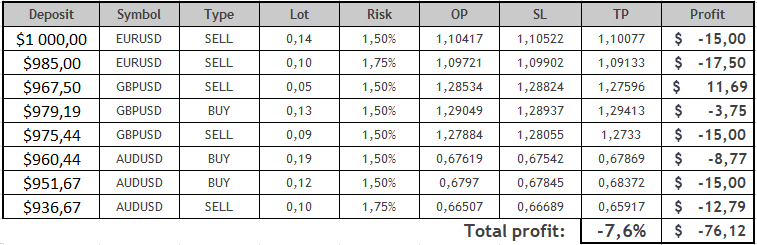

Review of trades of the Owl Smart Levels strategy for the week from July 24 to 28, 2023

Today I present you an overview of trades made using the Owl strategy - smart levels for the EURUSD, GBPUSD and AUDUSD currency pairs for the week from July 24 to 28, 2023. There were open in total 8 trades on all three currency pairs.

For convenience and timely receipt of signals I use the Owl Smart Levels Indicator. The main trading timeframe is M15, while the H1 and H4 timeframes are used to confirm the trend direction of the higher timeframe.

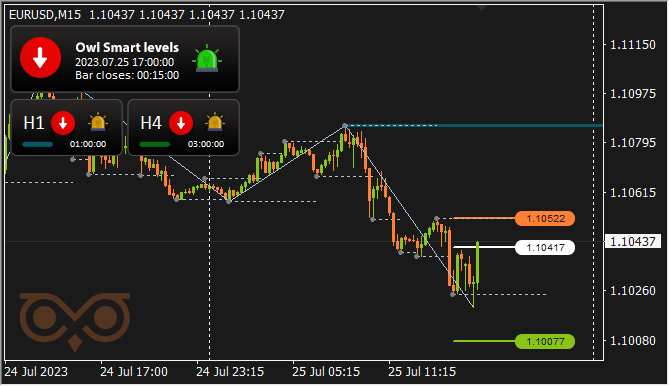

EURUSD review

The Owl Smart Levels indicator gave the first signal to open a trade on EURUSD for selling on Tuesday afternoon.

Fig. 1. EURUSD SELL 0.14, OpenPrice = 1.10417, StopLoss = 1.10522, TakeProfit = 1.10077, Profit = -$15.

The trade was closed at StopLoss and brought a loss of $15.

The market spent the whole Wednesday and the first half of Thursday in the dead zone, after which it spiked more than 1000 points in less than 2 hours. It should be said that in general the market behaved rather unpredictably, but, what is especially bad, it was not so clearly seen, except, perhaps, for the above-mentioned peak.

Nevertheless, the second trade on EURUSD, also opened for selling, turned out to be unprofitable.

Fig. 2. EURUSD SELL 0.10, OpenPrice = 1.09721, StopLoss = 1.09902, TakeProfit = 1.09133, Profit = -$17.5.

The trade closed on StopLoss and Owl Smart Levels, unfortunately, couldn't warn about it due to unusual market volatility.

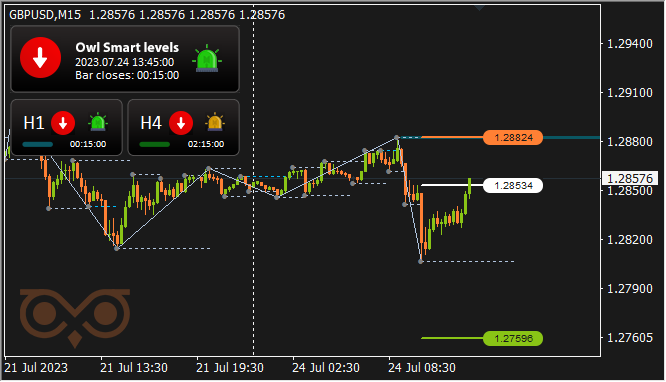

GBPUSD review

The first trade on the asset GBPUSD the indicator Owl Smart Levels offered to open for selling on Monday afternoon.

Fig. 3. GBPUSD SELL 0.05, OpenPrice = 1.28534, StopLoss = 1.28824, TakeProfit = 1.27596, Profit = $11.69.

This trade became an example of how the signal given in time about the change of price movement and the necessity to close it "manually" helped not only to reduce the loss, but also to get a small profit.

The indicator suggested to open the next trade on Wednesday, also in the middle of the day.

Fig. 4. GBPUSD BUY 0.13, OpenPrice = 1.29049, StopLoss = 1.28937, TakeProfit = 1.29413, Profit = -$3.75.

And in this case the loss was reduced to the very minimum, also by closing the trade "manually" according to the indicator's prompting.

On Thursday in the afternoon the market was in the dead zone and the next trade, opened for selling, took place on Friday morning.

Fig. 5. GBPUSD SELL 0.09, OpenPrice = 1.27884, StopLoss = 1.28055, TakeProfit = 1.27330, Profit = -$15.

It seems that after the USD jump, as well as after the EUR/USD market 1000 points drop (the screenshot, as it seems by the time, shows a parallel situation), the pair currency restored its value in a way that is not quite "clear" for the indicator, and in both cases it failed to give a correct signal, as well as to warn about closing the trade.

On Friday afternoon the market was in the dead zone, and there were no more trades on the asset.

