For this strategy, we use our next-generation FX Power NG, which is available for

MT4 👉 FX Power MT4 NG and MT5 👉 FX Power MT5 NG

Use our new Custom Alerts MT4 / Custom Alerts MT5 to get a hint if it gets interesting

and you'll find the corresponding chart templates for MT4 and MT5 at the end of this article.

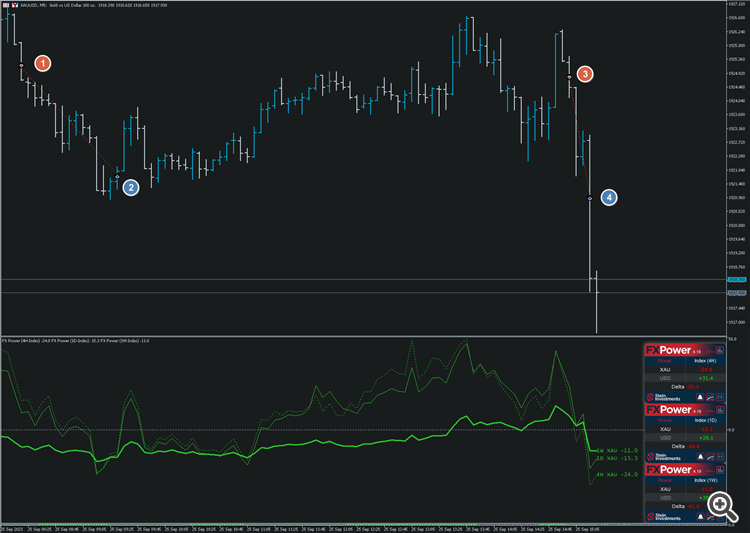

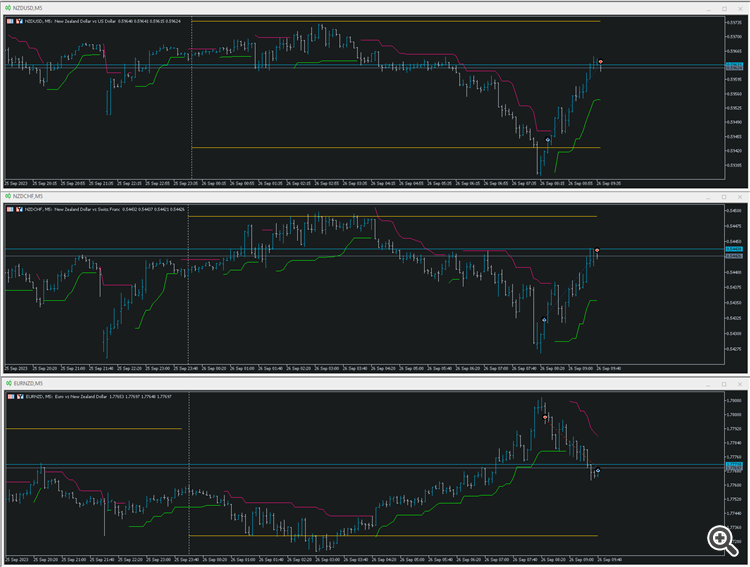

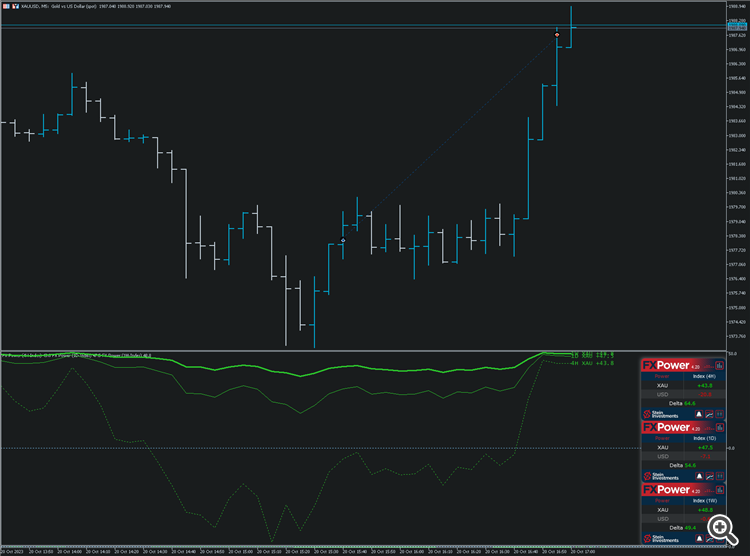

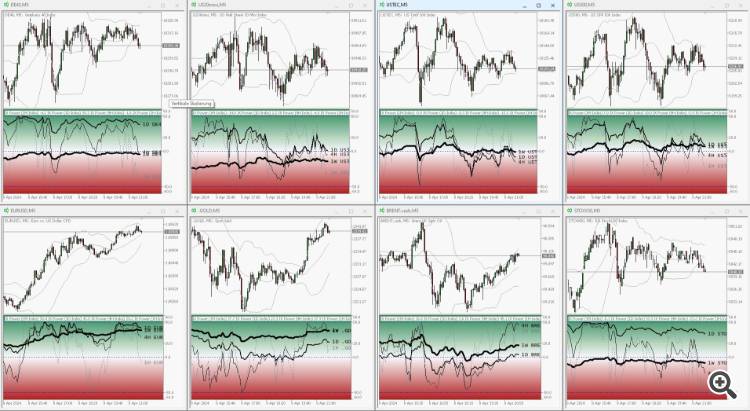

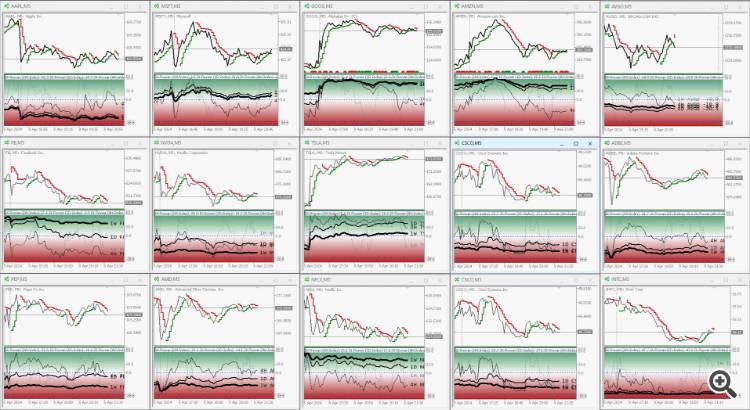

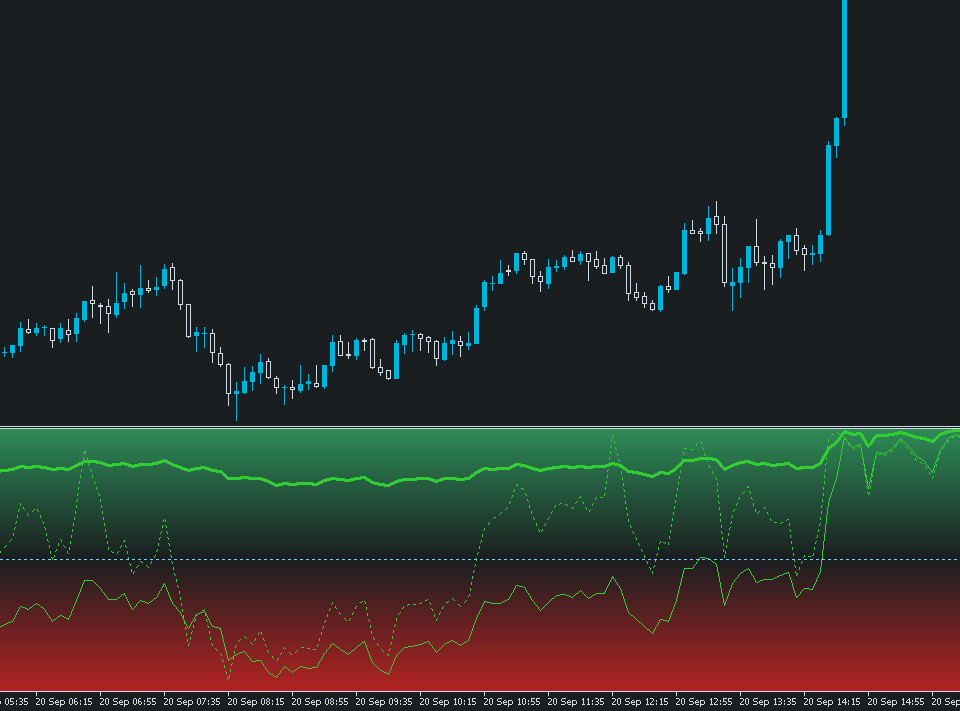

The goal of our setup looks like this, and it contains a long-term analysis of 1 Week seen as a thick line,

a medium-term analysis of 1 Day as a thin line, and a short-term analysis of 4 hours as dotted line.

In this XAU example, the thick 1-Week strength line is our baseline, where the other two lines mostly return to.

But before we go into details here are some tutorial videos of how to create this beautiful chart setup.

Step 1: Create the Triple Instance Setup

Step 2: Focus on what's relevant

Step 3: Define individual line styles

Step 4: Save chart space with our compact panel mode

Step 5: Use templates to duplicate the setup on other charts

The Dog Walk Strategy

1. The thick green line is the 1-week trend. It's the man who goes for a walk. He knows the direction and moves along.

2. The thin green line is the 1-day trend. It's the adult and experienced dog who is happy about the walk, knowing his route.

3. The dotted green line is the 4-hours trend. It's the puppy in this story, and totally excited about everything.

In our analogy, the long-term trend (man) sets the direction, while the medium and short-term trends (dogs) deviate again and again, take new paths and yet sooner or later swing back in the direction of the long-term trend.

Basically, it is the usual interplay of trend and setback.

But being able to visualise it in this way opens up the possibility of recognising the end of a setback and taking a position in the direction of the overriding long-term trend.

