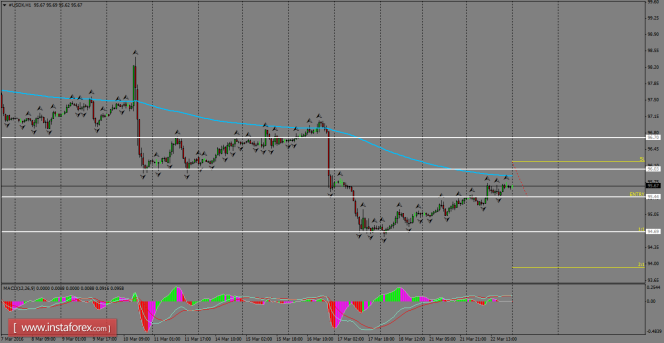

Daily Analysis of USDX for March 23, 2016

The Index is currently doing a consolidation move above the 95.44 level, which is very close to the 200 SMA price zone on the H1 chart. In the short-term, USDX is expected to make another pullback in order to resume the overall bearish bias, as the structure is still showing price action that favors the downside. The MACD indicator is in neutral territory.

H1 chart's resistance levels: 96.03 / 96.70

H1 chart's support levels: 95.44 / 94.69

Trading recommendations for today: Based on the H1 chart, place sell (short) orders only if the USD Index breaks with a bearish candlestick; the support level is at 95.44, take profit is at 94.69, and stop loss is at 96.18.

The material has been provided by InstaForex Company - www.instaforex.com