TECHNICAL ANALYSIS at 13/08/2020 for EURUSD, GBPUSD, AUDUSD, USDJPY, XAUUSD

Morning Market Review 13/08/2020 EUR / USD, GBP / USD, AUD / USD, USD / JPY, XAU / USD

The iPump indicator was used for the analysis

The British pound is trading with an upward trend against the US dollar in today's morning session, retreating from the local lows, updated the day before. The reason for the restoration of the “bullish” dynamics for the instrument is again a weak dollar, while British investors are widely discussing the macroeconomic data released on Wednesday from the UK. The UK economy showed a 20.4% decline in Q2 2020 after a 2.2% contraction in Q1. On an annualized basis, GDP fell 21.7% after contracting 1.7% in the last quarter. However, it should be noted that the record GDP contraction caused by the forced closure of the economy due to the coronavirus did not scare investors too much, and the pound hardly noticed any negative publications. The result was quite expected and by now these figures hardly reflect the real situation in the British economy.

Main Levels

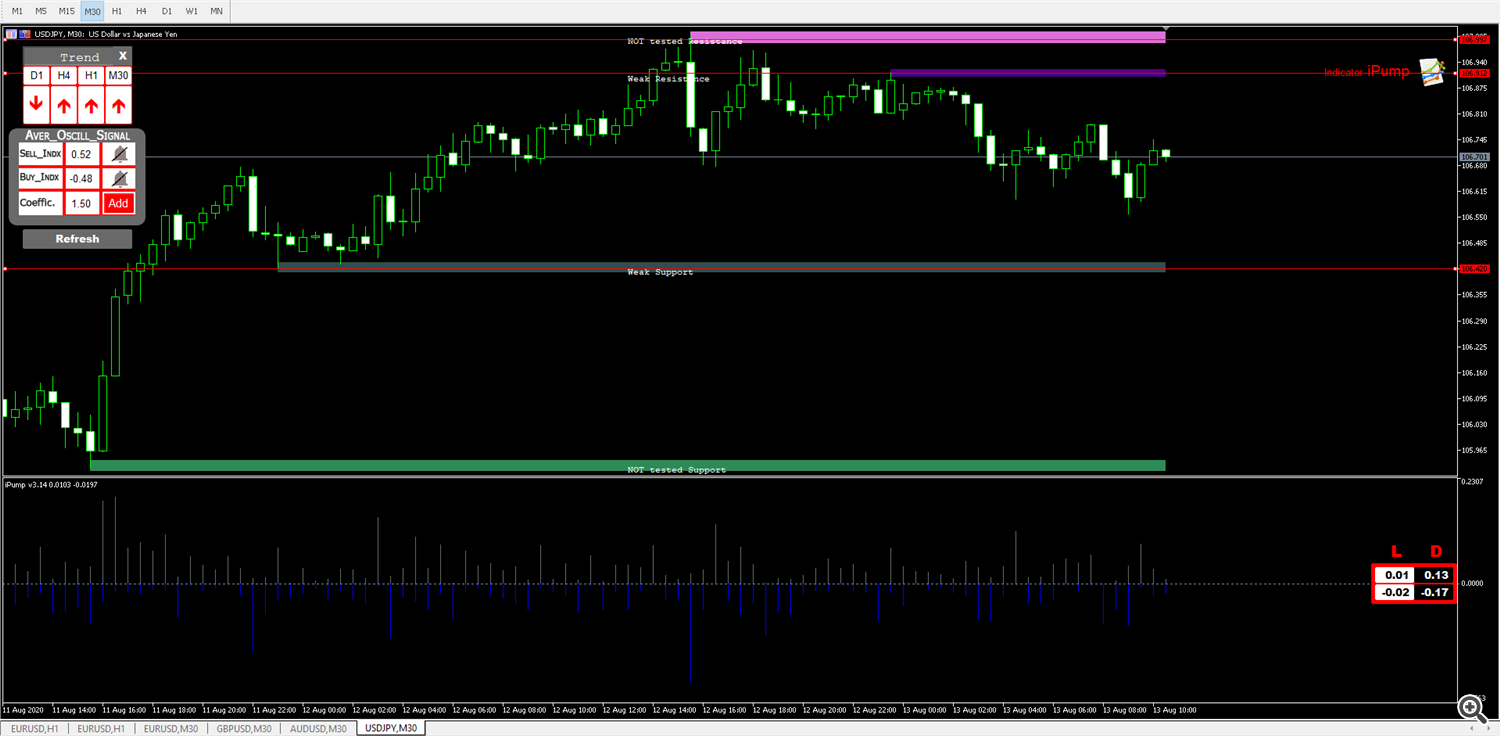

The US dollar is trading in different directions against the Japanese yen during today's morning session, retreating from the local highs since July 23, updated the day before. The “bullish” momentum for the dollar weakens noticeably at the end of the week, despite the fact that the fundamental situation in the US is gradually improving. Investors are optimistic about the growth of US stock exchanges, as well as the confident positive dynamics of 10-year US Treasuries, which reached their maximum levels over the past month. The macroeconomic statistics from the US published yesterday also supported the buying sentiment for the dollar. The consumer price index, excluding food and energy, rose 0.6% in July, accelerating after a 0.2% mom growth on a neutral outlook. In annual terms, the same indicator increased by 1.6% after rising by 1.2% in June.

Main Levels

Gold prices are showing moderate gains during today's Asian session, recovering from a sharp decline earlier in the week, which was caused by a number of technical factors and a large-scale correction of the US currency. The reason for the next wave of gold purchases was the weak macroeconomic statistics from the UK. It became known on Wednesday that the UK economy contracted by more than 20%, showing the worst dynamics among all the G7 countries. The asset is also supported by the continuing uncertainty around the new package of economic assistance to the American economy, which the US legislators have not yet been able to agree on.

The iPump indicator was used for the analysis

# TECHNICAL ANALYSIS at 13/08/2020 for EURUSD, GBPUSD, AUDUSD, USDJPY, XAUUSD