The paradigm of working with signals for advisors Neon Trade MT4 and NeonTrade MT5 is described in this post, along with a listing of currently available signals.

Introduction

Brokers recommended for using the full range of signals

Characteristics of grouping settings by folders with signals

- dev - the smaller this number, the smoother the profit curve. (0 - perfectly smooth line)

- pos - the minimum acceptable number of positions in the setting

- q - the quality of the setting (typically equivalent to the profit factor, minus all costs, such as spreads and swaps)

Listing of available signals (folders with settings grouped by different criteria)

Signals of regular currency pairs with clustering by time and days:

Regular signals with long position holding:

- Signal0 - dev = 0.15 ; pos = 200+ ; q = 0.25 +

- Signal1 - dev = 0.2 ; pos = 150+ ; q = 0.15 +

- Signal2 - dev = 0.15 ; pos = 50+ ; q = 0.15 +

- Signal4 - dev = 0.15 ; pos = 100+ ; q = 0.15 +

- Signal5 - dev = 0.2 ; pos = 150+ ; q = 0.25 +

- Signal6 - dev = 0.15 ; pos = 50+ ; q = 0.25 +

- Signal7 - dev = 0.15 ; pos = 100+ ; q = 0.25 +

- Signal8 - dev = 0.2 ; pos = 150+ ; q = 0.35 +

- Signal9 - dev = 0.15 ; pos = 50+ ; q = 0.35 +

- Signal10 - dev = 0.15 ; pos = 100+ ; q = 0.35 +

- Signal11 - dev = 0.1 ; pos = 100+ ; q = 0.15 +

- Signal12 - dev = 0.1 ; pos = 150+ ; q = 0.25 +

- Signal13 - dev = 0.1 ; pos = 220+ ; q = 0.25 +

Short-term position signals (we aim to close the position as early as possible, but also look for a good exit point):

- Signal1scalp - dev = 0.2 ; pos = 150+ ; q = 0.15 +

- Signal2scalp - dev = 0.15 ; pos = 50+ ; q = 0.15 +

- Signal4scalp - dev = 0.15 ; pos = 100+ ; q = 0.15 +

- Signal5scalp - dev = 0.2 ; pos = 150+ ; q = 0.25 +

- Signal6scalp - dev = 0.15 ; pos = 50+ ; q = 0.25 +

- Signal7scalp - dev = 0.15 ; pos = 100+ ; q = 0.25 +

- Signal8scalp - dev = 0.2 ; pos = 150+ ; q = 0.35 +

- Signal9scalp - dev = 0.15 ; pos = 50+ ; q = 0.35 +

- Signal10scalp - dev = 0.15 ; pos = 100+ ; q = 0.35 +

- Signal11scalp - dev = 0.1 ; pos = 100+ ; q = 0.15 +

- Signal12scalp - dev = 0.1 ; pos = 150+ ; q = 0.25 +

- Signal13scalp - dev = 0.1 ; pos = 220+ ; q = 0.25 +

Short position-holding signals, additionally specifying a window for the position to exist (the position is closed when exiting the temporary window if the temporary window is selected correctly):

- Signal1CIOOT - dev = 0.2 ; pos = 150+ ; q = 0.15 + ;

- Signal2CIOOT - dev = 0.15 ; pos = 50+ ; q = 0.15 + ;

- Signal3CIOOT - dev = 0.15 ; pos = 100+ ; q = 0.15 + ;

crypto signals with clustering by time and days:

Regular signals with long position holding:- Crypto1 - dev = 0.2 ; pos = 70+ ; q = 0.25+ ;

- Crypto2 - dev = 0.15 ; pos = 30+ ; q = 0.15+;

- Crypto4 - dev = 0.15 ; pos = 40+ ; q = 0.15+;

- Crypto5 - dev = 0.1 ; pos = 40+ ; q = 0.15+;

Short-term position signals (we aim to close the position as early as possible, but also look for a good exit point):

- Crypto1scalp - dev = 0.2 ; pos = 70+ ; q = 0.25+ ;

- Crypto2scalp - dev = 0.15 ; pos = 30+ ; q = 0.15+;

- Crypto4scalp - dev = 0.15 ; pos = 40+ ; q = 0.15+;

- Crypto5scalp - dev = 0.1 ; pos = 40+ ; q = 0.15+;

Signals for American stocks with clustering by time and days:

Regular signals with long position holding:- STOCKS1 - dev = 0.2 ; pos = 150+ ; q = 0.15 +

- STOCKS2 - dev = 0.15 ; pos = 50+ ; q = 0.15 +

- STOCKS4 - dev = 0.15 ; pos = 100+ ; q = 0.15 +

- STOCKS5 - dev = 0.2 ; pos = 150+ ; q = 0.25 +

- STOCKS6 - dev = 0.15 ; pos = 50+ ; q = 0.25 +

- STOCKS7 - dev = 0.15 ; pos = 100+ ; q = 0.25 +

- STOCKS8 - dev = 0.2 ; pos = 150+ ; q = 0.35 +

- STOCKS9 - dev = 0.15 ; pos = 50+ ; q = 0.35 +

- STOCKS10 - dev = 0.15 ; pos = 100+ ; q = 0.35 +

- STOCKS11 - dev = 0.1 ; pos = 100+ ; q = 0.15 +

- STOCKS12 - dev = 0.1 ; pos = 30+ ; q = 0.25 +

- STOCKS13 - dev = 0.1 ; pos = 50+ ; q = 0.25 +

Short-term position signals (we aim to close the position as early as possible, but also look for a good exit point):

