As Bank of England Governor Mark Carney said in an interview with the BBC, the central bank of the UK will raise the key interest rate if the UK economy continues to move the current rate.

"If the economy will move the current course, then it may be appropriate to raise rates", - said Carney. This increase, in his opinion, could take place quite soon.

The pound reacted rather weakly to this statement of Mark Carney. Moreover, at the beginning of the European session, the pound declined after the published data showed that the current account deficit of the UK's balance of payments in the second quarter significantly exceeded the forecast (16.00 billion pounds), reaching 23.2 billion pounds. At the same time, GDP growth in the second quarter was confirmed at 0.3%.

Nevertheless, the pair GBP / USD closes the month and the third quarter with a gain, despite the decline for the second week in a row.

The expectation of an early interest rate increase in the UK contributes to the purchase of the pound and the growth of its quotes. Earlier, the Bank of England repeatedly signaled that it was preparing for the first more than a 10-year rate hike to limit inflation. Many economists expect that the first increase may take place in November.

For today, another performance by Mark Carney (14:45 GMT) is planned. From it, participants in financial markets are waiting to clarify the situation regarding the future policy of the central bank of Great Britain. If Mark Carney touches on the topic of monetary policy and confirms the plans of the Bank of England for a rapid increase in the interest rate in the UK, the pound will once again strengthen in the currency market, including the GBP / USD pair.

Of the news for today, we also expect data from the United States. At 12:30 (GMT) will be published a report of the US Department of Commerce with data on personal income / expenditure of Americans and price indices (for August). If the data prove to be better than forecasted values (slight growth of indicators is expected), the dollar will grow on the foreign exchange market.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

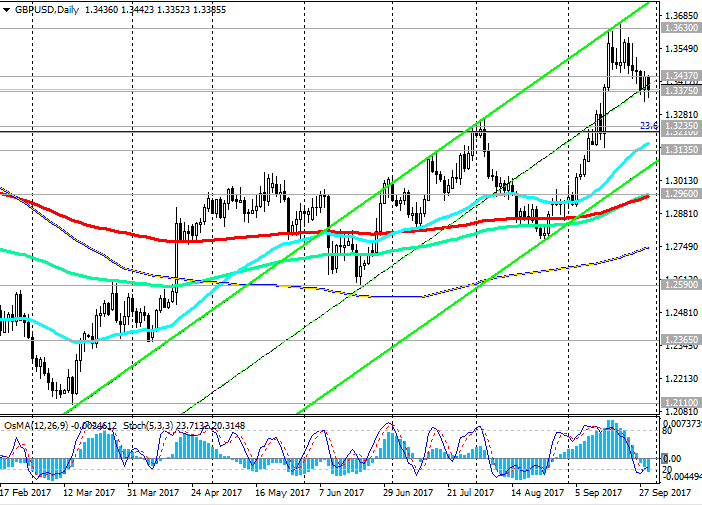

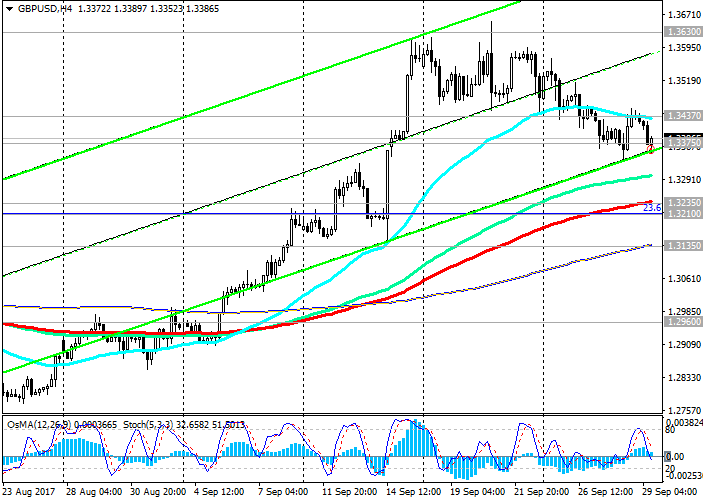

Today, the GBP / USD pair continues its corrective decline after active growth at the beginning of the month. Yesterday, GBP / USD broke the short-term support level 1.3437 (EMA200 on the 1-hour chart) and continues to decline to support levels 1.3235 (EMA200 on the 4-hour chart), 1.3210 (Fibonacci level 23.6% correction to the pair GBP / USD decline in wave , which began in July 2014 near the level of 1.7200).

Indicators OsMA and Stochastics on the 1-hour, 4-hour, daily charts were deployed to short positions.

The breakdown of these levels will cause a deeper correction to the support level of 1.3135 (the bottom line of the ascending channel on the daily chart).

While the pair GBP / USD is trading above support level 1.2960 (EMA200 on the daily chart), the positive mid-term dynamics of the GBP / USD remains.

In case of breakdown of the local resistance level 1.3437, the resumption of growth is likely with the targets of 1.3260 (highs of August), 1.3460 (July and September highs of 2016 reached after the referendum on Brexit), 1.3630, 1.3780 (EMA144 on the weekly chart).

Support levels: 1.3375, 1.3235, 1.3210, 1.3135, 1.3100, 1.3020, 1.2960, 1.2900

Resistance levels: 1.3437, 1.3500, 1.3630, 1.3780

Trading Scenarios

Sell Stop 1.3345. Stop-Loss 1.3410. Take-Profit 1.3300, 1.3235, 1.3210, 1.3135, 1.3100, 1.3020, 1.2960, 1.2900

Buy Stop 1.3410. Stop-Loss 1.3345. Take-Profit 1.3437, 1.3500, 1.3630, 1.3780

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com