Trading recommendations

Buy Stop 1.3360. Stop-Loss 1.3320. Take-Profit 1.3380, 1.3555, 1.3680

Sell in the market. Stop-Loss 1.3350. Take-Profit 1.3250, 1.3200, 1.3165, 1.3100

Technical analysis

OPEC's decision to reduce production caused a sharp rise in oil prices, which has strengthened by 16% after the decision. The loonie has a strong correlation with oil prices also raised in the foreign exchange market and in the pair USD/CAD.

After a referendum on Sunday in Italy and publishing data on Friday from the labor market in the US on Monday, the US dollar has appreciated sharply, as financial markets began the trading day with a gap.

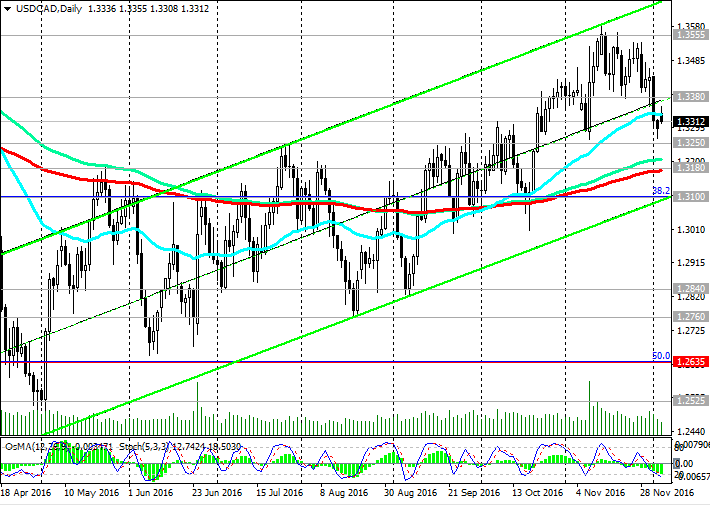

So far, the pair USD / CAD remains in ascending channel on the daily chart above strong support levels 1.3180 (EMA200 on the daily chart), 1.3100 (38.2% Fibonacci level of the correction to the growth of the pair to the beginning of July 2014 and the level of 1.0650). Near the 1.3100 level is the lower boundary of the rising channel on the daily chart. The upper limit of the channel runs near the mark of 1.3680 (Fibonacci level of 23.6%).

If on the daily and the weekly USD / CAD pair is in the uplink, the 4-hour chart of the USD / CAD formed a new downstream channel with a lower limit, passing near the level of 1.3250. Short-term support level 1.3380 (EMA200 on 4-hour chart) is breached and the pair is developing a downward trend towards support level 1.3180 (EMA200 on the daily chart).

In case of breaking the support level 1.3100 and the downward trend of decline in the pair may continue to support levels 1.2840, 1.2760 (August lows).

Break of 1.2760 support level could signal a further reduction of the pair USD / CAD 1.2635 with the immediate objectives (50.0% Fibonacci level), 1.2525 (at least one year).

The resumption of growth of the pair will be linked to her return above the level of 1.3380. The upper boundary of the rising channel on the daily and weekly charts passes near the level of 1.3680. In case of breaking this level and continued growth is probably the end of a downward correction, and complete recovery of the rising dynamics of the pair USD / CAD.

Support levels: 1.3250, 1.3200, 1.3180, 1.3100, 1.3085, 1.2840, 1.2760, 1.2635

Resistance levels: 1.3380, 1.3555, 1.3680

Overview and Dynamics

The Canadian dollar fell on Monday after residents of Italy did not support the constitutional reform referendum held at the weekend. Such voting outcome increases uncertainty about the global economic outlook.

Residents of Italy did not support the amendments to the constitution proposed by the government. Thus, in the heart of Europe was won by populists and Prime Minister Matteo Renzi is about to resign.

At the same time, despite strong employment data, the US stock markets closed mixed: DJIA index fell by 22 points (-0,1%), S & P500 closed unchanged at 2192, and the Nasdaq Composite rose 5 points (+ 0.1%).

The number of jobs in the United States in November increased by 178 000 (forecast 175 000), after rising by 142,000 in October (revised data from 161,000). In the manufacturing sector the number of jobs has decreased by 4,000 (forecast -2000) after the reduction for 5000 in October (revised data -9000). The unemployment rate in November fell to 4.6% (forecast 4.9%) from 4.9% in October. At the same time, the report NFPR was not so good, to the US dollar could strengthen further. The market has already priced in the dollar has taken into account the rate increase to 0.25% in December. Therefore, if the Fed will increase rates, the strong strengthening of the dollar is not going to happen. Much will depend on the tone of the accompanying Fed comments about her future plans. According to the latest CME Group, the probability of a rate hike is estimated at about 93% in December.

Oil prices, meanwhile, continued to grow at the OPEC decision to cut production. On the NYMEX on Friday, oil prices rose 1.2%, to 51.68 dollars per barrel. Spot price of Brent crude oil is also growing. At the beginning of the European session on Monday it is close to the level of 54.70 dollars per barrel, and it provides support to the Canadian currency.

On Wednesday (18: 00 GMT + 3) scheduled meeting of the Bank of Canada. As expected, the central bank did not change its key interest rate, keeping it at a record low 0.5%.

In the accompanying statement, the Bank of Canada will evaluate its decision, and will outline the current situation in the national economy in terms of the future direction of monetary policy of the bank. Volatility is expected to surge in the Canadian dollar trade. Rising oil prices continue to support the Canadian dollar.

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.