XAU/USD: the dollar drops before the performance Janet Jellen

With the opening of today's trading day, and especially at the beginning of the European session, the dollar is falling in the foreign exchange market. Published yesterday, data from the US Department of Commerce showed a reduction in orders for durable goods in May by 1.1% compared to the previous month, which was the strongest decline in six months. Demand for durable goods in the US in May fell for the second consecutive month.

Other macro data from the US also come out with weaker indicators. So, published on Friday, indicators of activity in the manufacturing and services sectors in the US declined in June. The preliminary index of supply managers (PMI) for the US manufacturing sector in June fell to 52.1 against 52.7 in May, reaching a 9-month low. The preliminary index of supply managers (PMI) for the US service sector fell to a 3-month low, reaching 53 versus 53.6 in May.

The decline in macroeconomic indicators and the low level of inflation in the US can not but worry the Fed leaders.

Previously, the Federal Reserve raised the key interest rate to a range of 1% -1.25%, saying it expects another rate hike this year. However, market participants do not believe that the Fed can really proceed with further tightening of monetary policy amid weak data on inflation in the US.

"The US Federal Open Market Committee can refrain from actions and analyze the development of the macroeconomic situation in the coming quarters", said Fed President St. Louis James Bullard on Friday.

Today, market participants will wait for the speech of the head of the Fed, Janet Yellen, which will start at 5:00 pm (GMT). If Janet Yellen again signals about the Fed's inclination to tighten monetary policy, confirming its view that slowing inflation is a temporary phenomenon, then the dollar will quickly regain its positions in the foreign exchange market.

According to the CME Group, futures for interest rates by the Fed indicate that the probability of another increase in the Fed's rates this year is about 50%. Rising rates usually support the dollar, making it more attractive to investors. At the same time, prices for precious metals, denominated in US currency, are declining.

*)An advanced fundamental analysis is available on the Tifia website at tifia.com/analytics

Support and resistance levels

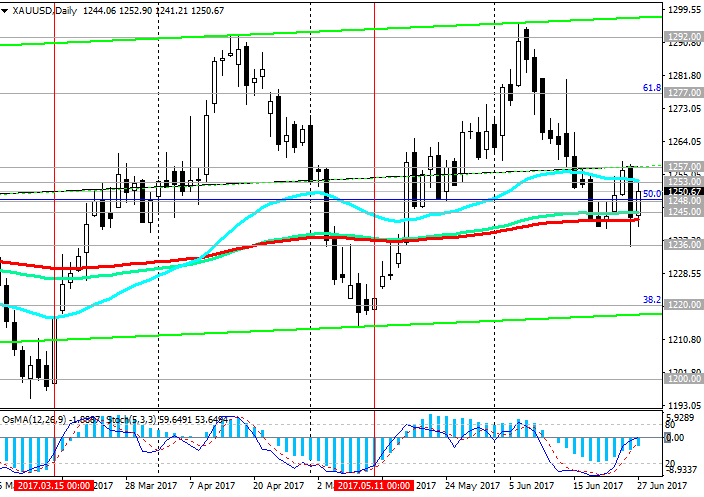

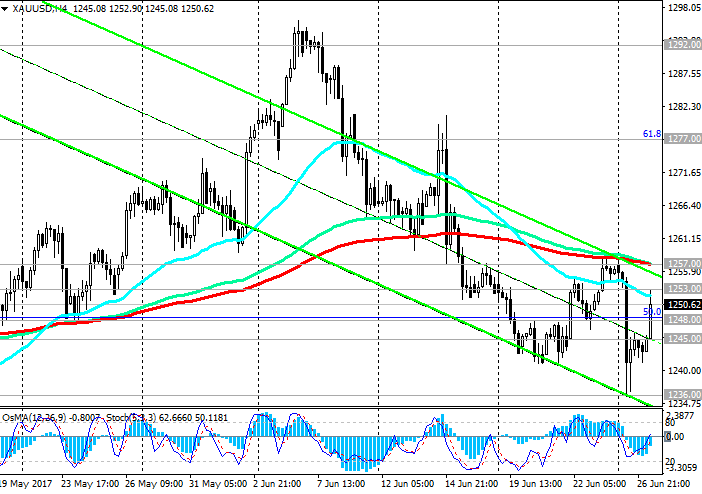

Meanwhile, the price of gold is growing with the opening of today's trading day. The pair XAU / USD pushed back from the support level of 1245.00 (EMA144, EMA200 on the daily chart), however, its growth stopped at the short-term resistance level of 1253.00 (EMA200 on the 1-hour chart).

The pair XAU / USD is in the descending channel on the 4-hour chart. More seriously to the recovery of the upward movement of the pair XAU / USD can be attributed only after its consolidation above the resistance level 1257.00 (EMA200, EMA144 and the top line of the descending channel on the 4-hour chart).

If the trend of strengthening the dollar will gain momentum, then the price of gold will continue to decline gradually. The return of the pair XAU / USD into the zone below the key support level of 1245.00 will strengthen its negative dynamics.

The breakdown of the support level of 1220.00 (the Fibonacci level of 38.2% correction to the wave of decline since July 2016) will increase the risks of a return to the downtrend.

Support levels: 1248.00, 1245.00, 1236.00, 1220.00, 1200.00, 1185.00

Resistance levels: 1253.00, 1257.00, 1260.00, 1277.00, 1295.00, 1305.00

Trading Scenarios

Sell Stop 1249.00. Stop-Loss 1254.00. Take-Profit 1245.00, 1236.00, 1220.00, 1200.00, 1185.00

Buy Stop 1254.00. Stop-Loss 1249.00. Take-Profit 1257.00, 1260.00, 1277.00, 1295.00, 1305.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia company website tifia.com