ChatGPT Forex Robot helped me to pass MFF Challenge in 6 trading days

ChatGPT Forex Robot helped me to pass MFF Challenge in 6 days

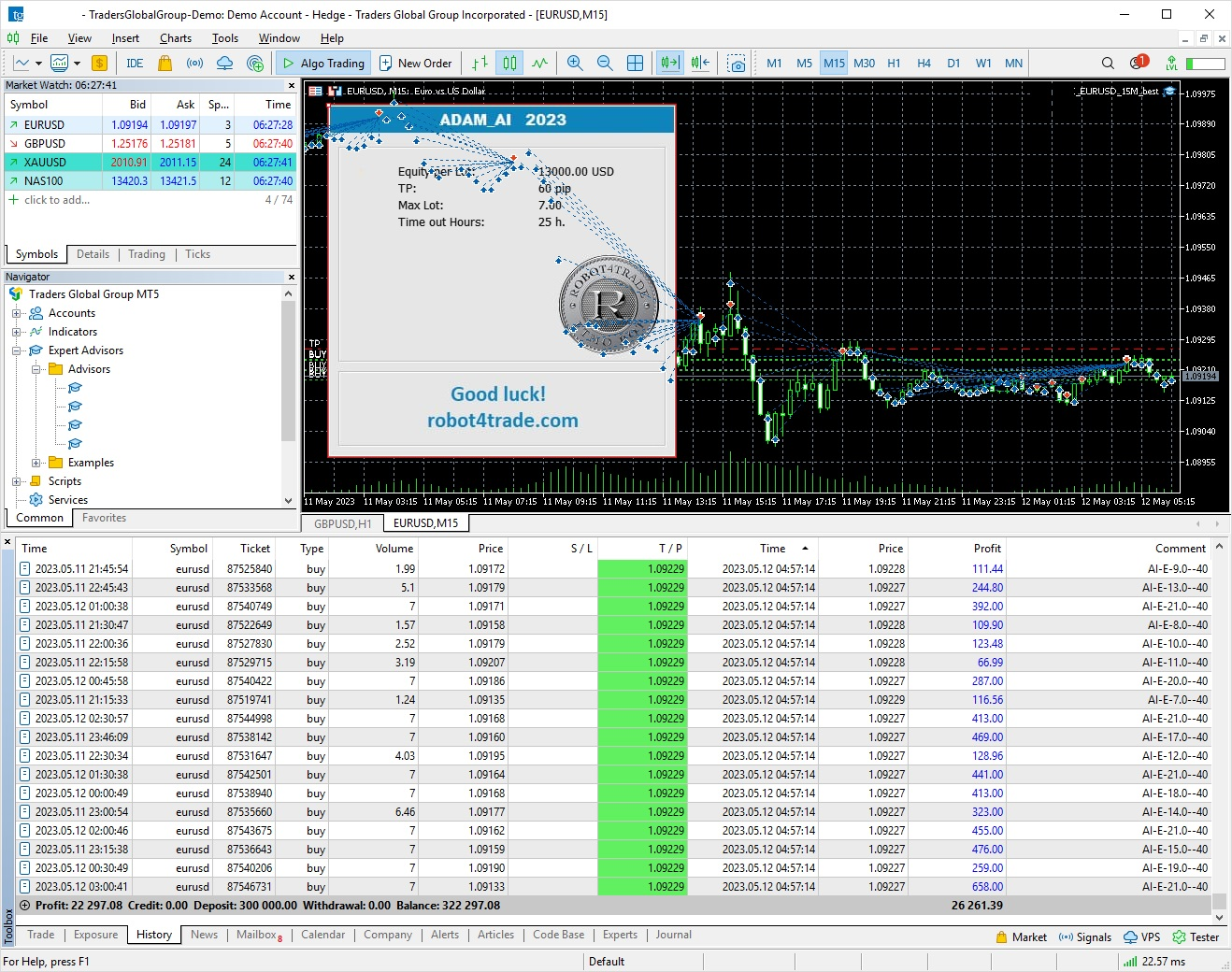

ADAM_AI was specially created using ChatGPT for Forex Brokers and Prop Firms Challenges, like MFF, FTMO. Just passed 300k challenge in 18 days and 100k in 6 days! https://www.robot4trade.com/

FTMO with Adam_AI https://trader.ftmo.com/metrix?share=d8a60daf1676&lang=en

Best Regulated Broker: https://rb.gy/umqw1

Best Prop Firm: https://rb.gy/jfuw0

FX VPS: https://rb.gy/ygncd

I'm excited to share with you my experience with the latest AI technology and how we used it to create a powerful system to pass the MFF and FTMO challenge with algo trading. It all started when I got introduced to the incredible capabilities of chatGPT, an AI solution that has revolutionized the way we approach complex problems in trading. We decided to combine our 17 years of experience in the stock market and algorithmic trading development with the cutting-edge solutions provided by chatGPT. So, let me walk you through the steps we took to create our system to pass the FTMO challenge: Step 1: We brainstormed ideas and debated which strategy to use, which indicators to rely on, and which tricks would be most effective for the FTMO challenge. Step 2: We had direct conversations with chatGPT, and I was impressed with the intelligence of the responses I received. After hours of discussion, I received hundreds of lines of code that were 100% compiled in MQL. This was lightning-fast, and I was in shock. Step 3: We then turned to our trusted programmer to dissect our code, and add more complex elements that had proven successful in our previous developments, and in passing FTMO and MFF. Step 4: We went through the optimization stage, testing hundreds of thousands of parameter value combinations over the past months' history, and we were blown away by the amazing results we achieved within the first two days of testing. This was unexpected, as usually it takes weeks to get even minimal positive results from thousands of trades. Section 5: Adding Risk Management Techniques One of the most crucial steps in creating a trading bot is incorporating risk management techniques. In this section, we'll take a look at some of the methods I used to manage risk, including stop-loss orders and position sizing. We'll also discuss the importance of analyzing the bot's performance and making necessary adjustments. Section 6: Generating Manual Rules Another essential aspect of building a trading bot is generating manual rules. In this section, we'll explore the different rules I implemented, such as entry and exit criteria, and how they helped improve the bot's profitability. We'll also discuss the importance of optimizing trading parameters and how it can impact the bot's performance. Section 7: Monitoring and Adjusting Performance In this section, we'll talk about the importance of monitoring the bot's performance and making necessary adjustments. We'll look at some of the indicators I used to measure the bot's profitability, such as profit factor and drawdown, and how I made adjustments based on the results. We'll also discuss the role of backtesting and how it can help identify potential issues with the bot's performance. Section 8: Implementing External Equity Protection Measures Finally, we'll discuss the importance of implementing external equity protection measures. We'll look at some of the tools I used, such as equity protectors, to ensure that the bot's performance was not affected by market fluctuations. We'll also talk about the importance of setting up rules to close out positions before the weekend and limit potential losses.