While the dollar is strengthening in the foreign exchange market, and market participants are preparing for the Fed meeting, which will be held on March 20-21, gold prices are down, today is the fifth week in a row. The growth of the dollar makes gold and other commodities traded for the US currency, less attractive to holders of other currencies.

As expected, the Fed will raise the range of key interest rates by 25 basis points, to 1.50% -1.75%. Earlier in December, Fed executives planned 3 interest rate increases in 2018, and 2 increases in 2019. At the January meeting, the leaders of the Fed confirmed their intentions to support the previously planned plans to tighten monetary policy amid the fast-growing US economy.

So, the macro data published on Friday confirmed the growth of industrial production in the USA. The index of industrial production in February was + 1.1% (the forecast was + 0.3%, the previous value was -0.3%). At the same time, the consumer confidence index rose to 102.0 in March (the forecast was 99.3 and 99.7 - the previous value), a maximum of almost 14 years.

It is likely that at the March meeting, the Fed will also raise its forecast for economic growth for the next two years. The expected increase in budget spending in the US, as well as stimulation of the economy due to lower taxes on the activities of US corporations against the backdrop of low unemployment will contribute to the growth of inflationary pressures. This, in turn, can force the Fed to accelerate the pace of normalizing monetary policy.

Investors are trying to understand whether the Fed will raise interest rates 4 times, whereas the Fed previously talked about 3 interest rate increases in 2018. At higher interest rates, gold is difficult to compete with assets that generate interest income, for example, with treasury bonds. Basically, economists expect that a further increase in the interest rate in the US this year will put pressure on gold. However, the decline in gold prices will be restrained by its purchases from retail buyers and also by some investors using gold to hedge the risks of growth in consumer prices amid the expected increase in inflation.

The drop in gold prices will also be hampered by political and economic uncertainty in the world, as many investors prefer to invest in reliable assets during periods of instability in the markets. Another reshuffle in the administration of the White House, as well as the introduction of duties on imports of steel and aluminum in the US, which provoked fears of unleashing trade wars, increase the demand for protective assets, such as gold.

For today, important news in the economic calendar is not planned, and, apparently, the positive dynamics of the dollar will remain, and the pair XAU / USD will remain under pressure, until Wednesday. At 18:00 (GMT) on Wednesday, the Fed's interest rate decision will be published and the speech of the head of the Federal Reserve Bank Jerome Powell will begin, and the comments of the Fed on the decision and prospects of monetary policy in the US will be published.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

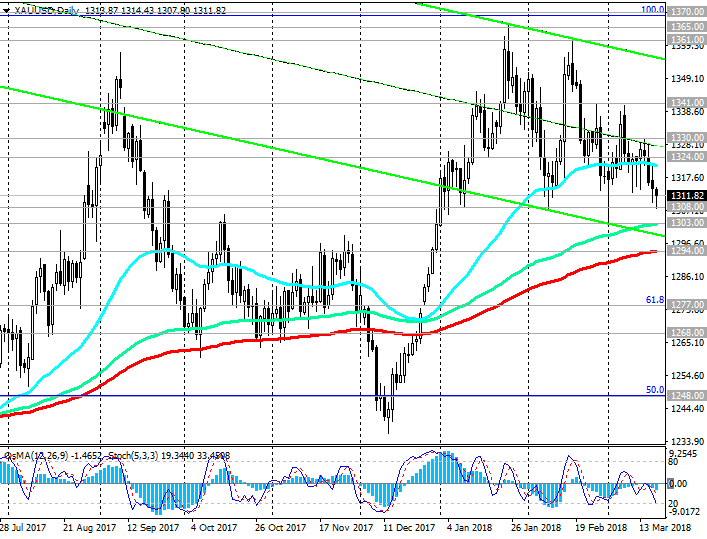

Support levels: 1308.00, 1303.00, 1294.00,

1277.00, 1268.00, 1248.00

Resistance levels: 1324.00, 1330.00, 1341.00, 1361.00, 1365.00, 1370.00, 1390.00, 1425.00

Trading Scenarios

Sell Stop 1307.00. Stop-Loss 1316.00. Take-Profit 1303.00, 1294.00, 1277.00, 1268.00

Buy Stop 1316.00. Stop-Loss 1307.00. Take-Profit 1324.00, 1330.00, 1341.00, 1361.00, 1365.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com