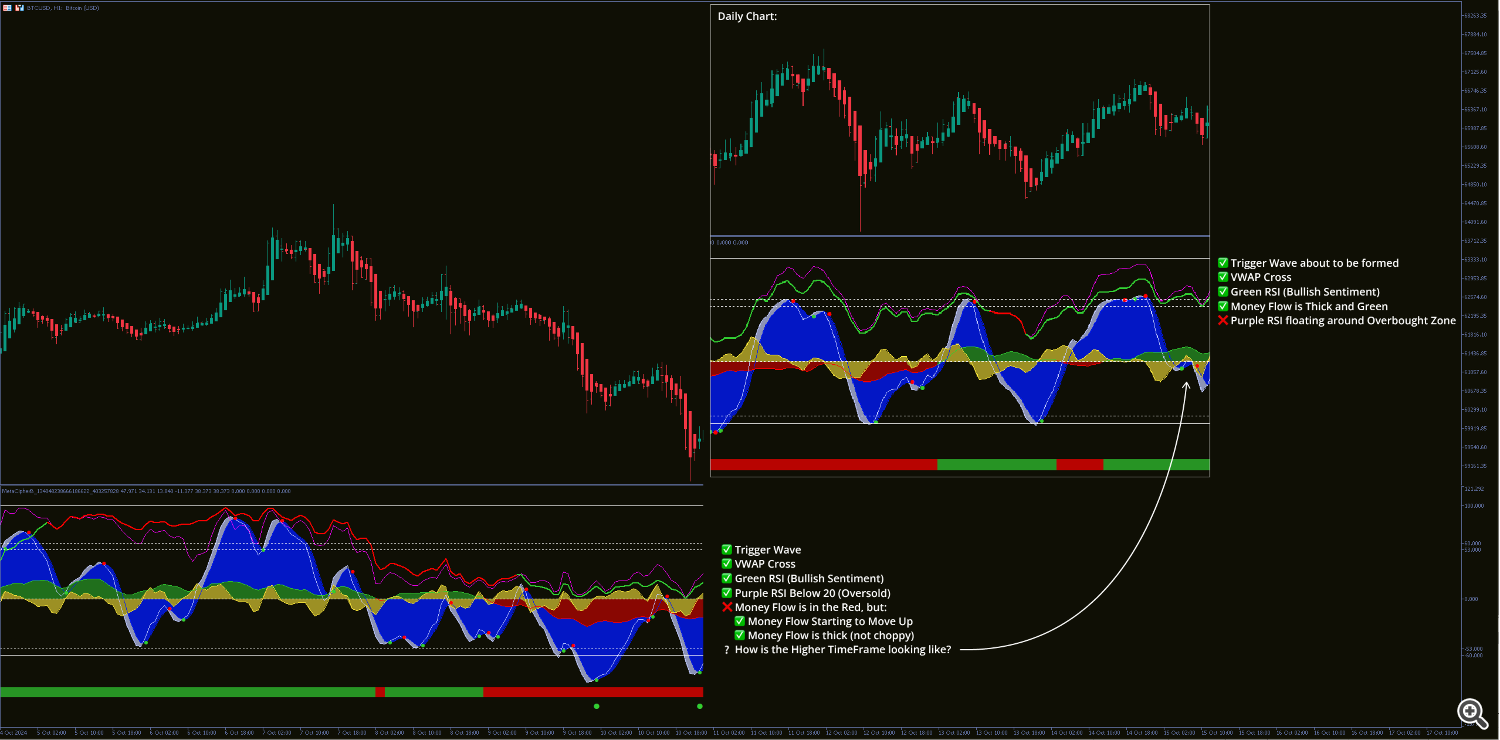

From Theory to Trade

Now that you know the components, let's put them to work.

There are several ways to trade with Meta Cipher B. I'll break down one of my favourite approaches here, and cover others in future posts.

