USD/CHF: ahead - Catholic Easter. The exchanges are closed.

Today there is a low activity of traders. The volume of trading on the forex market even more fell with the beginning of the European session. In Catholic countries today is a day off (Good Friday). Stock and commodity exchanges in Europe, the United States, as well as in Australia, New Zealand, and Canada will be closed. Although forex and works in the usual mode, volatility and trading volumes will be restored only on Tuesday.

Meanwhile, the dollar is declining from the opening of today's trading day against all major currencies, including against the franc. The dollar is not helped by the positive macro statistics released yesterday, according to which the price index of personal consumption expenditure (PCE) in February rose by 1.8% compared to the same period of the previous year and by 0.2% compared to the previous month. This Fed's preferred inflation indicator indicates that inflation in February rose and approaches the Fed's target level of 2%.

President of the Federal Reserve Bank of Philadelphia and member of the FOMC Patrick Harker said on Thursday that, in view of the acceleration of inflation this year, it is necessary to raise the rates a total of three times, whereas previously he had forecast two increases.

Harker expects that in the coming years inflation will slightly exceed the target level of 2%. "Trade taxes increase costs", - said Harker. New forecasts of the Fed's leaders published last week suggest higher economic growth, higher inflation and lower unemployment compared with the December forecasts. Heads of the Fed refer to the likely acceleration of economic growth due to changes in tax policy and increased federal spending.

As you know, last week the leaders of the Fed unanimously voted to raise the key interest rate to a range of 1.5% -1.75% and outlined two more such increases this year.

Investors expected to receive signals from the Fed for 4 rate hikes this year. However, this did not happen, and the dollar declined shortly after the Fed meeting, as 3 rate increases are already laid in the prices and quotes of the dollar.

Concerns of investors is continued due to the cause increased risks of the emergence of world trade wars after the well-known steps of the US administration towards escalating the protectionist position and imposing restrictions on the importation of a number of foreign goods into the US.

In this situation, investors prefer safe assets, such as the yen, gold and franc.

Meanwhile, the Swiss franc also remains under pressure, despite its purchases as a safe haven. As you know, in mid-March, the Swiss National Bank left its negative interest rates unchanged. The deposit rate remained at the level of -0.75%, the range for the 3-month LIBOR rate also remained unchanged, between -1.25% and -0.25%. The NBS traditionally stated that the franc rate is still too high, which indicates that the NBS still intends to keep rates in the negative territory.

"The bank still considers it necessary to have a negative interest rate and is ready to intervene in the foreign exchange market, if the situation requires it", the NBS said.

Thus, the difference in the direction of monetary policy in the US and Switzerland is the most important argument in favor of the growth of the USD / CHF.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

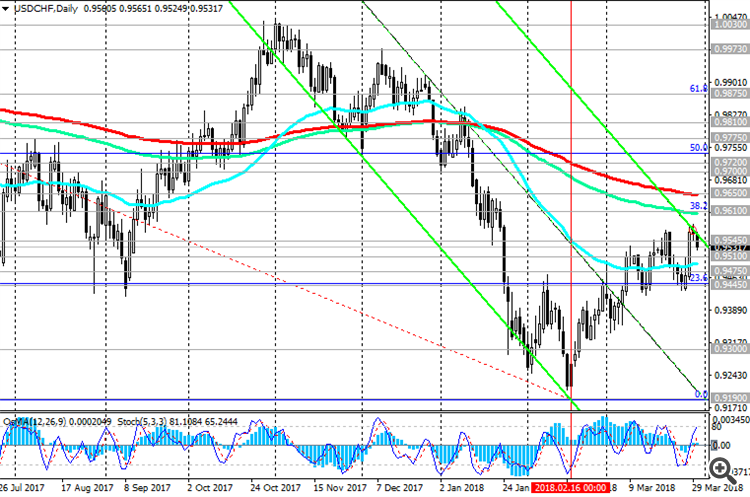

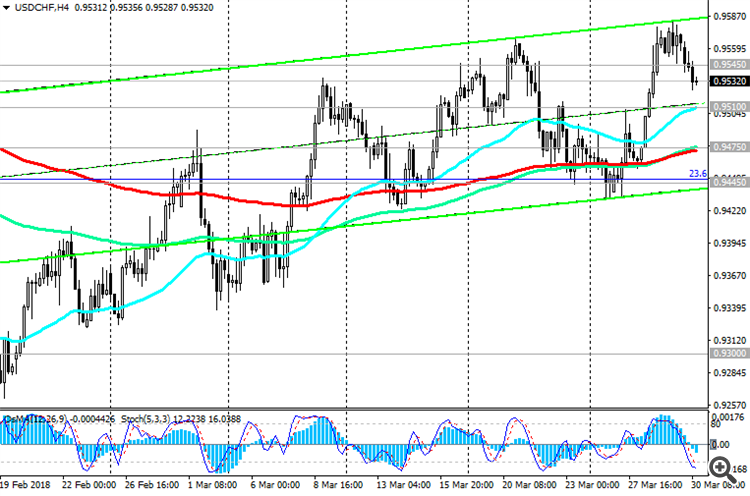

Support levels: 0.9720, 0.9690, 0.9650, 0.9635, 0.9600, 0.9545, 0.9500, 0.9445

Resistance levels: 0.9775, 0.9810, 0.9875, 0.9900, 0.9973, 1.0000

Trading Scenarios

Buy Stop 0.9740. Stop-Loss 0.9690. Take-Profit 0.9775, 0.9810, 0.9875, 0.9900, 0.9973, 1.0000

Sell Stop 0.9690. Stop-Loss 0.9740. Take-Profit 0.9650, 0.9635, 0.9600, 0.9545, 0.9500

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com