On Wednesday, May 30, the Bank of Canada will be deciding on the interest rate. After the Bank of Canada left the rate at the previous level of 1.25% in April, the Canadian dollar declined. The central bank is concerned about international trade conflicts and weaker economic expectations than expected.

Uncertainty over the NAFTA negotiations puts pressure on Canadian investment and exports, said earlier this month, Bank of Canada Deputy Governor Lawrence Schembri, noting that "we (at the Bank of Canada) have to hedge themselves because of the uncertainty surrounding NAFTA negotiations".

The USD / CAD is currently in the grip between two differently directed factors. The strengthening US dollar and the uncertainty associated with the prolongation or amendment of the terms of the NAFTA agreement support the USD / CAD pair. At the same time, rising oil prices help strengthen the Canadian dollar and reduce the pair USD / CAD.

However, the last few days, oil prices are falling due to reports that OPEC may decide at its June meeting to increase oil production amid fears of a reduction in production in Iran and Venezuela.

So, Saudi Arabia's oil minister Khaled Al-Falih said on Friday he wants to discuss the possibility of easing the requirements for limiting production with other participants in the OPEC + agreement during the meeting in June.

"Despite the higher demand in the world economy, the growth of investment (Canadian) companies focused on exports will be limited by the increased uncertainty surrounding foreign trade and concerns about regulatory rules. In addition, after the tax reform in the United States, the question of likely investors switching to US assets", said in the Bank of Canada in the accompanying statement after the decision on the interest rate at the previous meeting in April.

Economists expect that at the May meeting (May 30), the Bank of Canada will also not change the current monetary policy. The rate will remain at the current level of 1.25%.

Nevertheless, investors will carefully study the text of the accompanying statement of the Bank of Canada in order to understand the intentions of the central bank regarding the prospects for the monetary policy of the bank. Any hints of a rate hike in the coming months could cause a surge in volatility in the foreign exchange market, primarily in currency pairs with the Canadian dollar, including in the pair USD / CAD.

If the rhetoric of the Bank of Canada's statement is soft, it will cause further weakening of the Canadian dollar. However, with the resumption of rising oil prices, it is also necessary to wait for the resumption of the strengthening of the Canadian dollar.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

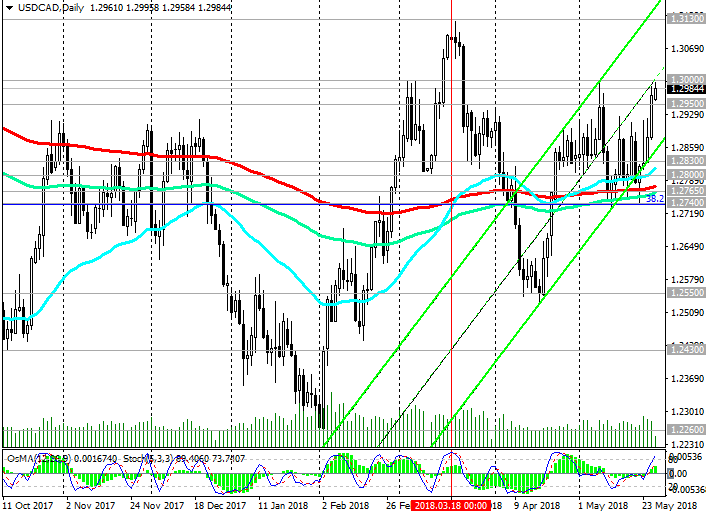

Support levels: 1.2950, 1.2900, 1.2830, 1.2800, 1.2765, 1.2740, 1.2600, 1.2550, 1.2430, 1.2360, 1.2260, 1.2170

Resistance levels: 1.3000, 1.3130, 1.3200, 1.3450

Trading Scenarios

Sell Stop 1.2940. Stop-Loss 1.3010. Take-Profit 1.2900, 1.2830, 1.2800, 1.2765, 1.2740, 1.2600, 1.2550

Buy Stop 1.3010. Stop-Loss 1.2940. Take-Profit 1.3130, 1.3200, 1.3300, 1.3450

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com