USD/JPY: How Far Will Flying On One Engine Get You? - Credit Agricole

USD/JPY: How Far Will Flying On One Engine Get You? - Credit Agricole

USD/JPY dropped sharply in response to the

BoJ’s policy inaction in April. The outcome eroded the market’s belief

that the BoJ will be easing anytime soon, if at all, and may argue for

further JPY appreciation.

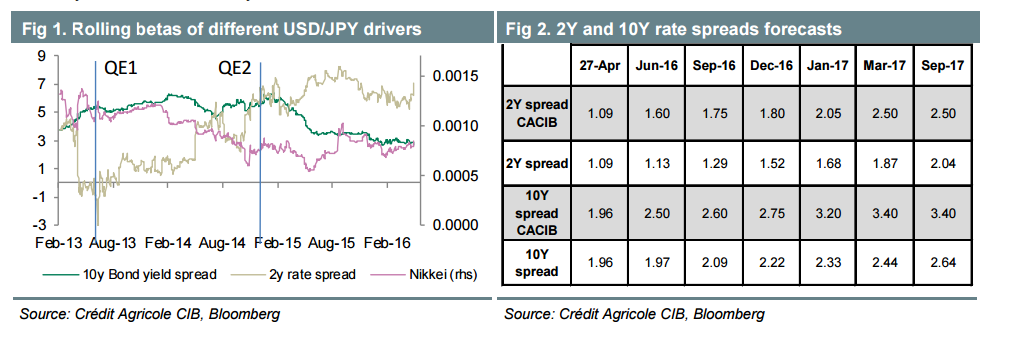

We still think that policy divergence

could remain a USD/JPY driver even if it has to rely on only one engine

for now – the Fed tightening policy from here.

Below we assess

the impact on USD/JPY of the persistent widening of the USD-JPY rate

spreads expected by us and the (more dovish) market consensus. Our

results point at sustained USD/JPY strength ranging from 3% to 6% by

year-end 2016 and 10% to 12% by the end of 2017.

The results

suggest that the policy divergence implied from our rates forecasts

could push USD/JPY at 116 by end-2016 and 121 by end-2017. When using

the consensus expectations, the result is a very gradual appreciation to

111 by end- 2016 and 119 by end-2017.

If we were to relax

the above assumption and add some stock market outperformance,

presumably on the back of more government stimulus and/or further BoJ

easing, this changes the results to a degree. Assuming that Nikkei

revisits its recent highs around 18000 – a fairly conservative

assumption – it could lift our projections for USD/JPY to 118 by end-

2016 and 123 by end-2017. When using the consensus rates forecasts, we arrive at 113 by end-2016 and 121 by end-2017.

'This content has been provided under specific arrangement with eFXnews.'

![]()