The Blue Wave Strategy (Perfect for newcomers):

- Spot a big blue wave that dips below -60 or shoots above +60. That's your anchor wave

- Wait for a second, smaller wave in the same direction. That's your trigger wave

- Watch for the pinch where the light blue cuts through the dark blue

- Boom, you've spotted a divergence (price makes a new low, but momentum makes a higher low = bullish divergence)

Exit strategy:

Wait for another pinch on the opposite side (ideally using other signals to filter out weak waves). If you went long when the waves pinched below zero, exit when they pinch above zero. Simple, elegant, effective.

Of course, you can apply your own exit rules, whether it's a fixed take-profit, scaling out with partial exits, or using the other Meta Cipher B signals for confirmation. The key is to stay consistent and let the data guide your decision.

Now, to really see it in action:

I'll turn off the other indicators for a moment so you can visualise this pattern clearly. But remember, we still have all the other four signals that build on this one, adding confirmation and depth to every setup.

Meta Cipher B - The Blue Waves Strategy (Long)

The beauty of this approach? You're essentially front-running the crowd. When price makes that second low but momentum refuses to confirm it, that's your signal that the selling pressure is exhausted. Time to go fishing for a bottom (or top)!

Speaking of tops, the same logic applies when shorting. I'll use the same example, but keep in mind we're in an uptrend here, and every other Meta Cipher B signal would be warning you not to go short:

Meta Cipher B - The Blue Waves Strategy (Shorting... in an uptrend?)

🧩 Putting It All Together

Now that you’ve seen the Blue Wave Strategy in isolation, let's look at how everything works together.

In real trading, you rarely act on one signal alone, it's about confluence. When several components of Meta Cipher B align, that's where the edge comes from.

Below is a practical example, let's look at the BTCUSD H1 chart:

Meta Cipher B - A Practical Example

As you can see, we got multiple signals aligning (not all of them, but that's ok).

Let's look at what played out:

Meta Cipher B - A Practical Example: The Outcome

As time went on, you can see several trigger waves forming, many of them acting as anchor waves as well. Each of these moments revealed potential entry opportunities.

I've also highlighted a few possible take-profit zones, though those depend on your personal TP strategy. Considering how strong and healthy the money flow was during this move, a partial take-profit approach would’ve allowed you to ride the entire trend, right up to the point where the money flow finally started to curve downward.

💡 Pro Tips for Maximum Effectiveness

- The Morning Ritual: Start every session by checking money flow on the daily chart. This tells you the market's "mood" and guides your bias for the day.

- The Patience Play: Don't just jump on every green dot. Wait for at least two signals to align.

- The Divergence Double-Check: When you spot a divergence on the momentum waves, confirm it with the RSI lines.

- The Timeframe Stack: Keep two charts open, your trading timeframe and one higher. Avoid trading (or at least trade with more caution) when they are not fully aligned.

- Why this is important: Even a perfect 15-minute setup will get steamrolled if the 4-hour trend is bearish. By confirming with higher timeframes, you're essentially checking that you're swimming with the current, not against it. Your win rate will thank you.

- The Candle Edge: Use Heikin Ashi candles with Meta Cipher B. Their smoothed structure makes momentum shifts and reversals easier to read, helping you see trends more clearly and filter out short-term noise.

- The Rejection Trade: Sometimes the best trade is the one you don't take. If money flow is thin, or if you're fighting the higher timeframe trend, just skip it. There's always another bus coming.

- The Alert Advantage: Set up alerts for green/red dots. This lets you monitor multiple instruments without sitting glued to your screen. Meta Cipher B will tap you on the shoulder when it's showtime.

Key Takeaways:

What Meta Cipher B Can and Can't Do

Let's set expectations straight.

What it CAN do:

- Give you multi-layered confluence analysis in one clean window

- Help you identify high-probability entries and exits

- Spot divergences that aren't obvious from price action alone

- Save you from indicator overload

- Work on any timeframe from M1 to MN1

- Alert you to opportunities automatically

What it CAN'T do:

- Print money

- Guarantee winning trades (nothing can, despite what the internet says)

- Replace risk management and position sizing discipline

- Work well when you ignore confluence and chase every signal

- Make you a profitable trader overnight (this takes practice)

Always remember: Meta Cipher B is a tool (a very sophisticated, well-designed tool) but still just a tool.

