With the coming of the new year, the decline in the dollar, especially noticeably observed at the end of the past year, continued. Nevertheless, the dollar is gradually beginning to win back the lost positions.

Despite the fact that the negative dynamics of the dollar is observed in relation to commodity currencies, such as Canadian, New Zealand, Australian dollars, against the euro and the assets-shelters (yen, franc, gold), the dollar is strengthening.

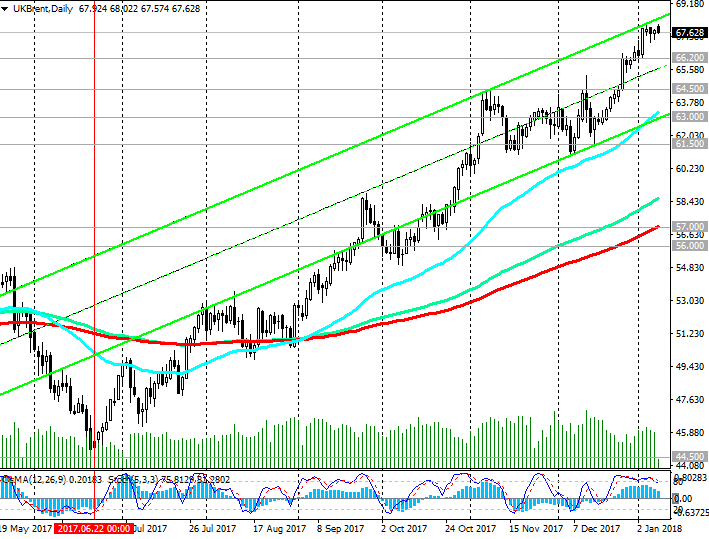

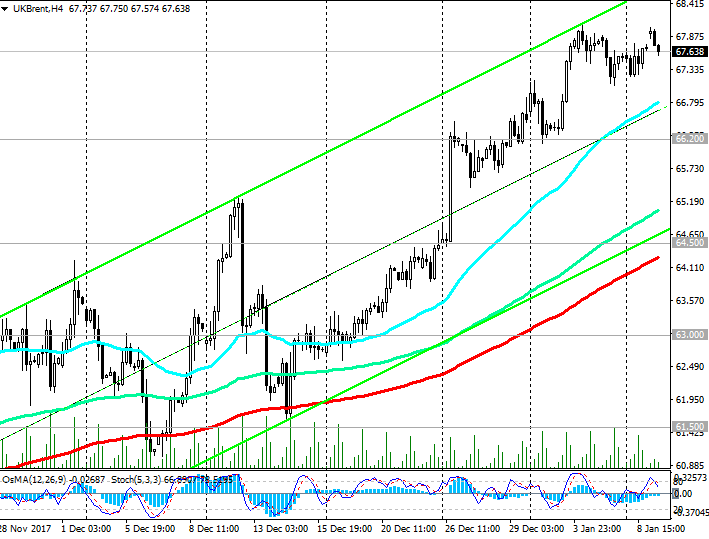

Meanwhile, with the coming of the new year, oil prices are also rising. During today's Asian trading session, the price of Brent crude oil was again in the zone of multi-month highs near the level of 68.00 dollars per barrel. The last time the price was at current levels in May 2015.

Cold frosty weather in the US and riots in Iran, held several days ago, provoked a sharp rise in oil prices at the beginning of the year. According to various estimates, Iran possesses about 10% of the world's proven oil reserves, being the 4th largest oil producer after Venezuela (20% of the world's reserves), Saudi Arabia and Canada. Russia, by the way, is on the 8th place with reserves of 80,000 million barrels as of 2016. Iran is the third largest in terms of oil production in OPEC. Therefore, the information received from Iran on anti-government actions, made investors fear of possible interruptions in oil supplies, which, in turn, affected the next increase in oil prices.

As the American oil service company Baker Hughes reported last Friday, the number of active oil drilling rigs in the United States fell by 5 units to 742 over the past week. This also has a positive effect on oil prices, as it indicates some decrease in oil production in the US.

Meanwhile, US oil companies have a significant prospect and an incentive to increase production while oil prices remain high. The growth of oil production in the US is one of the deterrents to the growth in oil prices.

In November 2017, OPEC and another 10 oil-producing countries that are not part of the cartel have extended the deal to reduce global oil production by the end of 2018. The surplus of oil on the world market, which exerted pressure on prices for several years, is gradually being absorbed. The positive dynamics of oil prices, in general, remains. A further price increase is likely to reach $ 70 per barrel.

Today, the American Petroleum Institute (API) at 21:00 (GMT) will report on oil and petroleum products in the US. And on Wednesday (15:30 GMT) the official weekly report of the US Energy Ministry will be presented. As expected, this agency will report a drop in oil and petroleum products by 4.1 million barrels last week (after a decline of 7.4 million barrels in the week before last). If the data are confirmed, they will further increase oil prices.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 67.00, 66.20, 64.50, 63.00,

61.50, 61.00, 60.00, 59.00, 57.00, 56.00

Resistance levels: 68.00, 68.20, 69.00, 70.00

Trading Scenarios

Sell Stop 66.90. Stop-Loss. 68.20. Take-Profit 66.20, 65.00, 64.50, 63.00

Buy Stop 68.20. Stop-Loss 66.90. Take-Profit 69.00, 70.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com