GBP: Recovery Only After The EU Referendum; Where To Target? - Credit Agricole

Intensifying Brexit fears have been keeping the GBP under selling pressure so far this year. Lingering Brexit fears and weakening data of late have added to the headwinds for GBP.

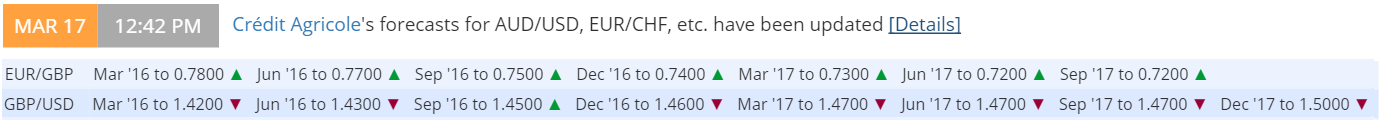

We expect the UK to remain part of the EU after the June referendum and think that the latest GBP underperformance will be temporary. Indeed, we expect the GBP to embark on a gradual appreciation trend in H2 2016 and in 2017.

Abating Brexit concerns, the unwinding of excessive market shorts as well as valuation considerations (GBP looks undervalued against USD) could help the currency recover later this year. In addition, rate expectations being somewhat out of line with the UK’s longerterm price outlook supports such a view.

In fact, medium-term inflation expectations as measured by 5Y forward breakeven rates remain close to 3%, irrespective of more muted external factors, such as weak commodity price developments, dampening the impact. This may be indicative of constructive domestic conditions, which should ultimately be reflected more in strengthening wage price developments. If so, investors may be quick to re-assess their view of the BoE’s monetary policy stance to the benefit of the currency.

Copy signals, Trade and Earn $ on Forex4you - https://www.share4you.com/en/?affid=0fd9105