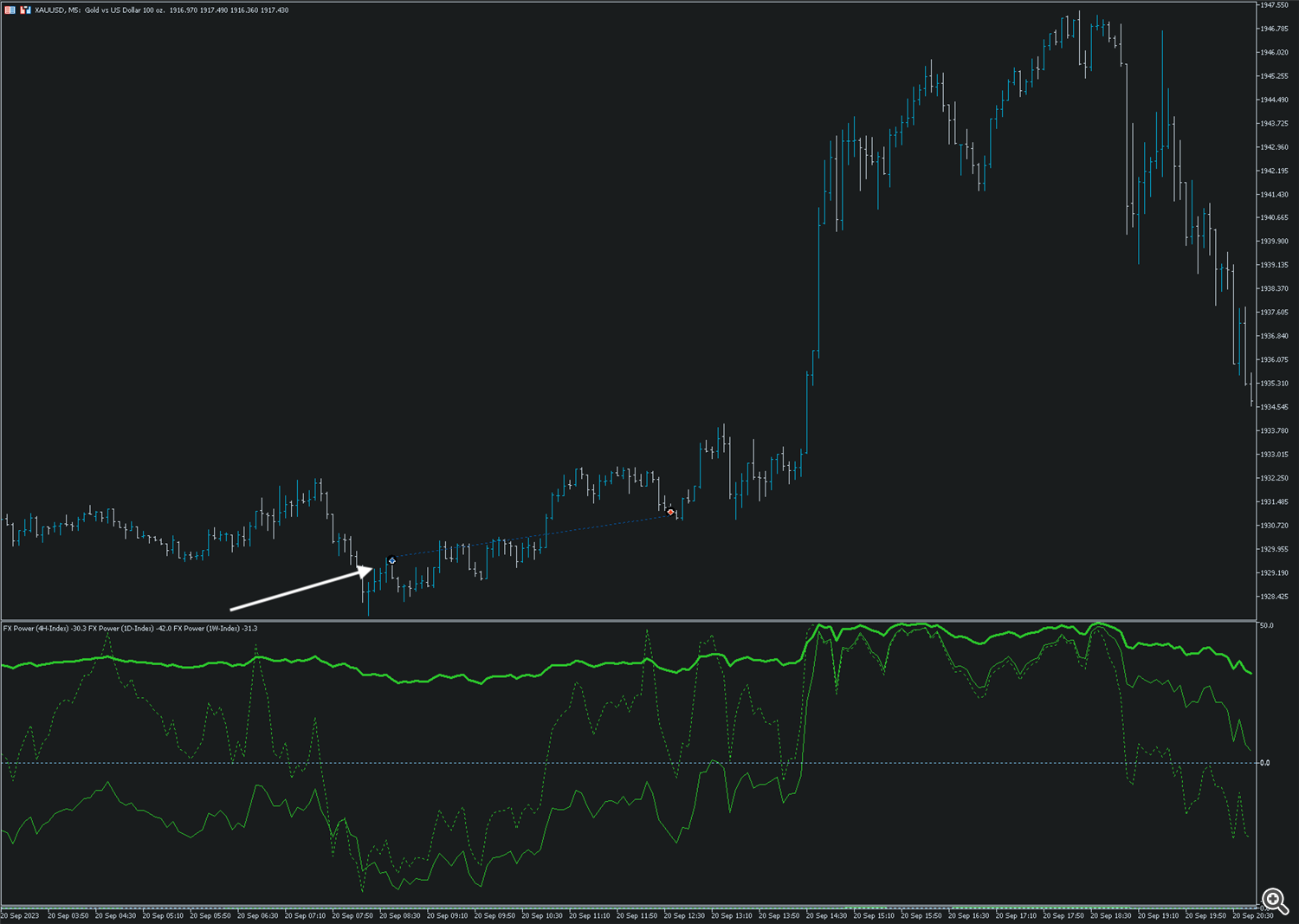

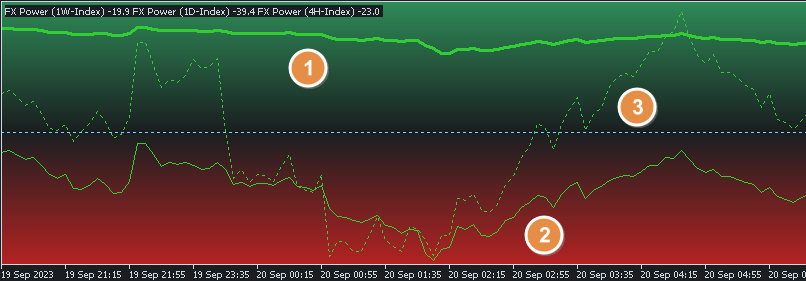

So let's bring the indicator information above in line with what happens on the underlying chart symbol.

