NZD/USD: New Zealand business confidence index remains in negative territory

As it was reported today during the Asian session by the Reserve Bank of New Zealand, the confidence index in the business circles of New Zealand in December is still deep in the negative territory and amounts to -37.8% (in November the value of the index was -39.3%). The index of business confidence assesses the business climate in New Zealand and allows you to analyze the economic situation in the short term. The decrease in the value of the indicator indicates a decrease in business confidence and a decrease in business investment, which negatively affects the production and other areas of the economy of New Zealand.

The mood of producers in the agricultural sector, the leading industry in New Zealand's economy, is still deteriorating, reflecting a negative reaction to the new government. The achievements of recent years in the growth of the country's economy belong to the former leadership of the country. The general elections that took place at the end of September in New Zealand led to the defeat of the ruling at the time conservative party.

The consumer mood in New Zealand is also deteriorating. This is evidenced by the decline in the consumer sentiment indicator in New Zealand, published today at the beginning of the Asian trading session (107.4 in the fourth quarter against 112.4 in the previous quarter).

According to many economists, the RBNZ can return to consideration of the possibility of raising the rate in New Zealand not earlier than the second half of 2018.

On the other hand, the US dollar currently looks more promising for investment than the New Zealand dollar against the backdrop of expectations of a phased increase in the Fed's rate and accelerating the growth of the US economy. The Fed plans to raise the rate 3 times in 2018. Thus, the fundamental factors testify to the reduction of the NZD / USD.

From the news for today, we are waiting for the publication of the results of the dairy auction (in the period after 14:00 GMT). Two weeks ago, the dairy price index, prepared by Global Dairy Trade, came out at + 0.4% (against previous values of -3.4%, -3.5%, -1.0%, -2.4%) . Dairy products - one of the main exports goods of New Zealand, so the reduction in world prices for dairy products harms the quotes of the New Zealand dollar.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

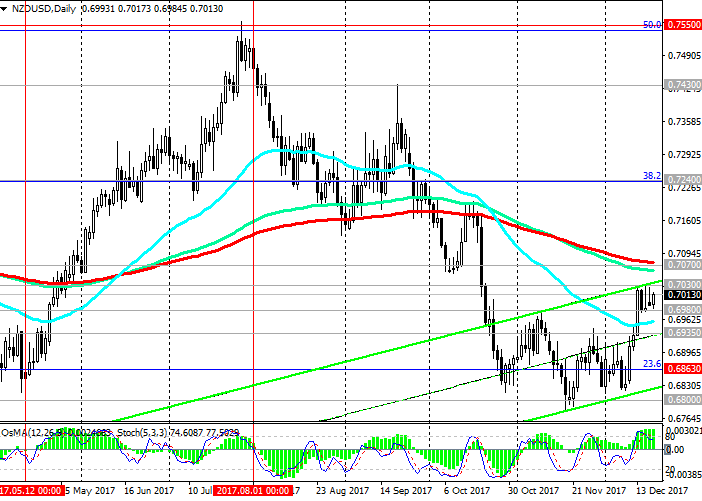

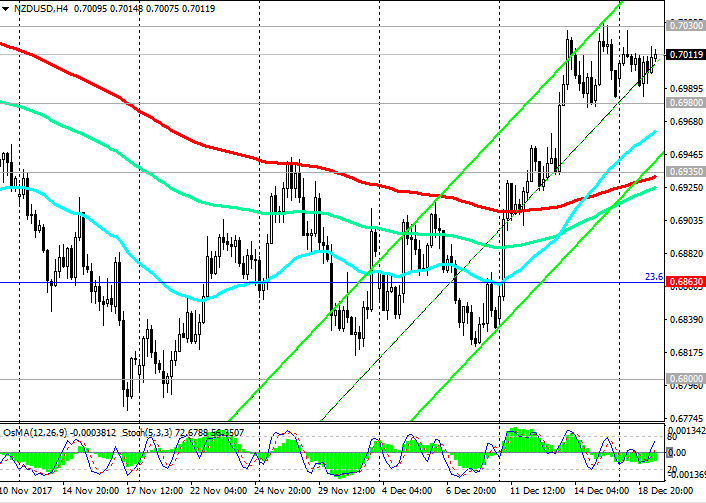

Support levels: 0.7000, 0.6980, 0.6935,

0.6863, 0.6800

Resistance levels: 0.7030, 0.7070, 0.7110, 0.7200, 0.7240, 0.7270

Trading scenarios

Sell Stop 0.6990. Stop-Loss 0.7040. Take-Profit 0.6980, 0.6935, 0.6863, 0.6800

Buy Stop 0.7040. Stop-Loss 0.6990. Take-Profit 0.7070, 0.7110, 0.7200, 0.7240, 0.7270

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com