- STOCKS1scalp - dev = 0.2 ; pos = 150+ ; q = 0.15 +

- STOCKS2scalp - dev = 0.15 ; pos = 50+ ; q = 0.15 +

- STOCKS4scalp - dev = 0.15 ; pos = 100+ ; q = 0.15 +

- STOCKS5scalp - dev = 0.2 ; pos = 150+ ; q = 0.25 +

- STOCKS6scalp - dev = 0.15 ; pos = 50+ ; q = 0.25 +

- STOCKS7scalp - dev = 0.15 ; pos = 100+ ; q = 0.25 +

- STOCKS8scalp - dev = 0.2 ; pos = 150+ ; q = 0.35 +

- STOCKS9scalp - dev = 0.15 ; pos = 50+ ; q = 0.35 +

- STOCKS10scalp - dev = 0.15 ; pos = 100+ ; q = 0.35 +

- STOCKS11scalp - dev = 0.1 ; pos = 100+ ; q = 0.15 +

- STOCKS12scalp - dev = 0.1 ; pos = 30+ ; q = 0.25 +

- STOCKS13scalp - dev = 0.1 ; pos = 50+ ; q = 0.25 +

- STOCKS1CIOOT - dev = 0.2 ; pos = 150+ ; q = 0.15 + ;

- STOCKS2CIOOT - dev = 0.15 ; pos = 50+ ; q = 0.15 + ;

- STOCKS3CIOOT - dev = 0.15 ; pos = 100+ ; q = 0.15 + ;

Manual Assemblies (we select them individually, specifically for you, manually, using settings from our automatic channels):

- ManualAssembly1 - assembly for regular currency pairs

- CryptoAssembly1 - assembly for cryptocurrencies

- StocksAssembly1 - assembly for American stocks

- ExoticAssembly1 - an assembly for metals and exotic currencies.

How to test a signal in the strategy tester?

There are two ways to do this:

- By downloading the free version of the Neon Trade robot and fulfilling the usage conditions of this version of the product.

- By purchasing or renting any version of the Neon Trade robot.

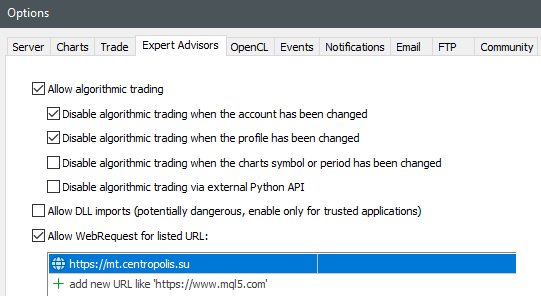

Once you have chosen one of the options, you can start testing signals. First, make sure to add permission for access to my API in the terminal settings, if you haven't done so already:

Now, let's create any chart in the terminal working window, or use an existing one. Attach an expert advisor to it, but make sure to turn off the "automatic trading" option in your terminal to avoid any trading operations that may occur when the expert advisor starts. It looks like this:

![]()

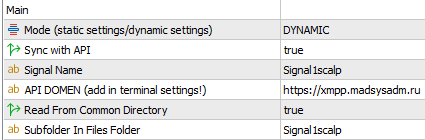

After that, we attach the advisor to your chart. Let's say we want to test "Signal1scalp" in the strategy tester. For this, we will need to set the following settings:

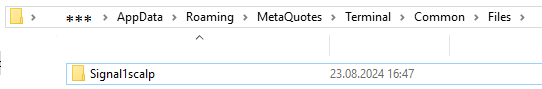

If everything is done correctly, you will see a user interface. It will display how many settings have been downloaded from the server. If the interface is empty, it means that the requested signal does not have any settings inside, or you made a mistake with the settings. If the indication appears, you can also see the downloaded folder with your signal at the following path "%APPDATA%\MetaQuotes\Terminal\Common\Files". This is how it will all look:

After that, we can remove the advisor from the chart. We no longer need it. We only did this operation to download the signal folder. This needs to be done before testing in the strategy tester, because the strategy tester disables any interactions with the API. By taking this action, we prepare the folder with files in advance. Now we can start testing the signal if it has been downloaded. To do this, in the tester we set the same settings as in the picture above, except for the following: "Sync with API = false". In other words, during testing, we disable synchronization with the API, as it does not work in the tester, as I mentioned earlier. Then we either set up a clean signal or add the effects you need. We repeat the operation with all the signals that interest you and make a decision on using one signal or another.

Afterword

Test and analyze as many signals and additional modes as possible, combine them to achieve the smoothest equity curve and recovery factor. Use our account monitoring for additional verification and filtering of test results, or rely solely on the monitoring. Prioritize monitoring to choose certain signals and additional modes.