Analytical Review of the Currency Pair AUD/USD

Technical data of the currency pair:

Previous closing: 0.7600;

Daily range: 0.7574-0.7658;

Opening: 0.7600;

52 - week range: 0.6824-0.8168;

Annual revenue: -5.40%;

Change in % for the previous day: -1.88;

Analytical review:

- In the last four trading sessions the AUD fell by over 200 points against the USD. During yesterday’s trading session the price of the AUD fell by 1.88%;

- Yesterday important Australian statistics was released, which showed that consumer price index amounted to -0.2% against 0.4% a month ago and the forecast of 0.3%;

- As expected, the US Fed left the key interest rate at the previous level of 0.25-0.50%. FOMC stated that the situation in the labor market of the country has improved despite instability of the global economy;

- The Australian dollar is a commodity currency. Demand for the AUD is supported by the rise in oil prices. During yesterday’s trading session the price of crude oil WTI rose by 2.75%;

- “Commitments of Traders” show ambiguous picture. Large speculators have increased the number of long positions by 3660 contracts. The number of short positions has also been increased by 10049 contracts.

Summary:

- Weak Australian statistics, the increase in the market sentiments in the USA and increased volatility in the financial markets put significant pressure on the currency pair;

- Demand for the Australian dollar is supported by the rise in oil prices;

- According to “СОТ”, large investors do not have common opinion about the CAD;

- Market movement is mixed. It is recommended to enter the market from the key support and resistance levels;

Trading tips for the currency pair AUD/USD

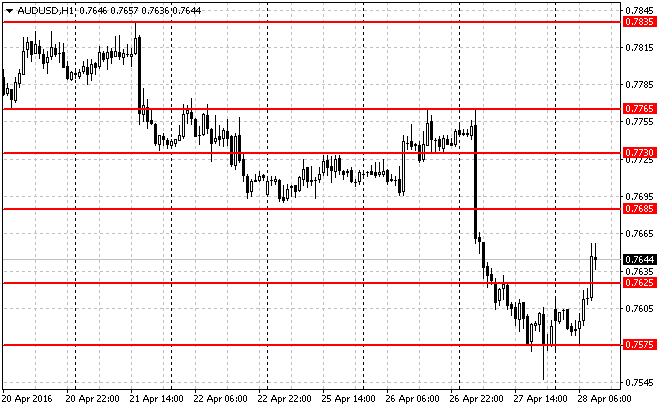

Key levels:

Support levels: 0.7575 and 0.7625.

Resistance levels: 0.7685 and 0.7730.

Medium-term trading, H1:

At the moment the currency is traded in the demand zone of 0.7635-0.7665. If the price maintains this zone and in case of the respective confirmation (such as Price Action pattern), we recommend to open short positions. Risk per trade is not more than 2% of the capital. Stop order can be placed slightly above the signal line. Take profit can be placed in parts at the levels of 0.7585, 0.7530 and 0.7490 with the use of trailing stops.

Medium-term trading, H1

Short-term trading, М15: at the moment the currency is traded in the range of 0.7610-0.7655. It is recommended to enter the market after breaking out and testing of this zone. Positions can be opened at the signal line and the nearest support/resistance levels. Risk per trade is not more than 3% of capital. Stop order can be placed slightly above/below the signal line. Take profit can be placed in parts of 50%, 30% and 20% with the use of trailing stop.

Short-term trading, М15