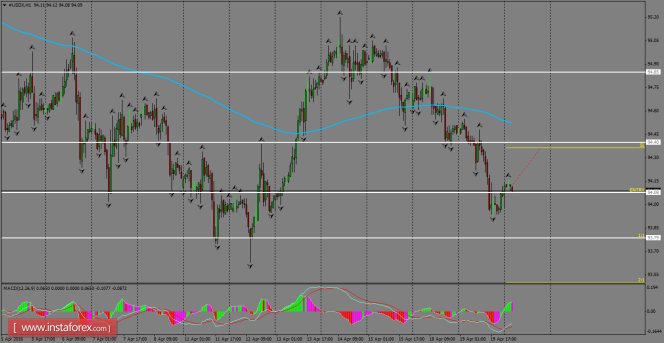

Daily Analysis of USDX for April 20, 2016

The short-term outlook is calling for more weakness, as the USDX is approaching a key bottom around the 93.79 level, but the price zone at 94.08 is blocking the bears' advance. That's why we would like to see a short rebound to re-test the ongoing highs from today's Asia session and this idea is favored by the current MACD position.

H1 chart's resistance levels: 94.40 / 94.85

H1 chart's support levels: 94.08 / 93.79

Trading recommendations for today:

Based on the H1 chart, place sell (short) orders only if the USD Index breaks with a bearish candlestick; the support level is at 94.08, take profit is at 93.79, and stop loss is at 94.36.