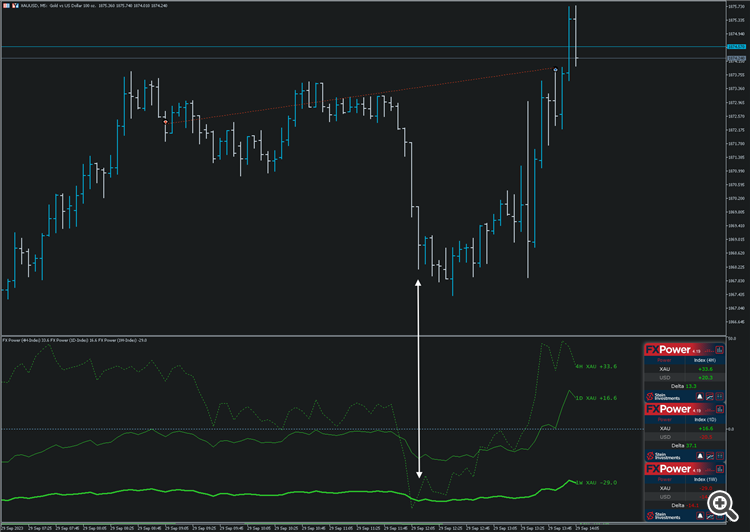

1. The dogs move away from their master.

2. They reach the lowest possible point

3. They start to turn back (possible entry)

4. The little one reaches his master (possible exit)

The game starts again

5. The two dogs reach the lowest possible point again and

6. Start to turn back (possible entry)

7. The small dog reaches its master (possible exit)

This time, the upward trend stabilises and gains even more momentum in the following hours.

I hope it becomes clear what I mean with this strategic approach, and I assume it will work across all currencies the same.

I created this article as food for thought and a joint project for our followers and FX Power users.

So please feel free to share your thoughts, trades, and ideas in the comments below.

