(02 MARCH 2019)WEEKLY MARKET OUTLOOK 3:ECB Policy Could Hurt Euro

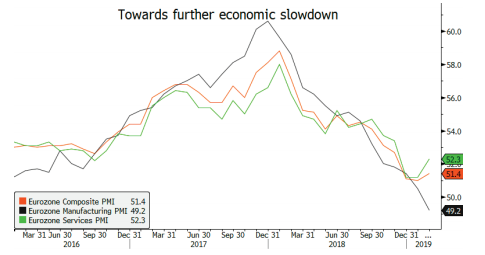

The European economy still faces weakening dynamics. Deflation is showing up in the single monetary union, with month-on-month January CPI at -1% while the situation seems to be more rosy in February, as both the global and services PMI indices seem to show a slight upside while headwinds on the front of transportation-related industries continue to weigh on the manufacturing gauge. Indeed, the German car industry, which accounts for 20% of total GDP of the country, faces production and sales disruption due to the worldwide harmonized light vehicles test procedure (WLTP) imposed by the EU on new and existing car models. Furthermore, the recent submission of a national security investigation from the US Commerce Department with regard to EU car imports to the US could lead to a tit-for-tat trade war between both nations if US President Donald Trump would act on the recommendation. Applying tariffs along 10% - 25% to EU car imports would have irreversible consequences on both economies and put numerous industries in danger. Yet, the risk remains limited since both sides are expected to start talks to reduce transatlantic industrial barriers along March while a final agreement could be reachable before year-end. Accordingly, although the risk of a major EU – US trade war remains limited, the situation requires the European Central Bank (ECB) to remain cautious and stay open to potential targeted long-term refinancing operations following its forward guidance of 7. March 2019 policy meeting. Still, further postponement of unconventional liquidity measures is not excluded if the economic situation improves. For now, we would however maintain a EUR-negative view, as long as the economic situation is not clarified.

By Vincent Mivelaz