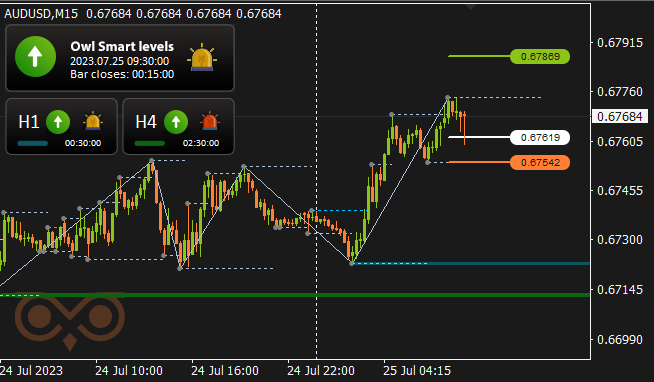

AUDUSD review

On Monday in the afternoon the market was in the dead zone, and on Tuesday morning the indicator already gave a signal, and the trade was opened.

Fig. 6. AUDUSD BUY 0.19, OpenPrice = 0.67619, StopLoss = 0.67542, TakeProfit = 0.67869, Profit = -$8.77.

Here the Owl Smart Levels gave a signal in time about the necessity to close the trade and the loss was minimized.

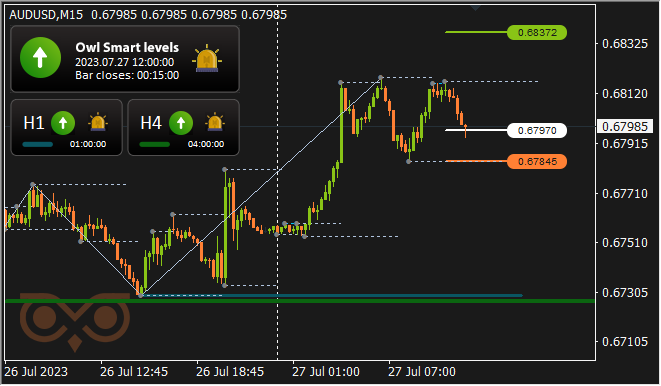

But on the next trade it could not be done.

Fig. 7. AUDUSD BUY 0.12, OpenPrice = 0.67970, StopLoss = 0.67845, TakeProfit = 0.68372, Profit = -$15.

There was no reversal of the big arrow and the trade was closed at StopLoss.

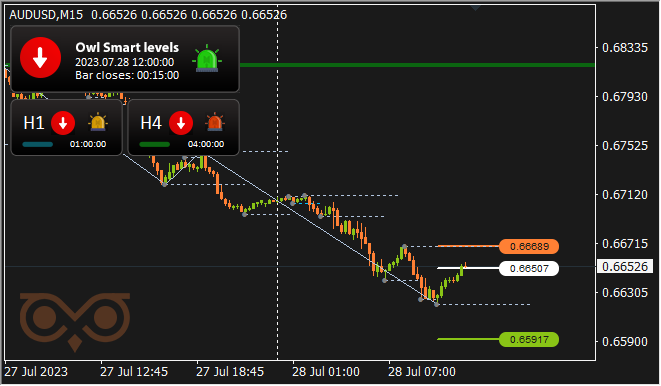

The last trade of the trading week was opened at noon on Friday.

Fig. 8. AUDUSD SELL 0.10, OpenPrice = 0.66507, StopLoss = 0.66689, TakeProfit = 0.65917, Profit = -$12.79.

As well as almost all trades of the week, it turned out to be unprofitable, but here the loss was slightly minimized thanks to the Owl Smart Levels hint.

Results:

Last trading week there were 8 trades and only one of them turned out to be profitable. The trades were opened in different directions, but the market situation this time, frankly to say, outplayed the Owl Smart Levels indicator due to its, though not so pronounced, but high chaotic nature. Most likely, the market chaoticization occurred due to the inconsistency with the forecasts of a large number of news, such as:

German Manufacturing Business Activity Index (PMI) (EUR),

UK Manufacturing Business Activity Index (PMI) (GBP),

U.S. Services Sector Business Activity Index (PMI) (USD),

New Home Sales (June) USA (USD),

US Crude Oil Inventories (USD),

German GDP (Q2) (EUR).

All of these data were below the forecasts. And even if we are not talking about some impressive and extreme events and huge volatility in the market, nevertheless, the overall effect of market chaotization was such that the Owl Smart Levels indicator did not have time to respond to such a rapidly changing market.

As a result, we got an unsatisfactory result this week. To be fair, since the beginning of this spring only one trading week from May 08 to 12 with the result of -45.86$ has been unprofitable so far. The anti-record was beaten last week, but this kind of market chaotic behavior is quite rare, and let's hope it won't happen again.

We will see how the trading will look like and how the market will behave, as well as what trades will be offered to us to open Owl Smart Levels on Monday, during the upcoming trading week.

See other reviews of the Owl Smart Levels strategy:

- From July 17 to 21, 2023, Total: +7.6%

- From July 10 to 14, 2023, Total: +3.6%

- From July 3 to 7, 2023, Total: +11%

- Archive of reviews >>

I'm Sergei Ermolov, follow me and don't miss more useful tools for profitable trading on the Forex market.