Analytical Review of the Stocks of United Technologies Corporation of 19.05.2016

Analytical Review of the Stocks of United Technologies Corporation of 19.05.2016

United Technologies Corporation, #UTX [NYSE]

Industrial goods Spacecrafts, USA

Financial performance of the company:

Index – DJIA, S&P 500;

Beta – 1.15;

Capitalization – 80.39;

Return on asset – 12.90%;

Income - 7.60 B;

Average volume – 7.48 М;

P/E - 22.58;

ATR – 2.50.

Analytical review:

- Since the beginning of February the price of company’s shares has grown by over 16%. It is expected that the rise will continue;

- The company ranks the fourth on capitalization in the sector of “Industrial goods” among the issuers traded in the American stock market;

- At the end of April the company issued report for Q1 of the fiscal year 2016. According to the press-release net sales amounted to 13.357 billion USD versus 13.320 billion USD for the same period a year ago. Net profit of the company was 1.47 USD per share against the forecast of 1.39 USD per share;

- The company issued revised forecast for the fiscal year 2016. It is expected that revenue and net profit per share will grow by 1%-3% to 56-58 billion USD and 6.30-6.60 USD respectively;

- The company continues to develop and diversify its business. This year the company plans to invest $1-$2 billion to the successful hi-tech companies, which shows optimism of the management about future of the company;

- Another factor, indicating possibility of the increase in company’s price is P/E Ratio. UTC’s P/E Ratio (22.58) is below the average P/E in the industry (41.40) and sector (25.98), which shows that further rise in the company’s quotes is possible.

Summary:

- Company’s last report has increased investors’ confidence to the company’s management. Despite pressure from the strong USD, company’s revenue and net profit have increased. The company has strong growth potential. Implementation of the investment projects and revised forecast for the current fiscal year will boost the rise in price of the company’s shares;

- It is likely that in the near future company’s quotes will go up.

Trading tips for CFD of United Technologies Corporation.

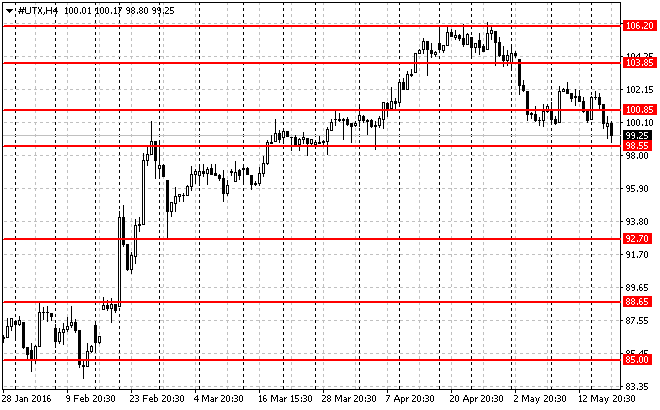

Key levels:

Support level: 98.55 USD.

Resistance levels: 100.85 USD, 103.85 USD and 106.20 USD.

Medium-term trading, H4

At the moment the issuer is traded in the demand zone of 98.55-100.85 USD. If the price maintains this zone and in case of the respective confirmation (such as pattern Price Action), we recommend to open long positions. Risk per trade is not more than 2% of the capital. Stop order can be placed slightly below the signal line. Take profit can be placed in parts at the levels of 103.80 USD, 106.20 USD and 108.50 USD with the use of trailing stop.

Medium-term trading, H4

Short-term trading М15

At the moment the issuer is traded between the local support and resistance levels of 99.00/100.00 USD. It is advisable to enter the market after breaking out and testing of these levels. Positions can be opened towards the signal line and the nearest support/resistance levels. Risk per trade is not more than 3% of the capital. Stop order can be placed slightly above/below the signal line. Take profit can be placed in parts of 50%, 30% and 20% with the use of trailing stop.

Short-term trading М15