The Moving Average Convergence Divergence (MACD) indicator is a popular technical analysis tool used by traders to identify trends and momentum in price movements. Developed by Gerald Appel in the 1970s, the MACD indicator compares the 26-day Exponential Moving Average (EMA) and the 12-day EMA to identify potential trading opportunities. In this article, we will discuss a trading strategy that uses the MACD indicator to make profitable trades.

Understanding the MACD Indicator The MACD indicator consists of two lines: the MACD line and the signal line. The MACD line is the difference between the 26-day EMA and the 12-day EMA, and it is plotted on a chart. The signal line is a 9-day EMA of the MACD line, and it is plotted on the same chart. When the MACD line crosses above the signal line, it is considered a bullish signal, and when it crosses below the signal line, it is considered a bearish signal.

Using the MACD Indicator in Trading The MACD indicator can be used in various ways to identify potential trading opportunities. Here are some ways traders can use the MACD indicator in their trading strategies:

-

Trend Identification: The MACD indicator can help traders identify trends in price movements. When the MACD line is above the signal line, it indicates a bullish trend, and when it is below the signal line, it indicates a bearish trend. Traders can use this information to make trading decisions based on the direction of the trend.

-

Momentum Analysis: The MACD indicator can also be used to analyze momentum in price movements. When the MACD line moves away from the signal line, it indicates increasing momentum, while when it moves closer to the signal line, it indicates decreasing momentum. Traders can use this information to determine the strength of a trend and make trading decisions based on the momentum.

-

Divergence Analysis: The MACD indicator can also be used to identify divergences between the MACD line and the price chart. Divergences occur when the MACD line moves in the opposite direction of the price chart. Bullish divergences occur when the MACD line makes higher lows while the price chart makes lower lows, and bearish divergences occur when the MACD line makes lower highs while the price chart makes higher highs. Traders can use divergences to identify potential trend reversals and make trading decisions based on them.

Trading Strategy with MACD Indicator Now let's look at a trading strategy that incorporates the MACD indicator:

-

Identify the Trend: Use the MACD indicator to identify the direction of the trend. When the MACD line is above the signal line, it indicates a bullish trend, and when it is below the signal line, it indicates a bearish trend.

-

Look for Crossovers: Look for crossovers between the MACD line and the signal line to identify potential entry and exit points for trades. When the MACD line crosses above the signal line, it is considered a bullish signal, and when it crosses below the signal line, it is considered a bearish signal.

-

Confirm the Signal: Confirm the signal by looking for other technical indicators that support the trading decision. For example, if the MACD line crosses above the signal line in an uptrend, look for other indicators such as the Relative Strength Index (RSI) to confirm the signal.

-

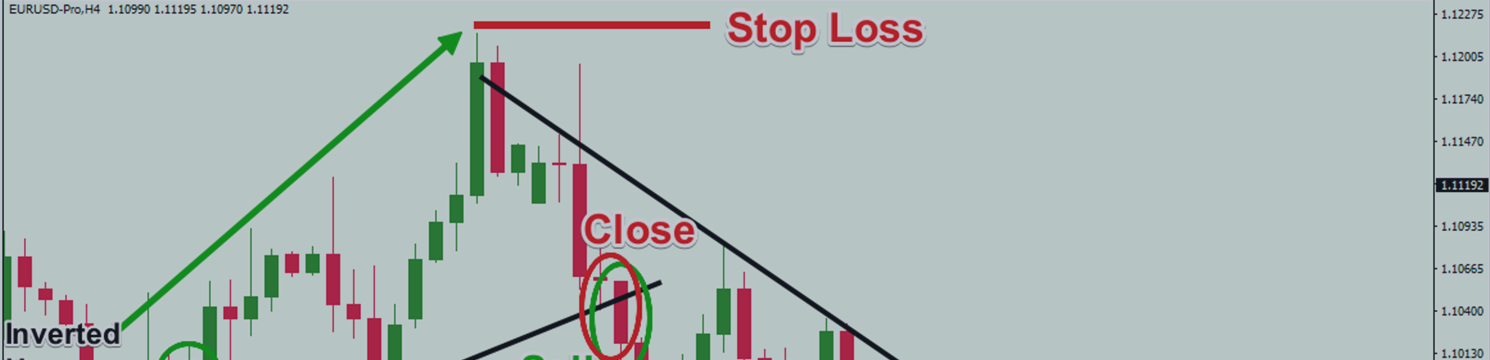

Place the Trade: Once the signal has been confirmed, place the trade. For a bullish signal, buy the asset, and for a bearish signal, sell the asset.

-

Manage the Trade: Manage the trade by setting stop-loss orders to limit losses and take-profit orders to secure profits. Traders can also use trailing stop orders to lock in profits as the price moves in their favor.

-

Exit the Trade: Exit the trade when the MACD line crosses back over the signal line in the opposite direction or when the trade reaches the stop-loss or take-profit levels.