According to the National Bureau of Statistics (ONS) report released on Thursday, retail sales in UK rose 1.6% in March after falling by -1.1% in March. The data presented became a pleasant surprise for the pound buyers after in the 1st quarter of this year compared to the last quarter of 2017, sales decreased by 0.5%.

The increase in retail sales may indicate the restoration of consumer confidence, as well as the acceleration of inflation, which may prompt the Bank of England to tighten its monetary policy. Nevertheless, the data released on Wednesday on consumer price inflation for April showed the weakest growth in more than a year.

In a broader perspective, "the growth in retail sales has slowed significantly, and the growth in sales of food, household items and sales in online stores has largely been offset by a decline in sales of many other goods and services", said National Bureau of Statistics spokesman Rob Kent-Smith. At the same time, it is likely that the salaries of the British will grow only gradually. In this case, the retail sector is likely to remain under pressure.

The UK economy is focused mainly on the domestic market, while the retail and domestic consumption sector is an important part of the British economy.

It is expected that in 2018 the UK economy will grow more slowly than other developed economies, as the uncertainty of the Brexit conditions puts pressure on activity and investment.

On Tuesday, the Governor of the Bank of England and members of the Committee on Monetary Policy said in Parliament that the bank could raise interest rates "in a few months". However, we should wait for "recovery of momentum before raising rates".

At the same time, as follows from the minutes of the May meeting of the Fed, published on Wednesday, the leaders of the US central bank came to the conclusion that "the next increase in interest rates will be expedient in the near future". However, there is no consensus on 3 or 4 rate increases this year among the leaders of the Fed.

Nevertheless, the leaders of the Fed intend to systematically pursue the planned monetary policy aimed at its further tightening.

With an increasing interest rate, the attractiveness of the dollar will grow. According to some leaders of the Fed, "it is advisable to continue to tighten monetary and credit policy in order to avoid increasing risks for macroeconomic stability".

Thus, the different focus of the monetary policy of central banks in the UK and the US, as well as the uncertainty about Brexit, will further reduce the GBP / USD pair.

From the news for today we are waiting for the speech at 17:00 (GMT) of the head of the Bank of England Mark Carney. If he touches on the topic of monetary policy in his speech, then volatility in pound trade can grow dramatically.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

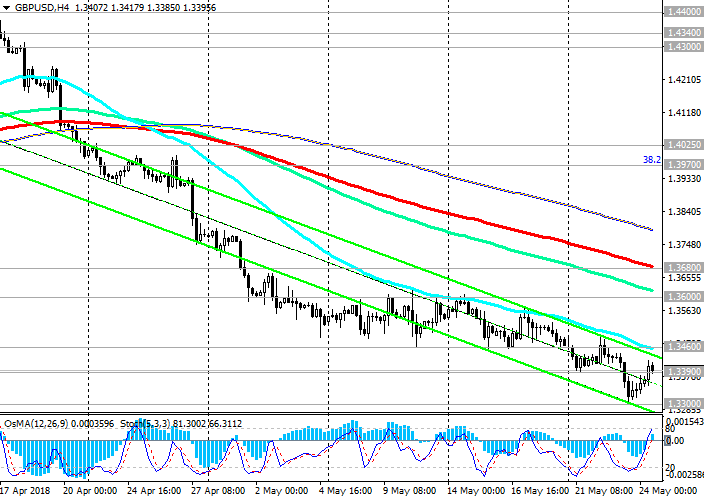

Support levels: 1.3300, 1.3210, 1.3050

Resistance levels: 1.3390, 1.3460, 1.3505, 1.3600, 1.3680, 1.3800, 1.3970, 1.4025

Trading Scenarios

Sell in the market. Stop-Loss 1.3470. Take-Profit 1.3300, 1.3210, 1.3050

Buy Stop 1.3470. Stop-Loss 1.3370. Take-Profit 1.3505, 1.3600, 1.3680

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com