As a professional trader it's important to know when and what instrument to trade, as well as knowing when not to trade and "sit on your hands". Preservation of capital during times of low profit probability is essential for a long term trading career. During this time of the year traders are likely to perform poorly as market conditions aren't good, and during this time traders must exercise discipline and cease trading. Christmas is a time for families and a relaxing time spent with loved ones. So do yourself a favor and take a break. The markets and opportunities will always be there when you get back. This may be the best trading decision you can make during this time and as well you can recharge your mental batteries for when you'll start trading again.

- Why "Not Trading" is Important

Knowing when not to trade

is as important as know when you should make a trade and experience

traders know that trading during holiday time has is shortfalls. Many

newbies, often fell the need to be in the market all the time even when

market conditions aren't in traders favor, and trading during the

Christmas time fall exactly in this category. For a newbie trader

holiday trading can be very tempting, so I'm going to outline 3

different reasons to avoid trading on holidays:

- Low Liquidity.

- Market Spikes.

- Recharge Yourself.

- Low Liquidity

When the Forex market has low liquidity,

it basically means that there aren't many Forex traders actively

trading currencies. Although Forex exchange market is the world's most

liquid financial market, this doesn't mean that the Forex market isn't

subject to varying liquidity conditions that currency traders need to

keep in mind, like trading during Christmas time. Even during normal

days liquidity will vary throughout each trading day differently. A low

liquid market will tend to have prices moving more dramatic and in

larger price increments when a bad news event hit the market.

Forex has many liquidity providers around the clock but with the major

banks being closed during the Christmas day, and we know that banks are

the biggest participants in the Forex market. If they are on holiday

then the volume of transactions is at low levels. This can lead to

either really static markets or on occasion erratic markets, which it doesn't follow the normal market price action.

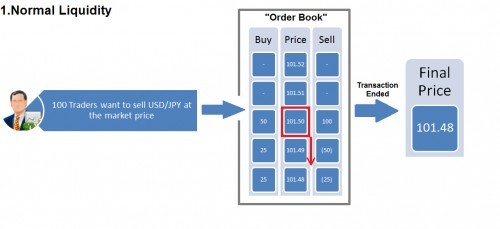

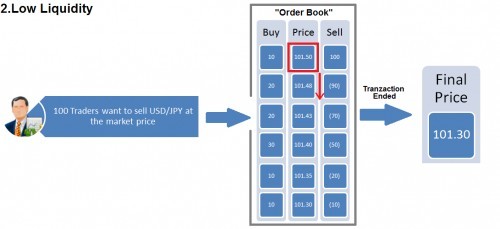

If you're still confused about the consequence of lower market liquidity let me go through an actual example and exemplify what's the market reaction when 100 traders want to sell USD/JPY at the market price, in two different market liquidity environment (see figure 1 and figure 2).

Figure 1. First case scenario: Normal Liquidity environment. When a price is matched, a transaction occurs. At the current market price 101.50 there are only 50 traders on the buy side so after all those trades are filled we move to the next best bid price available as we still have unfilled trader's orders from previous transaction. Next best price is 101.49 where we find only 25 traders willing to buy, after the transaction occurs we still have left 25 traders, willing to sell, with orders unfilled so we move to the next best available price which is 101.48 where the last traders have their order filled and the transaction has completed. At the end of this transaction, the market price would have fallen from 101.50 to 101.48.

- Figure 2. Low Liquidity environment. Following the same steps like in the first case we can see that at the end of this transaction, the market price would have fallen from 101.50 to 101.30. This is because lower prices must be offset to completely match the 100 traders sell orders, and at it can been seen there are fewer traders at each price level, or no traders at some levels.

As it can be clearly seen from above example on a low volume day, the number of traders wanting to buy the USD/JPY will be fewer.Therefore when the Forex market is having a low liquidity day, such unexpected spikes or dips may happen when the market price needs to be stretched further to meet a particular demand.

- Market Spikes

During this time of the year, Forex exchange rates are subject to more sudden and volatile price spikes than would be the case during more liquid periods. It's very hard to predict accurately how the market will react in such illiquid periods and therefore you're exposed to an increased risk of more volatile price action. Also some savvy investors like some hedge funds may use this opportunity of low liquidity markets to move the market past some key technical points and force the weaker hands to capitulate on their positions.

Now please don't get me wrong, you can still trade this market if you're a professional trader and how know to read market conditions very well, there are money laid on the table to be made. See Figure 3 , Seasonality chart for the major currency pair EUR/USD you can see that December has been quite a strong month for the euro.

- Figure 3. EUR/USD 30 Years Seasonality chart.

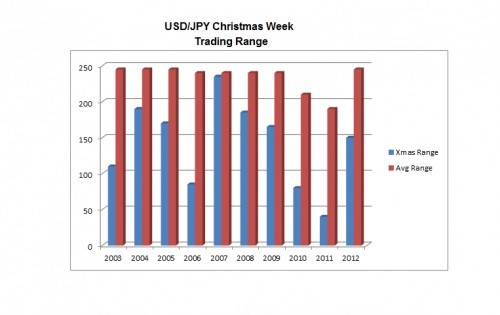

This low liquidity environment can lead to a narrow range, take a look for example on USD/JPY the weekly range has also been below average every year since 2003. In fact, the average trading range during Christmas week, in the Forex market tends to be approximately 25% less than the average trading range throughout the course of the year(see Figure 4).

- Figure 4. USD/JPY Christmas Week Trading range.

- Recharge Yourself

The way that we use our time has become more and more important as long work hours can be a health risk, especially when it comes to trading which is very demanding business. Indubitably trading can do damage to your mental health as you are constantly faced with making big decisions and you can easily go through a swing of emotions. These emotional swings and emotional stresses do impact on your mental state and can ultimately affect your trading decisions.

That's why it's important to schedule a break from trading, this might the best trading decision you could make as you're able to separate yourself from some of the emotions you have experienced, and recharge the mental batteries. A famous Latin quotation is saying:"Mens sana in corpore sano" (a healthy mind in a healthy body), now do yourself a favor and take care of yourself as well. Christmas is all about spending time with family and the loved ones, the market will always be here waiting for you.

<<READ MORE>>