WTI Crude has popped back above the $106.00 handle as reports of relaxed restrictions on US oil exports offset negative cues from an unanticipated jump in inventories. Meanwhile, heightened geopolitical tensions and a weaker greenback could continue to keep gold and silver elevated. Finally, copper is set for its 10th straight day of gains ahead of Chinese Industrial Profits data set to cross the wires on Friday.

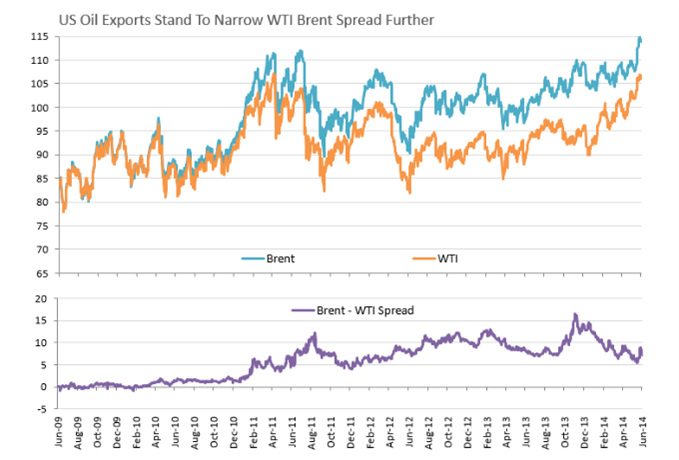

WTI Brent Spread Narrows

The US Commerce Department has confirmed initial reports from newswires that an ultra-light grade of oil has been permitted for export by US refiners. The decision relaxes a ban on US oil exports that has been in place since 1975, and threatens to bring fresh supplies of condensate to the international market. This in turn could stand to narrow the spread between the WTI and Brent benchmarks. While a noteworthy development in the US energy market, exports would likely not take place for some time, leaving further gains for WTI hinge on speculation alone in the short-term.

The export story may have overshadowed concerns of lessened demand for the growth-sensitive commodity on the back of a sharp revision lower to US first quarter growth, alongside a disappointing set of Durable Goods Orders figures. Additionally, traders seemingly looked past an unanticipated rise in total crude stockpiles reported by the Department of Energy.

Of additional note, the dip in the Brent crude benchmark in recent trading, suggests fears over supply disruptions from Iraq may be dissipating. As noted in recent commodities reports, the crisis in the Middle East holds the potential to spark significant volatility for prices. However, at this stage Iraqi crude output has likely been unaffected, suggesting that the conflict offers only a short-term source of support on speculation alone.

Copper Extends Gains Ahead of China Data

The first expansionary reading this year for a key gauge of Chinese manufacturing released on Monday may have alleviated fears over a further slowdown in economic growth for the Asian giant. The encouraging print for the leading indicator has likely bolstered copper prices, helping the base metal extend its recent gains for a tenth consecutive session. Upcoming China Industrial Profits data for May, while of less importance, may help give copper further guidance. A print above or greater than the prior reading of 9.6 percent would help suggest a stabilization in the industrial sector, which in turn could help push the growth-sensitive commodity higher.

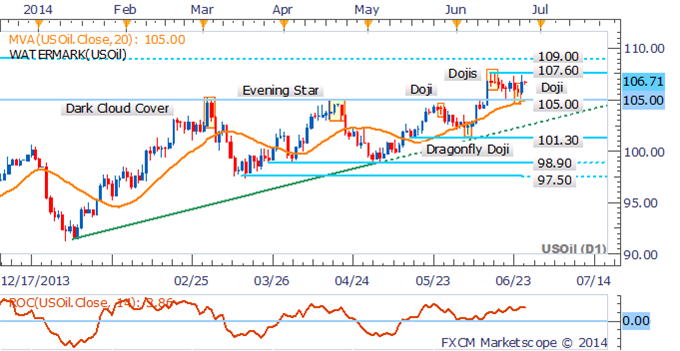

CRUDE OIL TECHNICAL ANALYSIS

With the uptrend intact for crude oil, pullbacks to

support at 105.00 are seen as an opportunity to enter new long

positions. A daily close above nearby resistance at 107.60 would open

the psychologically-significant 109.00 handle.