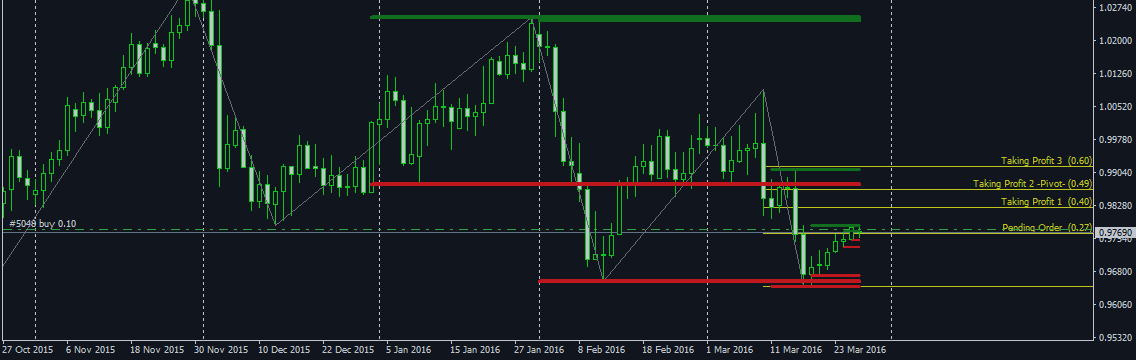

USDCHF is currently approaching the resistance level 0.9800 which was set as the buy target in our previous forecast for this currency pair. If the price breaks above the resistance level 0.9800 - USDCHF can then rise to the next buy target 0.9900 (Chernovolov, FxBazooka). With Stochastic (20,3,3) which represent 1 month volatility shows oversold signal and price has been rebound from its 1 year support trendline, Technical long for today (March,28) until at least a month ahead (Andy, TradingView).

We think the current USD fall will run out of steam. The catalysts for a turnaround back to a USD rally will be either strong US data confirming the need for tighter monetary policy in the US this year or other central banks globally fighting back against their own currency strength. In the short term FX rates can be influenced by central bank action but longer term it’s about the growth outlook relative to the rest of the world (Tse & Rubenfeld, Morgan Stanley). Franc has reached its local upside target. We think, today the price may fall towards 0.9726 and then grow to reach 0.9805. After that, the pair may fall towards 0.9700 (Sayadov, RoboForex published on FxStreet)

Indicators :