As you know, the Fed did not change its monetary policy at its July meeting and kept the key rate in the range of 1% -1.25%. The decision to keep the current monetary policy unchanged was unanimously adopted and was published yesterday at 18:00 (GMT).

The index of the dollar WSJ, reflecting the value of the dollar against the basket of 16 currencies, declined immediately after the publication of the Fed decision by 0.3%, to 86.42. The decision of the Fed was expected, however, the US dollar showed a large-scale decline in the foreign exchange market.

With the opening of today's trading day, the dollar continued to decline in the foreign exchange market.

However, it is worth paying attention to the fact that together with the dollar since the beginning of the European session, the Swiss franc also began to decline.

It was a safe haven, although it significantly lost this quality due to the NBS's actions in the foreign exchange market, the franc, along with gold and the yen, was actively bought recently due to the continuing political uncertainty in the US.

The Swiss National Bank has set a negative deposit rate, hoping that this will reduce the attractiveness of Swiss assets for international investors. Frack is usually strengthened during times of economic and political instability, thanks to Switzerland's strong economy, low levels of its debt and the stability of its political system. For the export-oriented Swiss economy, the exchange rate is especially important. A large share of its exports falls on the Eurozone, China, the United States and the rising franc leads to a rise in the price of Swiss goods.

After this week's meeting of the Fed, the dollar significantly weakened in the foreign exchange market, while purchases of assets-shelters, including francs, increased significantly.

The Swiss National Bank has traditionally stated that the Swiss franc is overbought, consistently advocating a soft monetary policy in the country.

As a result of the efforts of the Swiss National Bank aimed at curbing the growth of its currency, its foreign exchange reserves grew to about 700 billion francs (735 billion US dollars). However, investor purchases continue.

At the beginning of today's European session, there is a sharp decline in the franc, and to all major currencies, including against the yen, the dollar.

It is possible that the NBS conducts another currency intervention, which it never announces either before or after.

From the news for today we are waiting for the data from the USA. At 12:30 (GMT) a block of important macro data will be published: the weekly report of the US Department of Labor, containing data on the number of initial applications for unemployment benefits, orders for durable goods excluding transport in the US in June. The result above the expected indicates a weak labor market, which has a negative impact on the US dollar. The forecast is expected to increase to 240,000 versus 233,000 for the previous period, which should negatively affect the dollar.

*)An advanced fundamental analysis is available on the Tifia website at tifia.com/analytics

Support and resistance levels

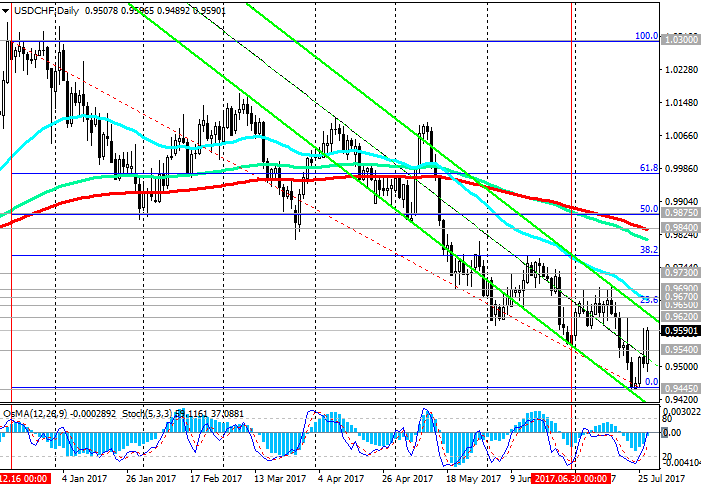

After reaching new annual lows near the 0.9445 mark at the end of last week, the pair USD / CHF rose during the last 4 trading sessions. Today, the pair USD / CHF is also actively growing since the beginning of the European trading session.

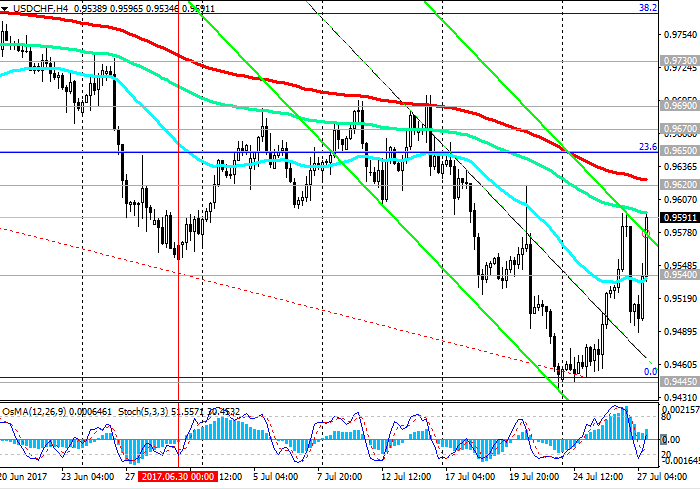

At the beginning of the European session, the pair USD / CHF is trying to gain a foothold above the short-term resistance level 0.9540 (EMA200 on the 1-hour chart). Indicators OsMA and Stochastics on the 1-hour, 4-hour, daily charts turned to long positions.

However, in order to break the bearish trend, the USD / CHF pair needs, first of all, to gain a foothold above the levels of 0.9620 (EMA200 on the 4-hour chart), 0.9650 (Fibonacci level of 23.6% of the upward correction to the last global decline wave from December 2016 and from the level 1.0300).

If the price falls below the 0.9540 level, the USD / CHF decline may resume within the descending channel on the daily chart. The lower boundary of this channel passes near the support level 0.9400. This level will become the goal in case of resumption of the pair USD / CHF decline.

The strong negative dynamics prevails. The main dynamics of the pair USD / CHF will still be connected with the dynamics of the dollar in the foreign exchange market. In the meantime, the dollar is weak.

Support levels: 0.9540, 0.9500, 0.9440, 0.9400

Resistance levels: 0.9620, 0.9650, 0.9670, 0.9690, 0.9730, 0.9840, 0.9875

Trading Scenarios

Buy Stop 0.9610. Stop-Loss 0.9560. Take-Profit 0.9650, 0.9670, 0.9690, 0.9730, 0.9840, 0.9875

Sell Stop 0.9560. Stop-Loss 0.9610. Take-Profit 0.9540, 0.9500, 0.9440, 0.9400

*) For up-to-date and detailed analytics and news on the forex market visit Tifia company website tifia.com