GBP/USD: investors are expecting for data from the UK labor market

As you know, last week the Bank of England retained the key interest rate at 0.50% without risking the weak recovery of the British economy, and also with the continuing of uncertainties regarding Brexit. The program for the purchase of stock assets by the Bank of England also remained unchanged at the level of 435 billion pounds sterling a year.

The Bank of England also lowered its forecast for GDP for 2018 from 1.75% to 1.40%.

In early May, disappointing macro data were published, indicating a weak growth in the UK economy in April. The PMI index for the manufacturing sector turned out to be the lowest for 17 months (53.9 against 54.8 under forecasts and 54.9 in March). Gross domestic product in the 1st quarter increased by 0.1% compared to the previous quarter, or by 1.2% year-on-year (the forecast was + 0.3% and + 1.4%, respectively). Thus, GDP growth has slowed significantly; The UK economy in the first quarter of 2018 grew at a slower pace in more than five years.

Slowing down the rate of inflation also caused the Bank of England leaders to refrain from raising the interest rate. So, the consumer price index pointed out that the annual inflation in the UK in March slowed from 2.7% to 2.5%.

On Tuesday, the focus of traders will be data from the British labor market, including data on employment and wages, which will be published at 08:30 (GMT). If the data here also prove to be weak, then the prospect of an increase in the rate in August will be postponed for an even later period. Although, some economists expect that the Bank of England can still go on raising rates in August or November.

The Bank of England's propensity for a softer monetary policy amid the Federal Reserve's intention to gradually raise the interest rate makes the pound vulnerable to the dollar and leads to a further decline in the GBP / USD.

As stated on Monday by the president of the Federal Reserve Bank of Cleveland and FOMC member Loretta Mester, "it is advisable to continue tightening monetary policy in order to avoid increasing risks for macroeconomic stability". In her opinion, "fiscal policy turns from limiting to stimulating, the growth rate of the economy exceeds trend, and investments are increasing, so the neutral interest rate is also likely to grow".

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

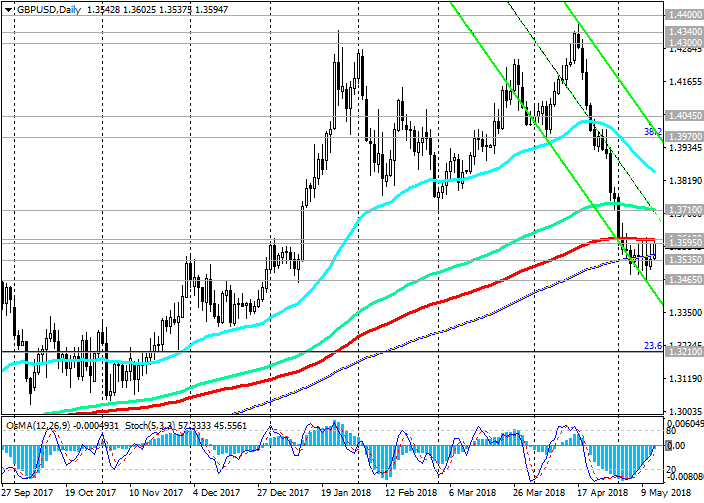

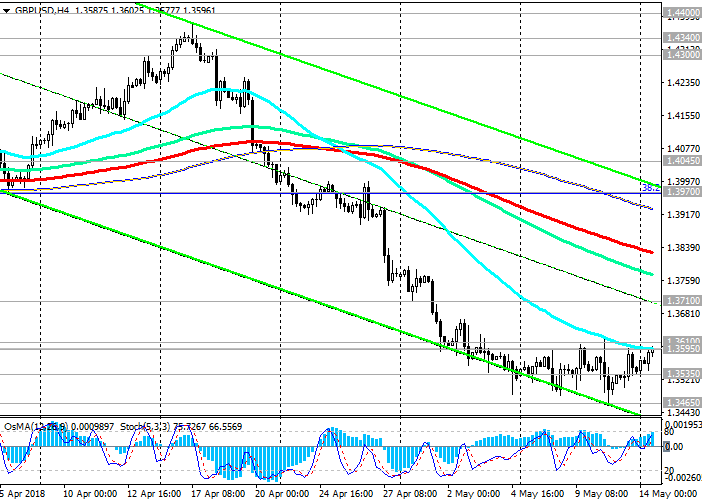

Support levels: 1.3535, 1.3465, 1.3400,

1.3300, 1.3210

Resistance levels: 1.3595, 1.3610, 1.3710, 1.3800, 1.3970, 1.4045, 1.4100, 1.4190, 1.4300, 1.4340, 1.4400

Trading Scenarios

Buy Stop 1.3625. Stop-Loss 1.3530. Take-Profit 1.3710, 1.3740, 1.3800, 1.3970, 1.4045, 1.4100, 1.4190, 1.4300, 1.4340, 1.4400

Sell Stop 1.3530. Stop-Loss 1.3625. Take-Profit 1.3500, 1.3465, 1.3400, 1.3300, 1.3210

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com