All the best and have fun trading

Daniel

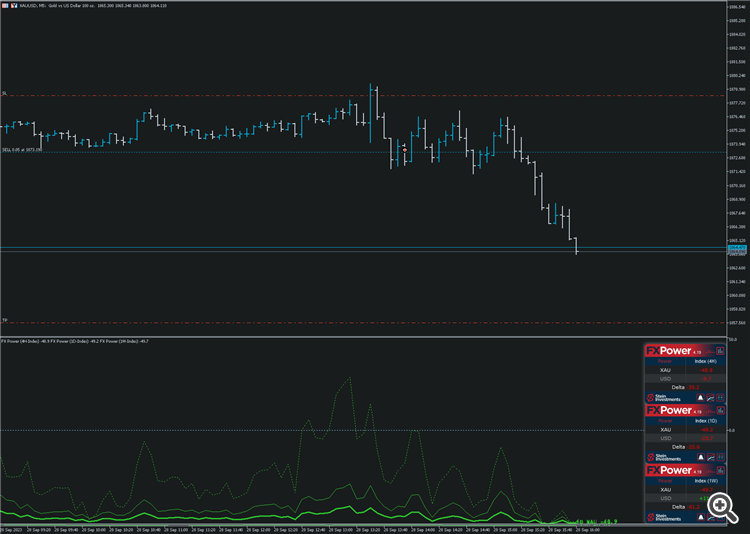

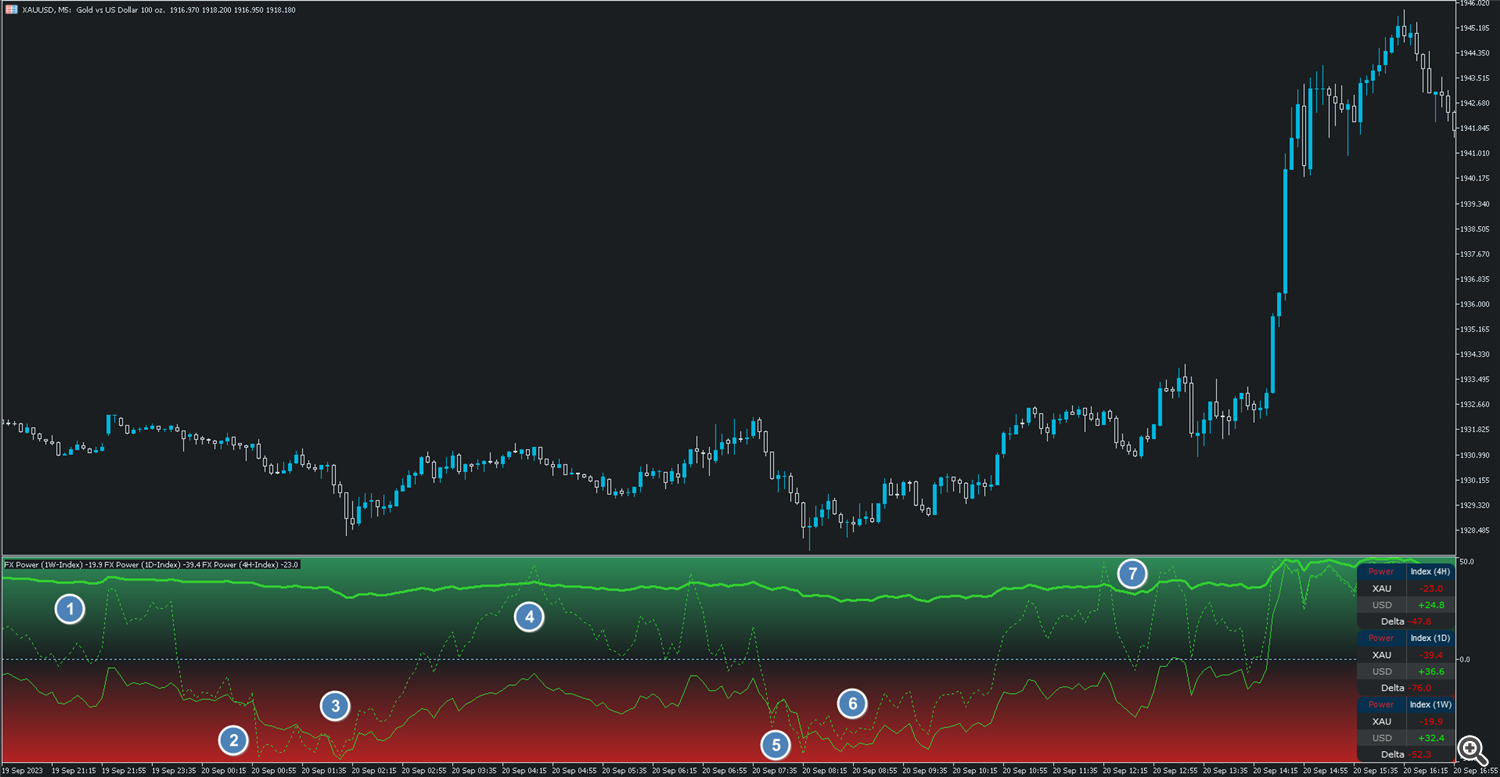

P.S: Here's a screenshot of my first attempt trading the dog walk strategy yesterday on Gold.

The entry was perfect, but I got stopped out due to an unnecesary trailing stop before the big move happened.

