There may be another 400% gain for Facebook and Google - Chart

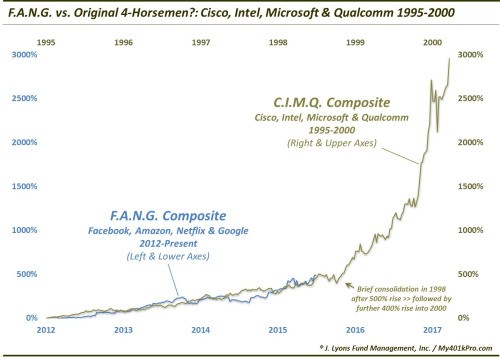

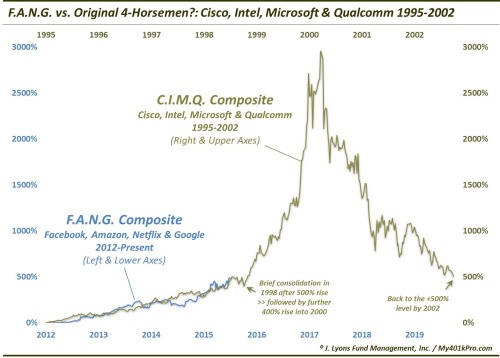

Facebook, Amazon, Netflix and Google — collectively named F.A.N.G. — have had an impressive ascent since 2012, and a modest run this year, even when accounting for the August selloff, says Dana Lyons, partner at J. Lyons Fund Management. It looks quite similar to what happened with Cisco, Intel, Microsoft and Qualcomm between 1995 and 2000, Lyons says in his blog.

If

those F.A.N.G. stocks track what C.I.M.Q. did, then maybe another 400% advance could be in store for them. Why not? Have a look at what Dana writes in his blog:

The entirety of the gains (more, in fact) in the 500-stock S&P index and the 100-stock Nasdaq index can be attributed to just the 4 F.A.N.G. stocks. Consider their respective gains for the year so far:

- Facebook: +31%

- Amazon: +117%

- Netflix: +154%

- Google: +41%

The question is: can they continue to push the major gauges higher with fewer and fewer stocks assisting them? Perhaps making that task seemingly unlikely is the fact that, prior to this year, the 4 stocks had already experienced substantial gains in the past few years. Consider their gains since the middle of 2012, around the time they started their current run:

- Facebook: +401%

- Amazon: +186%

- Netflix: +1503%

- Google: +133%

An equally-weighted composite of the 4 stocks would be up around 500% since 2012.

It would not be unprecedented, however, if those stocks continued to drive the averages higher even after such gains and though their run was quite modest this year. In almost any market era, one can pin-point such “trendy” momentum stocks that go to bubbly heights, Lyons says referring to the tech stock bubble days of the late 1990′s.

Through about 3.5 years into the middle of 1998, we see a familiar story with Cisco, Intel, Microsoft and Qualcomm. The composite was up roughly 500%, in line with the current F.A.N.G. over the same amount of time.

After consolidating for about 3 months around the middle of 1998, the stocks rose even higher. The C.I.M.Q. composite would go on to quadruple from its already extraodinary heights over the next year and a half, before popping in 2000. A similar move by the F.A.N.G. composite would hypothetically take it from its current level around 600 to around 3000.

Here is the similarity between F.A.N.G. 2012-2015 and C.I.M.Q. from 1995-2000: