In this article I would like to invite you to a journey to trade capital from prop firms. Before we start any journey, we usually take a look at a map showing us the goal we are trying to achieve. A good map can also show information how to get there.

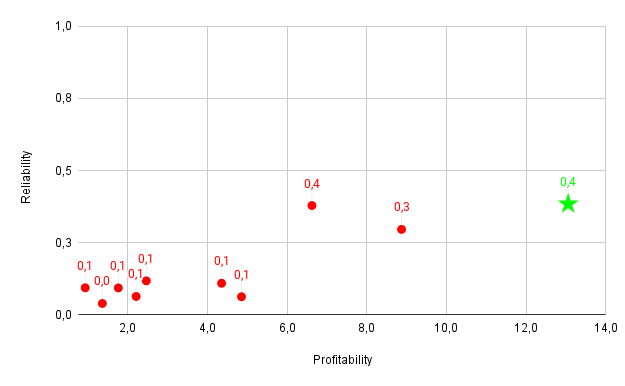

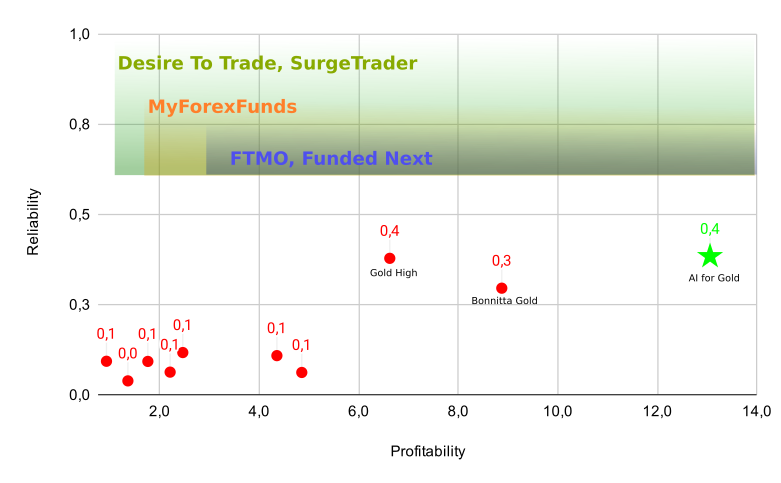

On our journey we shall apply a trading bot. In my prior analysis of Best Gold trading EAs 2023 (before June), there is a chart which shows currently best Gold trading EAs on the MQL market. This is also a map of its kind. This map shows us the locations of the EAs span on dimensions profitability and realiability. The further to the top right, the better.

The values here are computed using the publicly available data from the live signals:

-

Profitability: Total profits devided by the amount of weeks. In this signal for example we have 222% profits after 17 weeks, the EA would be on the X-Axis at222/17=13.0

-

Reliability: The profitability devided by the total drawdown: 13.0/34.8=0.38

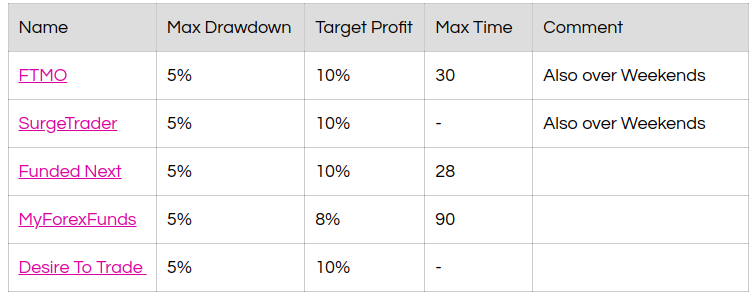

Prop Firms

Once we have charted the map of available Expert Advisors (EAs), the next step is to superimpose them onto the map delineating the "money making territory" defined by the prop firms boundaries. Initially, this list comprises a concise selection of the considered proprietary firms.

Each of the requirements can be drawn as an area on the map. FTMO for example, has a drawdown limit of 5% per day. The profit goal is 10% and we have only 30 days to reach it.

When we translate these boundaries into our profitability, time and risk map, we can draw a rectangle on our Prop-Firm-Journey Map.

-

The required minimal profitability per week should be around 3% and the max drawdown is 5%. Dividing 3%/5% = 0.6 we get the reliability value on the Y-axis.

-

The X-axis value - the profitability - is at least 3% per week. That is why the blue area can be extended infinetely to the right. If we make 300000% per week with a safe drawdown of 5%, no trader will complain. 😊

-

So finally we draw that rectangle starting at X-Axis=3 and Y-Axis=0.6.

Now that we have a clear understanding of how to chart the money territory of a single prop firm, let's delineate these lucrative territories with the top-rated prop firms.

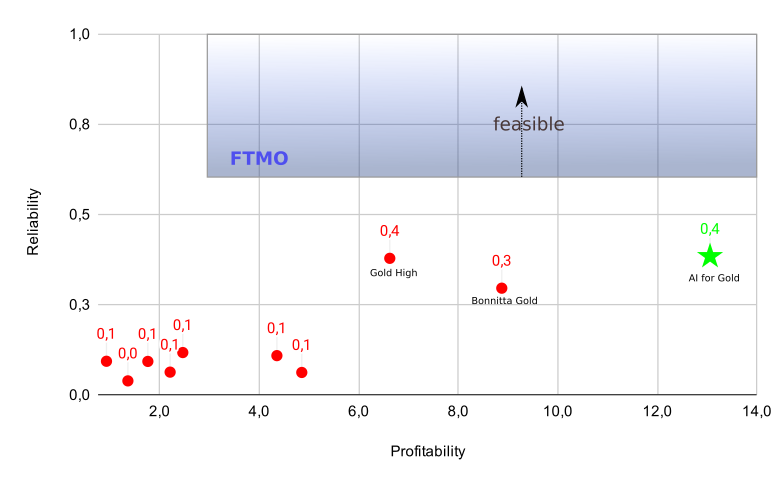

The Gap

Once I had mapped out the money making territory, it dawned on me that none of the examined Expert Advisors (EAs) resided within this domain! 🤯

To make matters worse, the majority of proprietary firms seems to offer variations regarding the profitability dimension. But they all require extreme reliability of at least 0.6. The good news is, when we make it to trade one of them, we can trade all of them.

The Way

The gap we observe between the EA-points on the map and the money territory is something we should inspect in more detail. The prop firm requirements are fixed. But during the computations of the EA-points we quitely accepted a few assumptions:

-

Inaccurate assumption #1: The EA produces the max draw down all the time

-

Inaccurate assumption #2: The implemented strategy of the EA does not change

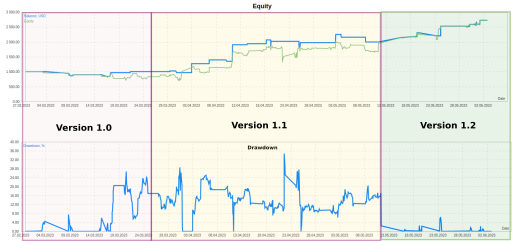

These two aspects can have a very strong impact. When we look at the performance of AI for Gold over time, we clearly can see that it changes everytime a new AI model + new strategy have been deployed.

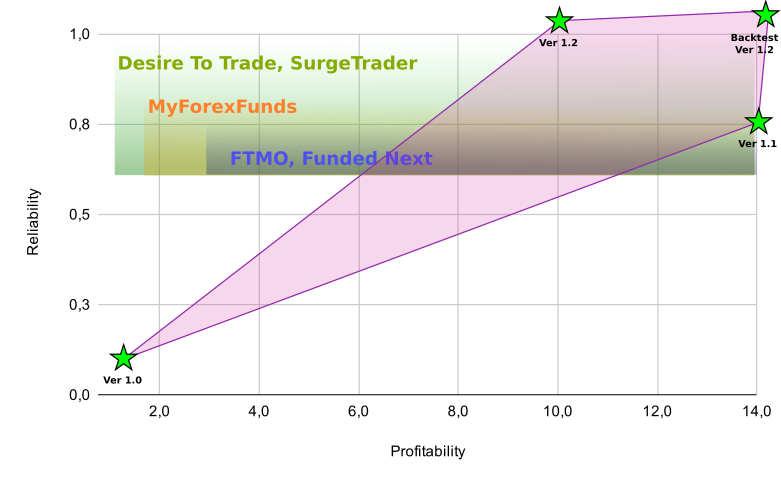

So basically we have here tree different strategies which can be charted as three different points on the map. Adding the performance from the backtest of version 1.2+ as the fourth point, we obtain the following chart:

So the new version is very much capable of trading prop firms. The live and backtest results indicate this. Now we can derive a configuration strategy for AI for Gold to trade the prop firms.

Take AI for Gold, set the risk level to 10 and multiply all lots with the factor of 0.5 or less.

You can download the set files from here and adjust the "Multiply all Lots" parameter to 0.5.

Conclusion

Can we trade the prop firms inside the money territory? Yes! Next time I post an article about prop-firm trading, I will focus on building a portfolio of uncorrelated EAs.

Subscribe to future Articles

To stay informed about this captivating topic, I encourage you to subscribe to my newsletter, where you will receive automatic updates on upcoming articles.