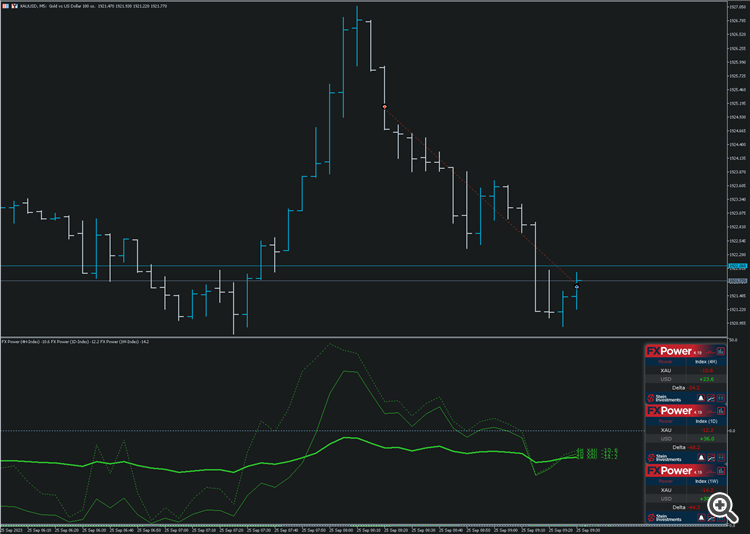

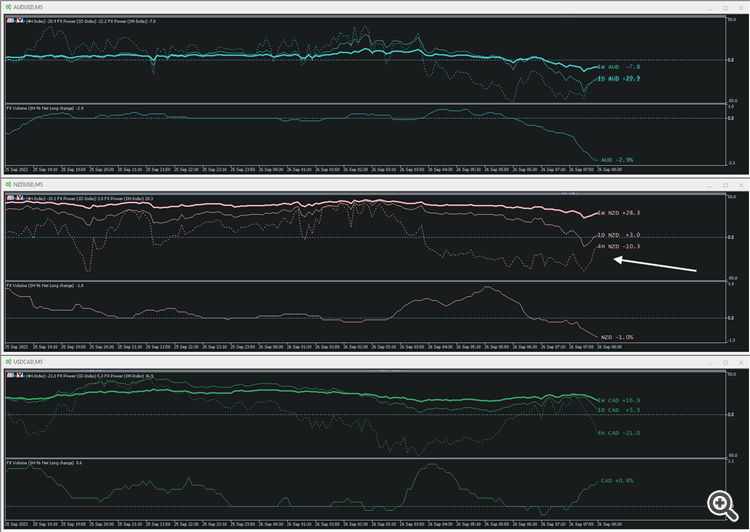

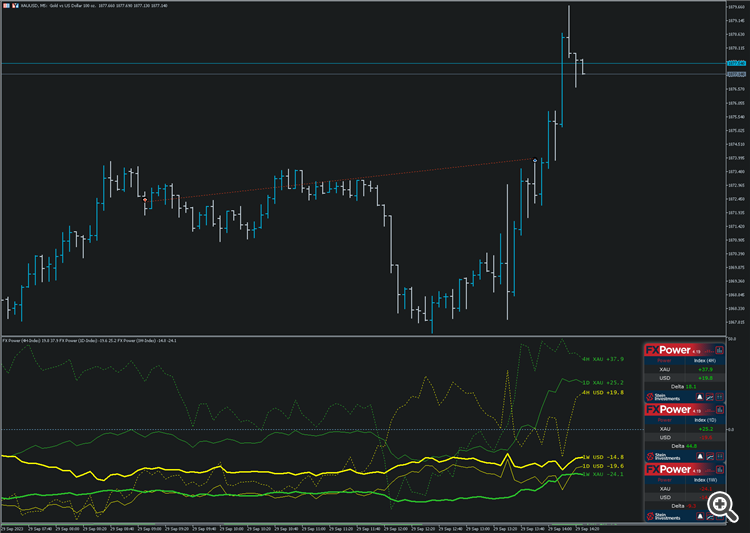

And here's another fantastic opportunity of the Dog Walk Strategy

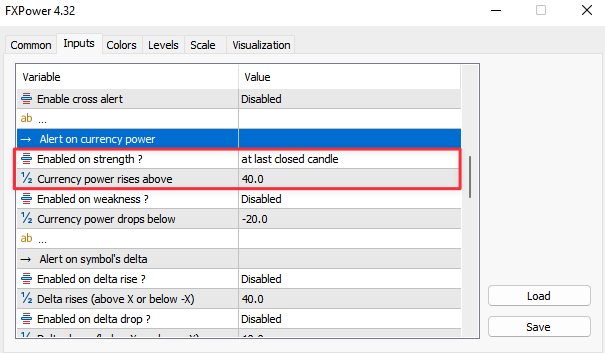

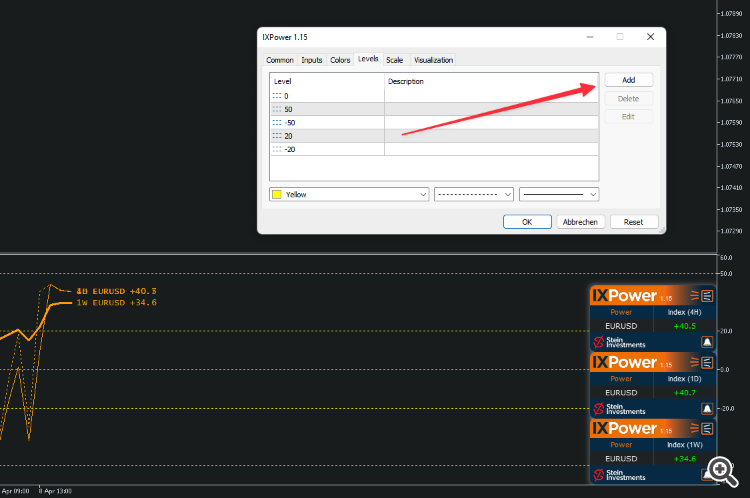

HOW TO GET AN ALERT FOR THIS SETUP?

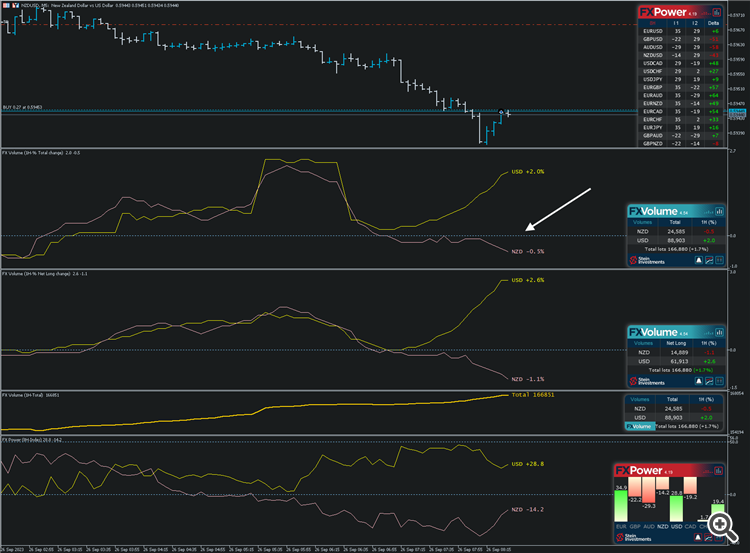

At first we need one clear BUY or SELL trend on the 1W. That's something we can easily identify at a glance.

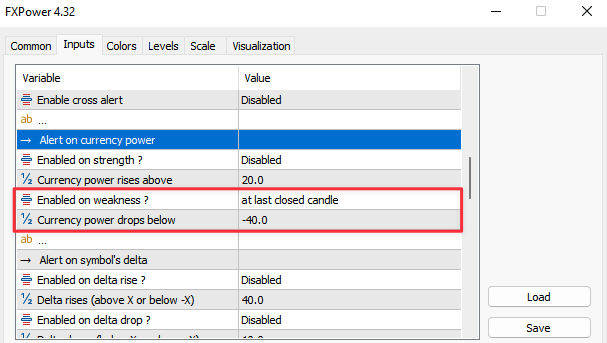

Then we just need an alert for the 4H option in the opposite direction.

Example:

If the trend is BUY on 1W, this defines the direction of my trade.

Then I set up an alert on 4H which gives me a hint when the reversal reaches a low point below -40.

So, I notice when it's worth having a closer look, and when this reversal is about to end I hop in with a stop loss below the last low on M5.

And the same works vice versa. If the main trend is SELL, you set up an alert if XAU rises above +40 on the 4H instance.