EUR/USD: Inflationary pressure in the Eurozone remains weak

According to the data published yesterday, the Eurozone's GDP in the second quarter increased by 0.6% (+ 2.1% in annual terms against + 1.9% in the previous quarter). Quarterly growth rates have become the highest since March 2015. This GDP growth indicates that the Eurozone has overcome the consequences of the financial crises of the last decade. The euro reacted rather weakly to the publication of data, and during the yesterday's trading day, the EUR / USD fell.

Today, the dollar continues to recover in the foreign exchange market. However, against the euro, the dollar declined during today's Asian session. According to official data published today, the producer price index (PPI) of the Eurozone in June compared with May fell by 0.1%. The decline in producer prices in the Eurozone was noted following the results of three of the last four months. Compared to June last year, the index rose by 2.5%, but this was the weakest growth in 2017.

In response to the publication, the pair EUR / USD declined, but remains positive. Suddenly, the strong recovery of the Eurozone economy in the first half of the year strengthened expectations of the curtailment of the QE program. In July, ECB President Mario Draghi called the restoration of the region's economy "strong" and promised that in the autumn the central bank's leaders would decide the fate of the bond purchase program, which ends in December. It is expected that the program will be extended for 2018, but its volumes will be reduced.

At the same time, Draghi once again reminded that the level of inflation will be the basis for making a decision to reduce the stimulus program for the economy. It is necessary to be "consistent and patient", so that inflation grows to a target level of just below 2%, according to Draghi. Strengthening the same inflationary pressure in the coming months seems unlikely.

Today we are waiting for the publication (12:15 GMT) of the employment report from ADP, which reflects the change in the number of employees in the US in July. Reducing the result weakens the US dollar. The growth is expected to reach 185 000 (against 158 000 in June), which should support the dollar.

Also today (16:00 and 19:30 GMT) are key representatives of the Fed, members of the FOMC Loretta Meister and John Williams. Probably, they will again pay attention to the low level of inflation and will express their opinion that the Fed should be delayed with another increase in the interest rate in the US.

Nevertheless, the Fed can still raise the rate again in December, despite the low level of inflation. As long as a strong labor market supports moderate wage growth, prospects for further tightening of monetary policy remain. In this regard, data on US employment on Friday may be very important.

*)An advanced fundamental analysis is available on the Tifia website at tifia.com/analytics

Support and resistance levels

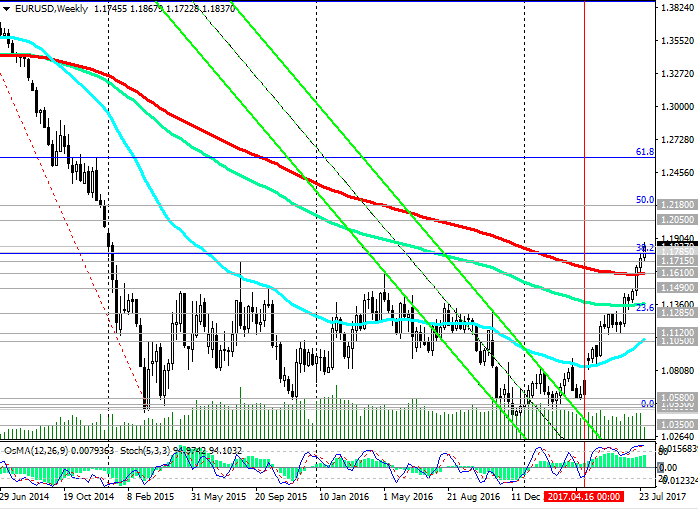

Today the pair EUR / USD has reached a new annual maximum near the level of 1.1865. The pair EUR / USD maintains positive momentum above support levels 1.1785 (the Fibonacci level of 38.2% of the corrective growth from the lows reached in February 2015 in the last wave of global decline of the pair from 1.3900 level), 1.1610 (EMA200 on the weekly chart).

In case of further growth and breakdown of resistance level 1.1865, the pair EUR / USD may go to the long-term target 1.2180 (50% Fibonacci level). In fact, this will mean the cancellation of the global downward trend, which began in May 2014.

The OsMA and Stochastic indicators on the daily and weekly charts still recommend long positions.

In the alternative scenario and in case of breakdown of the support level 1.1610, the decline may accelerate inside the uplink on the daily chart, up to the level of 1.1490 (the bottom line of the uplink on the daily chart and EMA200 on the 4-hour chart). In case of breakdown of the support level 1.1285 (Fibonacci level of 23.6%), risks of return to the downtrend will grow significantly.

Support levels: 1.1785, 1.1715, 1.1685, 1.1610, 1.1560, 1.1490, 1.1400, 1.1370, 1.1285, 1.1240, 1.1120, 1.1050

Resistance levels: 1.1865, 1.1900, 1.2000, 1.2180

Trading Scenarios

Sell Stop 1.1790. Stop-Loss 1.1870. Take-Profit 1.1715, 1.1685, 1.1650, 1.1610, 1.1560, 1.1500, 1.14400, 1.1370, 1.1285, 1.1240, 1.1120

Buy Stop 1.1870. Stop-Loss 1.1790. Take-Profit 1.1900, 1.2000, 1.2180

*) For up-to-date and detailed analytics and news on the forex market visit Tifia company website tifia.com