Apparently, the DXY dollar index may soon exceed a two-year high and rise above 103.00. At the time of writing, the DXY index was near 102.58, just below today's high of 102.77.

Market participants are looking forward to the May meeting of the Fed, at which its leaders are likely to tighten the existing parameters of monetary policy and raise interest rates by 50 basis points, as well as announce the start of reducing the central bank's balance sheet.

Meanwhile, against the US dollar today made an attempt to strengthen the Australian dollar. The reason was the publication by the Australian Bureau of Statistics (at 01:30 GMT) of the RBA report with inflation data in Australia in the 1st quarter of 2022. Consumer inflation index CPI increased by +5.1% (against the forecast of growth by +4.6% and +3.5% in the previous quarter).

The truncated average consumer price index rose +3.7% (yoy) after rising +2.6% in Q4 2021, exceeding the forecast (+3.4%) and RBA-defined target range of 2%- 3% (see Today Fundamental Analysis).

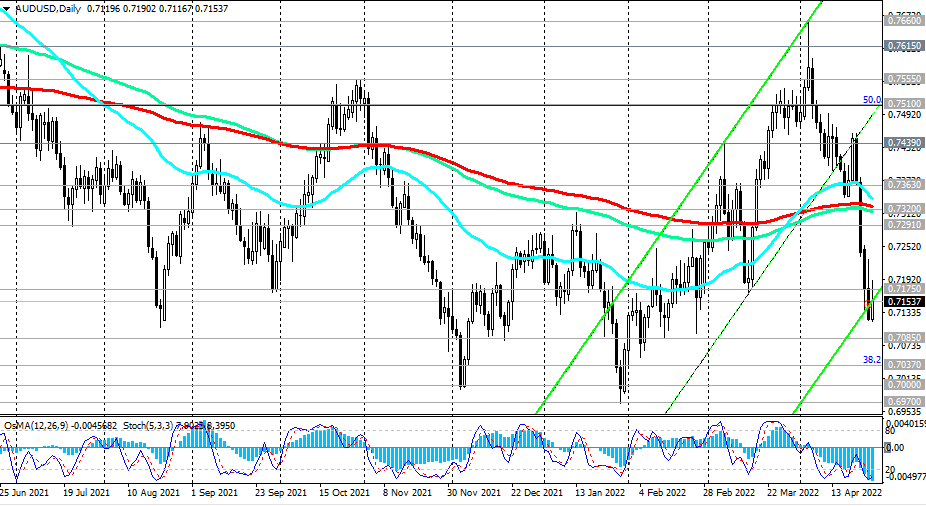

And yet, despite the fact that since the beginning of the month, the AUD / USD pair has fallen by almost 5.0%, economists believe that it can fall to 0.7000, due to concerns about the economic consequences of coronavirus lockdowns in China (this country can significantly reduce the consumption of raw materials and energy, including iron ore and coal supplied from Australia), the domestic political situation in the country (the upcoming parliamentary elections may lead to a change of power due to the decrease in popularity among the population of the ruling coalition of Prime Minister Scott Morrison), as well as against the backdrop of rising inflation, while the RBA has so far refrained from tightening monetary policy.

Support levels: 0.7117, 0.7100, 0.7085, 0.7037, 0.7000, 0.6970

Resistance levels: 0.7175 0.7228 0.7291 0.7320 0.7363 0.7400 0.7439 0.7465 0.7510 0.7555 0.7615 0.7660 0.7730 0.7815

*) see also “Technical analysis and trading recommendations” -> Telegram

**) Get no deposit StartUp bonus up to 1500.00 USD

Source: InstaForex