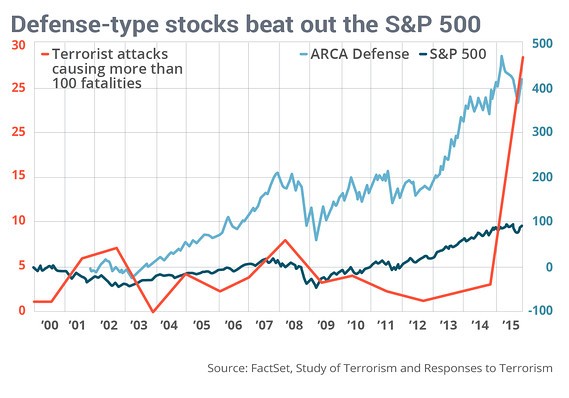

Holger Zschaepitz from Die Welt revealed this chart to show that the NYSE Arca Defense Index has outperformed the S&P 500 since 2000 by an impressive 1,200 percentage points.

The Arca Defense index consists of firms whose business includes military aerospace instrumentation, aircraft manufacturing and technology, specialized communication and radar systems.

In the chart above, MarketWatch reporter Barbara Kollmeyer also added the line indicating terrorist attacks.

Meanwhile, Andrew Thrasher, a portfolio manager from The Financial Enhancement Group, notes that these ETFs each offer a direct defense play: PowerShares Exchange-Traded Fund Trust Aerospace & Defense Portfolio, iShares U.S. Aerospace & Defense and SPDR S&P Aerospace & Defense. All three have added 3% or more this year. But Thrasher also warns that the sector is largely attached to politics, so investors should be cautious.

The Arca Defense gauge peaked out in relative

performance versus the S&P 500 right around the time President Obama

took office, on the view that Democrats prefer a smaller military, Thrasher explains.

Until 2013, performance didn’t regain ground, but further bumps can’t be

ruled out. Defense

stocks could see an increase in volatility, since the U.S. is having another election in 2016, he adds.

In a newsletter, Keith Fitz-Gerald, the chief investment strategist at Money Morning, touched an uneasy subject of investing in a time of fear and terrorism head-on. As many others have highlighted, history shows that markets recover over time from attacks, but also they tend to spur military spending, elevating related stocks. For instance, Boeing is up 448% since September 2001.

Fitz-Gerald also notes investors shouldn’t limit themselves to defense. Renewable energy company SolarCity had a 131% gain in less than three years, amid a push by Obama to reduce U.S. reliance on oil. Capitalism generates opportunities faster than terrorists can destroy them, Fitz-Gerald says.

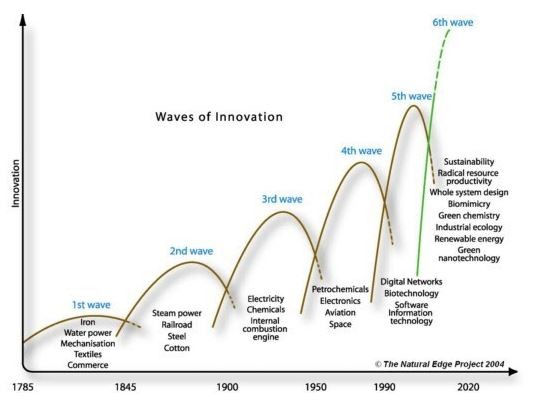

Below is his own chart that shows how canning investors have turned to innovation through the years: