How to Trade for living (Without Killing Your Creativity!) ft. Munehisa Homma

8 May 2021, 08:05

0

1 600

Often it may feel like trading for living means we can’t trade well—as if trading for living doesn’t leave space for creativity, as if we have to choose between thinking as manual trader (sensing emotions) vs. making decision as algorithms (being logical).

But that is not true.

Here’s why …

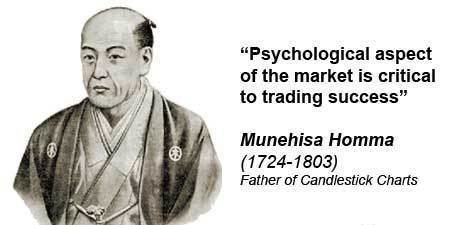

Back then in 1700s to late 1900s,from the rise of dojima rice exchange to newyork stock exchange, traders made logic reasoning with respect to emotions.

Price actions plays vital role in determining emotions of the fellow merchants and brokers on those days. Merchants use to record daily price changes in rice paper parchments.

Merchants are considered to be bankers on those days who trades from one country to another (eg) Japan,India and many parts of south east asia.

Dojima Rice Exchange:

From the beginning of 2000, Financial institutions started adopting Algorithms to take decisions which made profits by highspeed Arbitraging ,scalping and hedging. As years went on those strategies became very risky due to heavy competition between Algos and now those strategies are not on the board.

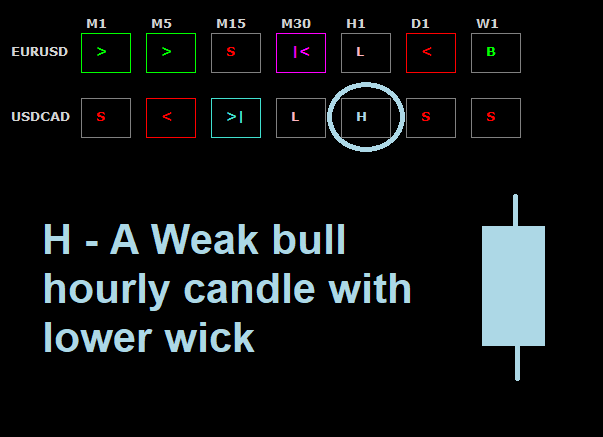

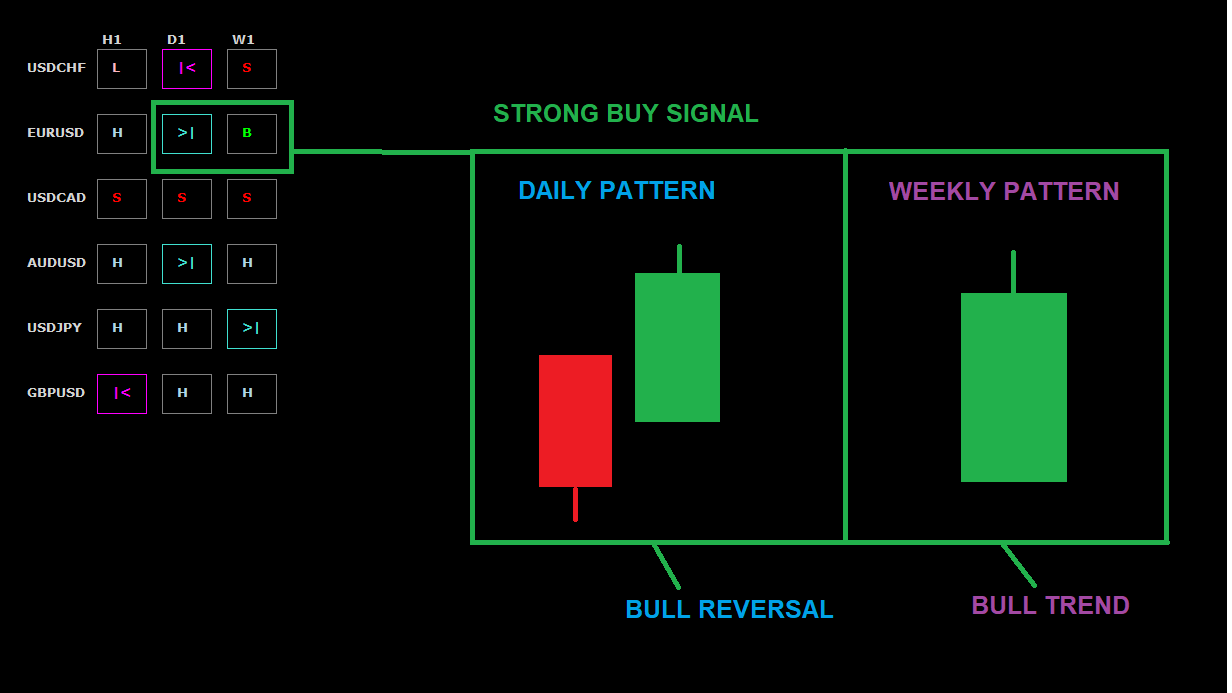

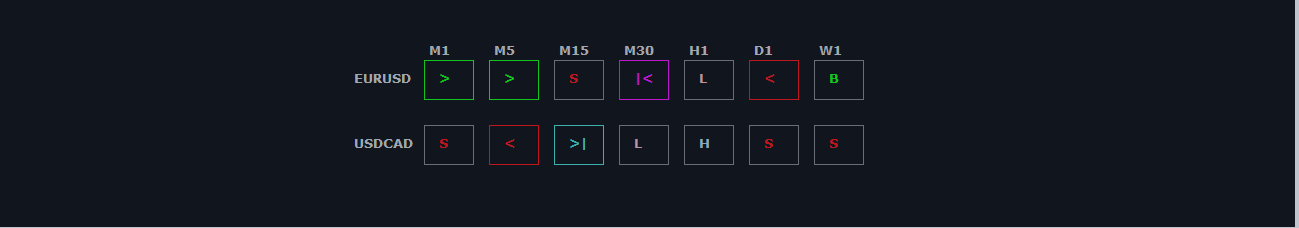

Evolution of Algorithms, Institutions started hiring data analyst and scientist to tap the underlying human emotions between currenies, stocks, cryptos etc to actually predict like expert human trader.

So,Now to be a successful trader who can make living from trading is the one who has hidden potential to tap into crowds human emotions. We are in an era where technologies can support us in taking decision but the best decisions can be filtered with prudent emotional intelligence.

Again we are in start of this vicious cycle.

A Hero who nailed it !!

From Being discriminated at the bottom of feudal system, Munehisa Homma became Financial Advisory & Honorary Samurai of Edo period.

Munehisa Homma a rice merchant who deals with small brokers to store rice in his warehouse. From there he makes trades via sakata port and other small vendors.