Your job is to understand it, practice with it, and integrate it into a complete trading plan. Demo trade with it first. Backtest your strategies. Build confidence before risking real capital.

Does This Indicator Look Familiar?

You may have come across Market Cipher B, a hugely popular paid indicator for TradingView that's been around for years.

Meta Cipher B brings that same powerful concepts to MetaTrader 5, optimised for speed, precision, and smooth performance.

Built entirely from the ground up, it delivers professional-grade signals without lag or sluggish scrolling, even on lower timeframes.

What instruments and timeframes does this work on?

The short answer: pretty much anything that's tradable.

Meta Cipher B is engineered to adapt to Forex, Stocks, Indices, Commodities, and Crypto. Basically, if your broker can chart it in MT5, Meta Cipher B can analyse it.

Timeframe-wise, the logic scales seamlessly:

-

Lower timeframes (1-5 min): Ideal for scalpers looking for quick momentum shifts.

-

Mid-range (15 min – 1 hour): Great for intraday traders who want structure without noise.

-

Higher timeframes (4 hour – Daily +): Perfect for swing traders and long-term trend analysis.

The underlying calculations adjust dynamically, so whether you're tracking EUR/USD, Apple, or BTCUSD, you'll get consistent, context-aware signals.

Meta Cipher B vs. Other Indicators

Compared to using separate RSI + Stochastic + MFI + VWAP indicators:

- Cleaner chart (one oscillator window vs. four)

- Integrated signals that consider all factors

- Better visual representation with color-coding

- Optimized calculations that work together

Compared to simple moving average systems:

- More leading signals (divergences predict turns)

- Better suited for all market conditions (trending and ranging)

- Multi-dimensional analysis vs. one-dimensional

Compared to Market Cipher B on TradingView:

- Works natively in MetaTrader 5 (no switching platforms)

- Integrates with MT5's alert and automation ecosystem

- Can be used with Expert Advisors for automation

Wrapping Up

Meta Cipher B isn't just another indicator to add to your collection. It's a complete momentum analysis system that replaces half a dozen other tools and does it more elegantly.

Whether you're a scalper looking for quick entries on the 5-minute chart, a swing trader hunting for multi-day setups, or anywhere in between, Meta Cipher B adapts to your style. The core principles remain the same across all timeframes: look for confluence, respect the money flow, and let the momentum waves guide you to divergences.

If you're tired of cluttered charts, conflicting signals, and second-guessing yourself, Meta Cipher B brings clarity to the chaos. It's like having a professional analyst on your screen, quietly pointing out when conditions align.

No, it's not magic, and it’s certainly not a crystal ball. But when understood and used properly, it's a powerful decision-support tool that can sharpen your analysis and improve the quality of your trades.

Beyond Meta Cipher B

While Meta Cipher B stands strong on its own, it's also designed to pair naturally with Meta Cipher A, offering full market context and deeper confirmation when used together.

Both are part of the Meta Cipher suite for MetaTrader 5, bringing professional, TradingView-style analysis natively to MT5.

Stay tuned for upcoming posts where I’ll dive into additional strategies and explore the rest of the suite: including Meta Cipher A (for trend analysis) and more tools designed to complete your trading framework.

💬 Have questions or insights?

Drop a comment below or reach out via the MQL5 marketplace, the trading community thrives on shared experience.

You can also join the Meta Cipher Trading Group, where traders share setups, discuss strategies, and explore how to combine the full Meta Cipher suite for maximum confluence.

⚠️ Risk reminder:

No indicator replaces proper risk management. Always use stop losses, never risk more than you can afford to lose, and size your positions responsibly. Meta Cipher B helps you find opportunities, managing the risk is still your job.