The Importance of a Running Count for Market Entry and Exit: Leveraging Blackjack Logic

Maintaining a running count is a crucial component in trading, particularly when determining optimal entry and exit points. Inspired by the blackjack counting strategy, the running count approach translates market signals into quantifiable numeric values, thereby offering clear, actionable insights.

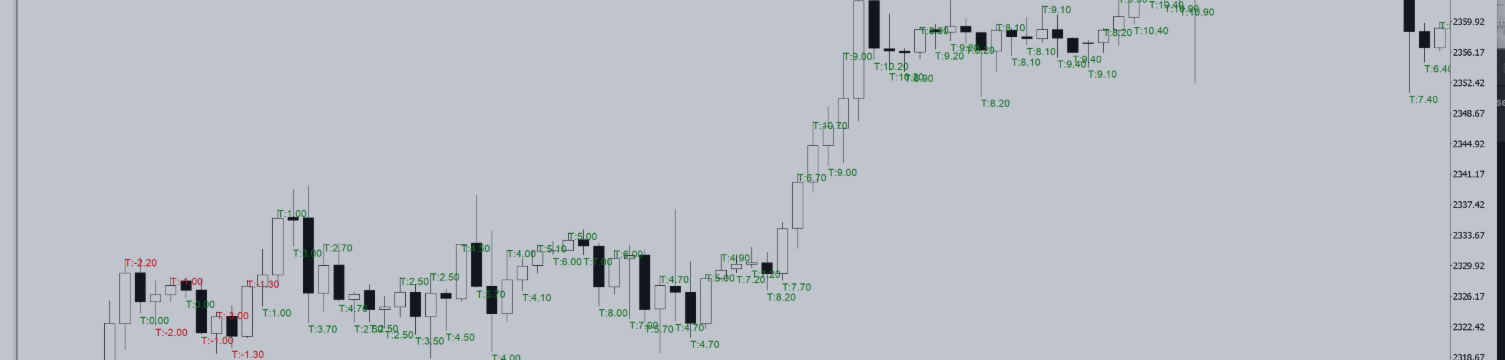

Each market indicator—whether it be candle formations, moving average crosses, gaps, or volatility readings from Average True Range (ATR)—is assigned a numeric value. Positive signals increase the count, suggesting bullish conditions, while negative signals decrease it, signaling bearish conditions. This continuous count acts as a barometer for market sentiment, guiding traders on when to enter or exit positions effectively.

Why is this method so effective? Just like counting cards in blackjack provides a clear advantage in betting decisions, maintaining a running market count provides real-time clarity on market strength or weakness. A rising positive count indicates increasing bullish momentum, making it advantageous to enter or maintain long positions. Conversely, a declining or negative count suggests bearish momentum, signaling traders to exit long positions or initiate shorts.

Moreover, leveraging machine learning to enhance this counting system refines its effectiveness. Neural networks analyze historical data, continuously optimizing count assignments and biases, thus significantly improving the accuracy of trading signals. By integrating this advanced analytical power, traders ensure that the running count remains responsive and precise.

I've demonstrated this approach clearly in a recent video, where viewers can see the running count in action, along with visual clusters indicating optimal buy and sell points. This practical example underscores how effectively this blackjack-inspired logic can be applied in real trading scenarios.

In summary, the running count strategy, deeply rooted in the logic of blackjack counting, offers traders a powerful framework for informed, profitable market entries and exits.