Review of trades of the Owl Smart Levels strategy for the week from April 17 to 22, 2023

Today I present you an overview of trades made using the Owl strategy - smart levels for the EURUSD, GBPUSD and AUDUSD currency pairs for the week from April 17 to 22, 2023. There were slightly more trades than last week, but the situation on the market has not become better.

For convenience and timely receipt of signals I use the Owl Smart Levels Indicator. The main trading timeframe is M15, while the H1 and H4 timeframes are used to confirm the trend direction of the higher timeframe.

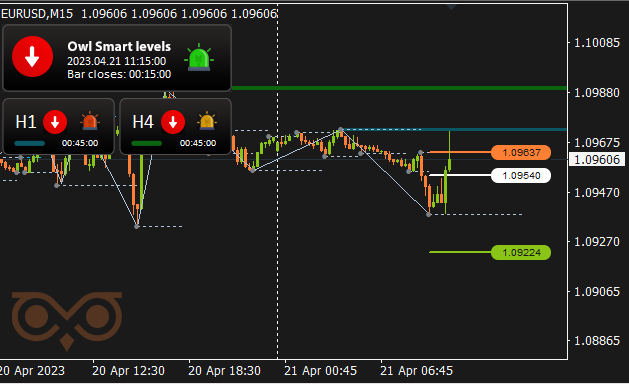

EURUSD review

Despite the presence of several signals on EURUSD, according to the rules of working with the indicator, almost all of them were not taken into account, as the price of the first two candles from the moment the signal appeared, somehow, was already on its line. The only trade was opened on the last day of the trading week and was unprofitable, immediately crossing out the StopLoss line on the 15-minute timeframe with a long shadow of the next candle.

Fig. 1. EURUSD SELL 0.15, OpenPrice = 1.09540, StopLoss = 1.09637, TakeProfit = 1.09224, Profit = -$15

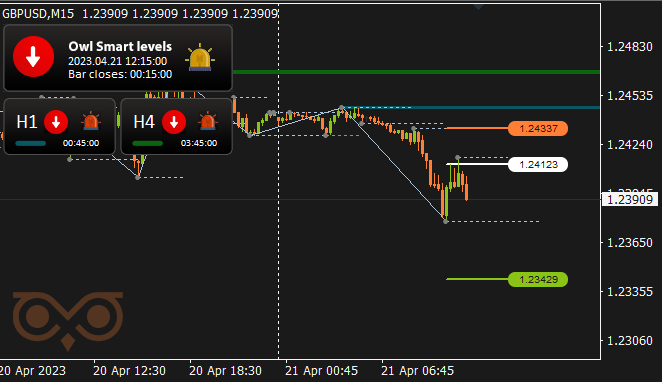

GBPUSD review

On the first three days there were no trades. The signal, on which the trade on GBPUSD was opened, was received on Thursday. However the trade was loss-making and was quickly closed by StopLoss, like on EURUSD.

Fig. 2. GBPUSD BUY 0.14, OpenPrice = 1.24346, StopLoss = 1.24238, TakeProfit = 1.24698, Profit = -$15.

The next trade was opened for selling and it also turned out to be unprofitable, being closed by the market at StopLoss.

Fig. 3. GBPUSD SELL 0.26, OpenPrice = 1.24123, StopLoss = 1.24337, TakeProfit = 1.23429, Profit = -$3.38.

Unlike the first trade on the asset, this trade was saved, or rather minimized the loss due to the reversal of the big arrow of the Owl Smart Levels indicator, which warns of a change in the direction of the price.

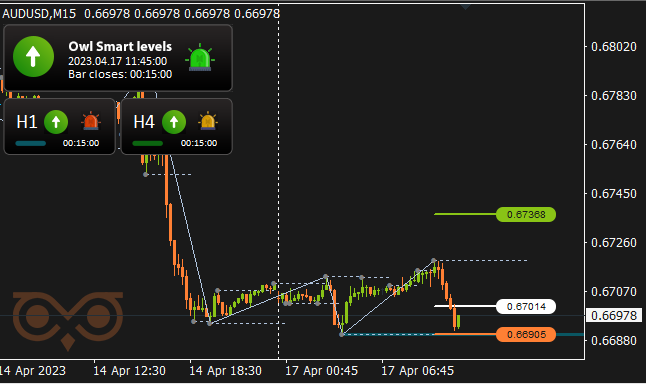

AUDUSD review

The first trade on AUDUSD asset was opened for buying on the chronological order of the very first in the trading week. However, the result of this trade was not as good as it could be. It has been closed by StopLoss, as well as described above, and brought a loss.

Fig. 4. AUDUSD BUY 0.14, OpenPrice = 0.67014, StopLoss = 0.66905, TakeProfit = 0.67368, Profit = -$15.

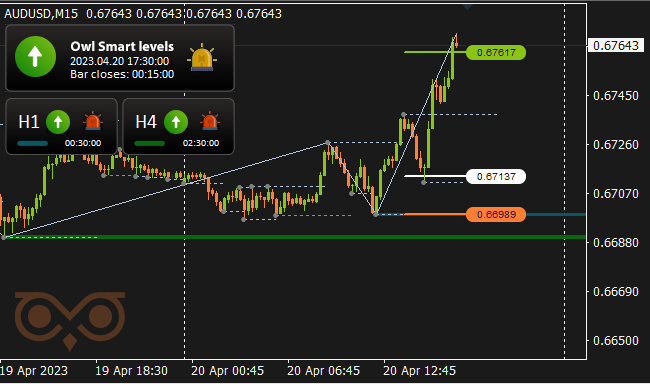

The situation was not very happy, see for yourself: 4 losing trades out of 4, among which 3 were for -$15. The "big" trade was necessary, which would lead all trade this week to profit. And it was done, but first, a small disclaimer.

Why was it so difficult to trade? The fact is that the Owl Smart Levels indicator based on the strategy of the same name is a trend indicator. In other words, a trader does not need to identify the trend by himself, assess its strength and duration, and then turn on the Owl Smart Levels, the indicator will do it all for you. But it is important to have a trend movement in the market. Unfortunately, for the last weeks the market has not been able to decide on it, which is not very good for the whole group of trend indicators.

So, Drum roll: the last trade of the last trading week has brought a long-awaited profit, finishing the trading week on a positive note.

Fig. 5. AUDUSD BUY 0.12, OpenPrice = 0.67137, StopLoss = 0.66989, TakeProfit = 0.67617, Profit = $56.76

I've already mentioned that after a good profit on trades opened with the help of the Owl Smart Levels indicator on the trend market in February, we can state a certain decline in the returns on the global flat market movement or "sideways" in March and April.

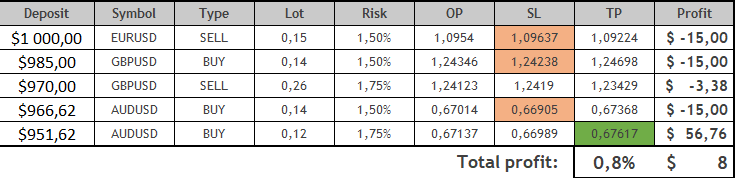

Results:

Well, let's wait for the trend to be formed.

See other reviews of the Owl Smart Levels strategy:

- From April 10 to 14, 2023, Total: +2%

- From April 3 to 7, 2023, Total: +8.2%

- From March 27 to 31, 2023, Total: +12.7%

- Archive of reviews >>

I'm Sergei Ermolov, follow me and don't miss more useful tools for profitable trading on the Forex market.